Global Chronic Wound Care Market - Key Trends & Drivers Summarized

Why Is Chronic Wound Care Becoming a Critical Global Healthcare Priority?

Chronic wound care has emerged as an urgent global healthcare concern due to an alarming rise in chronic diseases such as diabetes, peripheral artery disease, obesity, and venous insufficiency, all of which significantly elevate the incidence of non-healing wounds. Chronic wounds, including diabetic ulcers, venous ulcers, pressure ulcers, and arterial ulcers, pose substantial health risks, negatively impacting patient quality of life and escalating healthcare costs worldwide. Globally, diabetes-related foot ulcers alone account for a significant portion of lower-limb amputations, driving urgent attention from healthcare providers and policymakers. Furthermore, aging populations, particularly in developed countries, amplify the prevalence of chronic wounds as elderly individuals have weakened healing capacities and compromised immune systems. The extended duration of these wounds and complications like infections and amputations place immense financial and operational burdens on healthcare systems globally. As a result, healthcare organizations, hospitals, and long-term care facilities are aggressively adopting advanced wound care treatments such as bioactive dressings, negative pressure wound therapy (NPWT), hyperbaric oxygen therapy (HBOT), and advanced tissue-engineered products to reduce complications and accelerate healing times. Such trends underline the global urgency and rapid expansion of the chronic wound care market.How Are Innovative Technologies Transforming the Chronic Wound Care Landscape?

The chronic wound care market has significantly evolved due to technological breakthroughs and innovative treatment methodologies designed to enhance wound healing outcomes and patient recovery. Advances in bioengineered products, including skin substitutes, collagen-based dressings, growth factor therapies, and stem cell-based therapies, have revolutionized patient management by promoting faster and more effective healing processes. Negative pressure wound therapy (NPWT), known for its effectiveness in managing complex wounds, has witnessed expanded adoption due to technological improvements like portable and disposable NPWT systems, which improve patient comfort and reduce hospital stays. Likewise, hyperbaric oxygen therapy (HBOT), increasingly recognized for its efficacy in diabetic foot ulcers and ischemic wounds, is seeing rising utilization across specialized healthcare settings. Moreover, technological integration such as digital wound monitoring devices, telemedicine, and remote patient monitoring platforms has empowered healthcare providers to deliver timely and precise interventions, especially crucial for patients in remote or underserved regions. This convergence of technology and healthcare innovation enables early detection, accurate diagnosis, and efficient wound management, substantially enhancing patient outcomes and bolstering market growth.Why is the Shift Towards Home Care and Outpatient Settings Transforming Chronic Wound Management?

A significant paradigm shift in healthcare delivery towards home care and outpatient settings is reshaping the chronic wound care landscape globally. This transition, accelerated by patient preferences for comfort, convenience, and affordability, is influencing healthcare providers to offer chronic wound care solutions outside traditional hospital environments. Outpatient wound clinics, ambulatory surgical centers, and home-based care services have become increasingly favored due to lower costs, reduced risk of hospital-acquired infections, and improved patient satisfaction. The development of user-friendly, portable, and disposable wound care devices, including single-use NPWT devices, advanced dressings, and telehealth-compatible solutions, supports this trend by enabling patients and caregivers to manage complex wounds effectively in the comfort of their homes. This consumer preference, further influenced by the COVID-19 pandemic, has accelerated the adoption of remote wound care solutions, promoting telemedicine and virtual consultations as integral aspects of chronic wound management. Moreover, healthcare payers, insurers, and government bodies worldwide actively encourage this shift through reimbursement policies and financial incentives favoring outpatient and home care services, thus providing additional momentum to market growth.What Specific Factors Are Accelerating the Global Chronic Wound Care Market?

The growth in the chronic wound care market is driven by several factors, prominently including increasing prevalence of chronic conditions such as diabetes and obesity, rising geriatric populations, advancements in wound care technologies, favorable reimbursement scenarios, and shifting consumer preferences toward outpatient and home-based healthcare services. Technological advancements in advanced wound dressings (antimicrobial, bioactive, and moisture-retentive dressings), NPWT, skin substitutes, regenerative medicine, and biologics are crucial market accelerators, backed by extensive clinical evidence validating their efficacy and cost-effectiveness. The escalating global prevalence of chronic diseases, particularly diabetes and cardiovascular conditions, significantly drives chronic wound incidence, fueling demand for advanced therapeutic solutions. Additionally, improved patient awareness facilitated through educational initiatives and digital healthcare platforms contributes significantly to earlier diagnoses and increased treatment adoption rates. Growing geriatric populations worldwide further boost the market due to increased susceptibility to chronic wounds among elderly patients. Strategic industry investments in R&D, continuous advancements in medical device technologies, expansion of specialty wound care clinics, and increasing reimbursement coverage for advanced wound management products by healthcare payers further underpin market expansion. Collectively, these specific and interconnected factors establish a robust foundation for continued growth in the global chronic wound care market.Report Scope

The report analyzes the Chronic Wound Care market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Advanced Wound Dressing, Surgical Wound Care, Traditional Wound Care, Wound Therapy Devices); Application (Diabetic Foot Ulcers Application, Pressure Ulcers Application, Venous Leg Ulcers Application, Other Applications); End-Use (Hospitals End-Use, Specialty Clinics End-Use, Home Healthcare End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Advanced Wound Dressing segment, which is expected to reach US$9.9 Billion by 2030 with a CAGR of a 3.4%. The Surgical Wound Care segment is also set to grow at 2.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.7 Billion in 2024, and China, forecasted to grow at an impressive 5.8% CAGR to reach $3.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Chronic Wound Care Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Chronic Wound Care Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Chronic Wound Care Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, AngioDynamics Inc., Bayer AG, Becton, Dickinson and Company (BD), Boston Scientific Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Chronic Wound Care market report include:

- 3M Healthcare

- Acelity L.P. Inc. (now part of 3M)

- Aroa Biosurgery

- Avita Medical

- B. Braun Melsungen AG

- Cardinal Health

- Coloplast A/S

- ConvaTec Group plc

- Ethicon, Inc. (Johnson & Johnson)

- Healogics, Inc.

- Integra LifeSciences Holdings Corporation

- KCI (now part of 3M)

- Kerecis

- Medtronic

- MiMedx Group, Inc.

- Mölnlycke Health Care AB

- Organogenesis Holdings Inc.

- PAUL HARTMANN AG

- RestorixHealth

- Smith & Nephew

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Healthcare

- Acelity L.P. Inc. (now part of 3M)

- Aroa Biosurgery

- Avita Medical

- B. Braun Melsungen AG

- Cardinal Health

- Coloplast A/S

- ConvaTec Group plc

- Ethicon, Inc. (Johnson & Johnson)

- Healogics, Inc.

- Integra LifeSciences Holdings Corporation

- KCI (now part of 3M)

- Kerecis

- Medtronic

- MiMedx Group, Inc.

- Mölnlycke Health Care AB

- Organogenesis Holdings Inc.

- PAUL HARTMANN AG

- RestorixHealth

- Smith & Nephew

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 378 |

| Published | February 2026 |

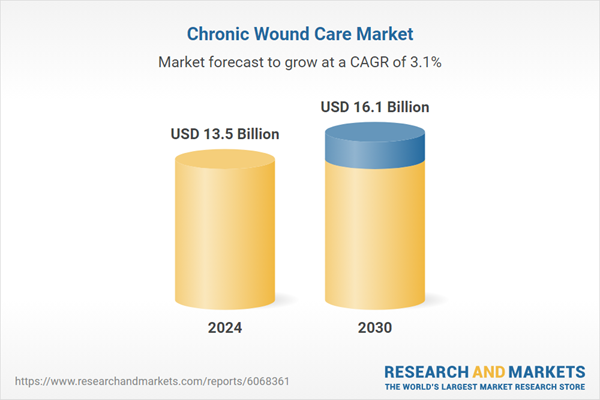

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 13.5 Billion |

| Forecasted Market Value ( USD | $ 16.1 Billion |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | Global |