Global Consumer Identity and Access Management (CIAM) Market - Key Trends & Drivers Summarized

Why is Consumer Identity and Access Management (CIAM) Gaining Unprecedented Importance?

As digital transformation accelerates across industries, businesses are increasingly focusing on secure and seamless customer experiences, making Consumer Identity and Access Management (CIAM) a critical technology. CIAM solutions enable organizations to manage and authenticate user identities while providing frictionless access across various digital platforms. With the growing adoption of cloud computing, mobile applications, and IoT devices, organizations need robust identity management frameworks to ensure security while enhancing user engagement. Data breaches, identity theft, and fraudulent activities have surged in recent years, prompting companies to adopt sophisticated authentication mechanisms such as multi-factor authentication (MFA), biometrics, and risk-based authentication.Additionally, stringent data privacy regulations such as the General Data Protection Regulation (GDPR), California Consumer Privacy Act (CCPA), and the Personal Data Protection Bill (PDPB) have heightened the need for advanced CIAM solutions. Companies are now required to provide greater transparency, control, and security over user data, driving demand for identity governance and compliance tools. The need for personalization and seamless omnichannel experiences further contributes to the growing adoption of CIAM, as businesses strive to deliver tailored interactions while maintaining high-security standards. As cyber threats continue to evolve, the role of CIAM in safeguarding customer identities while enabling frictionless access has become a strategic priority for enterprises worldwide.

How is Technology Transforming the CIAM Landscape?

Technological advancements are playing a pivotal role in reshaping the CIAM market, with artificial intelligence (AI), machine learning (ML), and blockchain emerging as key enablers. AI-powered identity verification and risk assessment tools are enhancing fraud detection capabilities, enabling organizations to proactively identify suspicious activities and prevent unauthorized access. Behavioral biometrics, which analyzes user interactions such as typing patterns, mouse movements, and voice recognition, is gaining traction as an additional security layer. This approach helps in continuous authentication, ensuring that only legitimate users gain access without causing friction in the user experience.Blockchain technology is also making inroads into the CIAM space, offering decentralized identity management solutions that reduce reliance on centralized databases. Self-sovereign identity (SSI) systems based on blockchain allow users to control their own digital identities without intermediaries, enhancing privacy and reducing the risk of identity theft. Meanwhile, passwordless authentication methods, including facial recognition, fingerprint scanning, and adaptive authentication, are gradually replacing traditional username-password combinations, minimizing credential-based attacks. The rise of cloud-based CIAM solutions has further accelerated adoption, providing scalability, flexibility, and cost-efficiency for businesses of all sizes. These advancements collectively drive the evolution of CIAM, making it more resilient, intelligent, and user-friendly.

What Are the Key Use Cases Driving CIAM Adoption Across Industries?

The application of CIAM extends across multiple industries, each leveraging identity management solutions to enhance security and improve customer engagement. The banking, financial services, and insurance (BFSI) sector remains a major adopter of CIAM, as financial institutions require stringent authentication measures to protect sensitive user data and prevent fraud. With the rise of online banking, digital wallets, and fintech applications, robust identity verification mechanisms such as AI-driven risk analysis and biometric authentication are becoming standard practices. Additionally, regulatory compliance requirements such as Know Your Customer (KYC) and Anti-Money Laundering (AML) further emphasize the need for sophisticated identity management solutions.The e-commerce and retail industry is another significant consumer of CIAM, as businesses strive to provide secure, seamless, and personalized shopping experiences. CIAM enables single sign-on (SSO) capabilities, allowing customers to navigate multiple digital touchpoints with ease while ensuring secure transactions. Similarly, the healthcare sector is adopting CIAM solutions to manage patient identities, secure electronic health records (EHRs), and comply with data protection regulations such as the Health Insurance Portability and Accountability Act (HIPAA). As organizations continue to digitize operations, the demand for CIAM in sectors such as media and entertainment, travel and hospitality, and telecommunications is also on the rise, driving market expansion.

What Factors Are Driving Growth in the CIAM Market?

The growth in the Consumer Identity and Access Management (CIAM) market is driven by several factors, including the increasing frequency of cyber threats, regulatory compliance mandates, and the demand for seamless digital experiences. The rise in identity theft, account takeovers, and credential-stuffing attacks has made it imperative for businesses to invest in advanced authentication and fraud prevention solutions. As organizations collect and process vast amounts of consumer data, ensuring compliance with privacy laws has become a major challenge, propelling the need for CIAM platforms with built-in regulatory frameworks. The shift towards digital-first business models, fueled by the growth of e-commerce, online banking, and remote work, has further amplified the need for identity security solutions that can balance protection with user convenience.Moreover, advancements in cloud computing and AI-driven identity analytics are enabling organizations to deploy scalable, intelligent, and adaptive CIAM solutions. The growing adoption of zero-trust security frameworks, which emphasize continuous authentication and least-privilege access, is also driving investments in identity management technologies. Additionally, the increasing demand for omnichannel customer engagement is pushing businesses to integrate CIAM solutions with customer relationship management (CRM) systems, enhancing personalization while maintaining security. As enterprises prioritize digital trust and user experience, the CIAM market is poised for substantial growth, with innovations in AI, biometrics, and decentralized identity management shaping the future of consumer identity protection.

Report Scope

The report analyzes the Consumer Identity and Access Management (CIAM) market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (CIAM Solutions, CIAM Services); End-Use (BFSI End-Use, Healthcare End-Use, Hospitality End-Use, Retail and eCommerce End-Use, Telecommunication End-Use, Education End-Use, Government End-Use, Energy and Utilities End-Use, Manufacturing End-Use, iGaming End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the CIAM Solutions segment, which is expected to reach US$13.1 Billion by 2030 with a CAGR of a 9.6%. The CIAM Services segment is also set to grow at 6.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.5 Billion in 2024, and China, forecasted to grow at an impressive 7.8% CAGR to reach $3.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Consumer Identity and Access Management (CIAM) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Consumer Identity and Access Management (CIAM) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Consumer Identity and Access Management (CIAM) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Armacell International S.A., BASF SE, Covestro AG, Dart Container Corporation, Fagerdala World Foams and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 37 companies featured in this Consumer Identity and Access Management (CIAM) market report include:

- Auth0 (a product unit of Okta)

- Avatier

- Centrify (now Delinea)

- CyberArk

- EmpowerID

- ForgeRock

- Google Cloud Identity

- IBM Security Verify

- iWelcome (acquired by Thales)

- Janrain (acquired by Akamai)

- LoginRadius

- Microsoft Azure Active Directory

- Okta, Inc.

- OneLogin

- Ping Identity

- RSA Security LLC

- SailPoint Technologies Holdings, Inc.

- Saviynt

- SecureAuth

- Transmit Security

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Auth0 (a product unit of Okta)

- Avatier

- Centrify (now Delinea)

- CyberArk

- EmpowerID

- ForgeRock

- Google Cloud Identity

- IBM Security Verify

- iWelcome (acquired by Thales)

- Janrain (acquired by Akamai)

- LoginRadius

- Microsoft Azure Active Directory

- Okta, Inc.

- OneLogin

- Ping Identity

- RSA Security LLC

- SailPoint Technologies Holdings, Inc.

- Saviynt

- SecureAuth

- Transmit Security

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 151 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

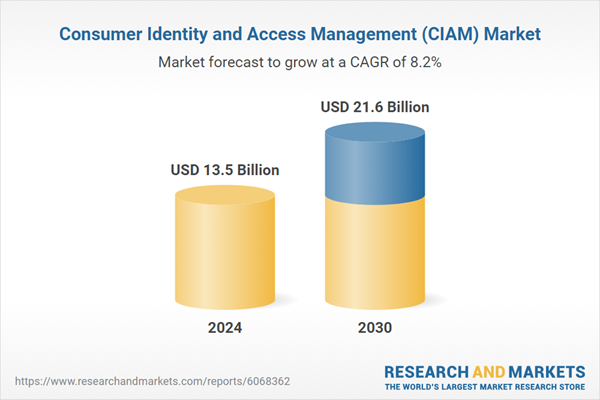

| Estimated Market Value ( USD | $ 13.5 Billion |

| Forecasted Market Value ( USD | $ 21.6 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Global |