Global Fiber and Specialty Carbohydrates Market - Key Trends & Drivers Summarized

What’ s Fueling the Spotlight on Dietary Fibers and Specialty Carbs?

The global demand for fiber and specialty carbohydrates is rising rapidly, driven by the intensifying focus on preventive health, functional nutrition, and clean-label food formulations. Consumers across major markets are increasingly seeking food products that go beyond basic nutrition, with fibers like inulin, beta-glucans, and resistant starches gaining attention for their prebiotic effects and ability to promote gut health. Specialty carbohydrates such as isomaltooligosaccharides (IMOs), fructooligosaccharides (FOS), and sugar alcohols like erythritol and xylitol are being utilized in a growing array of applications - from sports nutrition and dietary supplements to bakery products and low-GI foods. These ingredients offer not only health benefits but also contribute to improved texture, flavor masking, and sugar reduction in processed foods. Additionally, the clean-label trend has spurred manufacturers to explore natural sources and green extraction methods to meet regulatory and consumer scrutiny. Asia-Pacific and North America are emerging as hotbeds of innovation and demand, with rising disposable incomes and awareness about lifestyle diseases influencing purchasing behavior. This surge in health consciousness is reshaping the way food and beverage companies formulate their products, giving fibers and specialty carbohydrates a pivotal role in the evolving nutrition landscape.Could Label Transparency and Functional Ingredients Be Reshaping Consumer Preferences?

Consumers today are more ingredient-savvy than ever before, with label scrutiny influencing food choices across demographics. The movement toward transparency has put pressure on manufacturers to substitute synthetic and high-calorie sweeteners with fiber-rich and specialty carbohydrate alternatives that offer tangible health benefits. The rise in veganism, plant-based diets, and keto lifestyles has further accelerated this trend, as individuals look for ingredients that are compatible with their nutritional philosophies. Specialty carbohydrates derived from natural sources like chicory root, corn, and tapioca have found favor in this regard, offering low-calorie, low-glycemic solutions without sacrificing taste or texture. Moreover, the rapid spread of digital health platforms and fitness apps has empowered consumers to track their fiber intake more closely, raising awareness about digestive health, satiety, and blood sugar control. With food brands competing on the front of gut-friendly and metabolic health-promoting claims, demand for functional ingredients such as dietary fibers and non-digestible oligosaccharides is being catalyzed by both retail and e-commerce channels. Product launches are reflecting this change, with a sharp increase in bars, beverages, and snacks boasting fiber enrichment or sugar-free claims prominently on packaging. This evolving demand pattern is pushing innovation at the intersection of nutrition, convenience, and taste.Why Are R&D and Technological Innovations Playing a Crucial Role in Market Expansion?

The role of research and development in expanding the fiber and specialty carbohydrate market cannot be overstated. Biotechnological advancements are enabling the creation of novel carbohydrate structures with enhanced functionality and stability under varied processing conditions. Companies are investing in enzymatic synthesis and fermentation techniques to yield tailor-made prebiotics and low-digestible carbohydrates suited to specific health needs such as weight management, glucose regulation, and immune support. Furthermore, collaborations between academic institutions, ingredient suppliers, and food manufacturers are driving innovations in encapsulation, delivery systems, and taste modulation to optimize these ingredients for diverse applications. The integration of AI and data analytics into formulation development is also improving precision in ingredient blending, shelf-life prediction, and consumer personalization. Regulatory frameworks in Europe, North America, and APAC are gradually catching up with science, with updated guidelines around labeling, health claims, and usage thresholds providing clearer paths to market for novel carbohydrate types. These advances are helping companies shorten time-to-market for innovative product lines while ensuring safety, efficacy, and compliance. As the technology matures, we can expect to see a broader diversification of fiber and carbohydrate offerings tailored to targeted health outcomes, further embedding these ingredients into mainstream consumption habits.Is the Market’ s Upward Trajectory Supported by Shifting Lifestyles and Industry Demand?

The growth in the fiber and specialty carbohydrates market is driven by several factors that are reshaping both consumer behavior and industry dynamics. On the consumer front, rising incidence of lifestyle diseases such as obesity, diabetes, and cardiovascular disorders has intensified the demand for dietary interventions that can improve long-term health outcomes. There is a clear preference shift toward high-fiber, low-sugar alternatives in everyday foods, especially among aging populations and urban dwellers. The growing appeal of convenience foods with functional benefits has also led to increased incorporation of soluble and insoluble fibers in ready-to-eat meals, snacks, and beverages. In the food manufacturing sector, the push for sugar reduction, calorie control, and enhanced nutritional labeling is compelling producers to adopt specialty carbohydrates that meet both functional and regulatory demands. Meanwhile, the rise of microbiome-focused product development in the nutraceutical and functional food space is placing new emphasis on fermentable fibers and prebiotics. Market growth is further propelled by expanding distribution networks, particularly online channels that allow for niche, health-oriented brands to reach a broader audience. In developing economies, increasing urbanization, westernization of diets, and the proliferation of health-conscious consumers are opening new avenues for fiber-fortified and specialty carbohydrate-based products. All these trends converge to form a robust foundation for sustained market growth across multiple regions and verticals.Report Scope

The report analyzes the Fiber and Specialty Carbohydrates market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Source (Grains Source, Vegetables Source, Fruits Source, Dairy Products Source, Legumes & Pulses Source, Nuts & Seeds Source); Application (Functional Foods Application, Functional Beverage Application, Dietary Supplements Application, Animal Nutrition Application, Personal Care Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Grains Source segment, which is expected to reach US$5.2 Billion by 2030 with a CAGR of a 6.1%. The Vegetables Source segment is also set to grow at 2.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.9 Billion in 2024, and China, forecasted to grow at an impressive 8.1% CAGR to reach $3.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Fiber and Specialty Carbohydrates Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Fiber and Specialty Carbohydrates Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Fiber and Specialty Carbohydrates Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Fiber and Specialty Carbohydrates market report include:

- Ajinomoto Co., Inc.

- Archer Daniels Midland Company (ADM)

- BASF SE

- Cargill, Incorporated

- DSM (Dutch State Mines)

- DuPont de Nemours, Inc.

- FMC Corporation

- Grain Processing Corporation

- Green Plains Inc.

- Harrow Health, Inc.

- Ingredion Incorporated

- J. Rettenmaier & Söhne GmbH + Co KG

- Kerry Group plc

- Molson Coors Beverage Company

- Nutrien Ltd.

- Olam International

- Roquette Frères

- Südzucker AG

- SunOpta Inc.

- Tate & Lyle PLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ajinomoto Co., Inc.

- Archer Daniels Midland Company (ADM)

- BASF SE

- Cargill, Incorporated

- DSM (Dutch State Mines)

- DuPont de Nemours, Inc.

- FMC Corporation

- Grain Processing Corporation

- Green Plains Inc.

- Harrow Health, Inc.

- Ingredion Incorporated

- J. Rettenmaier & Söhne GmbH + Co KG

- Kerry Group plc

- Molson Coors Beverage Company

- Nutrien Ltd.

- Olam International

- Roquette Frères

- Südzucker AG

- SunOpta Inc.

- Tate & Lyle PLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 284 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

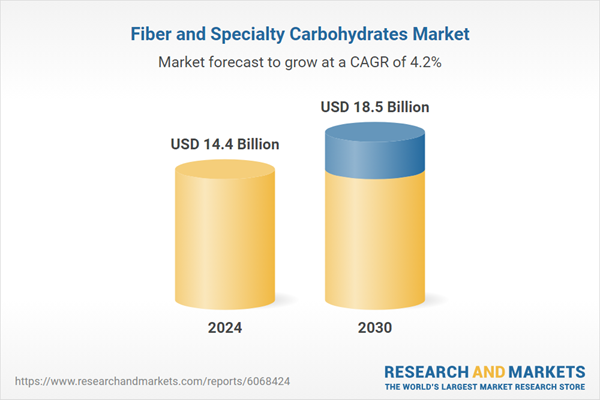

| Estimated Market Value ( USD | $ 14.4 Billion |

| Forecasted Market Value ( USD | $ 18.5 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |