Global Diethyl Phthalate Market - Key Trends & Drivers Summarized

Why Is Diethyl Phthalate a Crucial Industrial Compound?

Diethyl phthalate (DEP) has long been an essential compound in various industrial applications, primarily due to its effectiveness as a plasticizer in plastics, coatings, and personal care products. As a low-cost and efficient solvent, DEP enhances product flexibility and durability, making it indispensable in the manufacturing of cellulose acetate, cosmetics, and fragrances. Additionally, its use as a stabilizer in pharmaceutical coatings has expanded its applicability in the healthcare sector. The rising demand for flexible polymers in packaging, automotive, and consumer goods industries has further solidified DEP’ s role in industrial applications. With its compatibility with various formulations, DEP continues to be a widely used plasticizer despite growing concerns over phthalate exposure and regulatory scrutiny.What Are the Emerging Innovations in the Diethyl Phthalate Market?

Innovations in the diethyl phthalate market are largely driven by the need for safer and more sustainable alternatives. Manufacturers are investing in research and development to formulate low-toxicity and bio-based plasticizers that can serve as replacements for traditional phthalates. Additionally, advancements in polymer chemistry have led to the introduction of high-performance, non-phthalate plasticizers that provide similar functionality without the associated health risks. In the fragrance industry, DEP continues to play a role as a fixative, but growing interest in natural and organic formulations is prompting the development of alternative solvent systems. With increasing emphasis on regulatory compliance, manufacturers are focusing on producing DEP formulations with reduced environmental impact and enhanced biodegradability, ensuring long-term market viability.How Are Regulations Impacting the Diethyl Phthalate Industry?

Regulatory frameworks have significantly influenced the diethyl phthalate market, with many governments imposing restrictions on its use in consumer products due to health and environmental concerns. Agencies such as the European Chemicals Agency (ECHA) and the U.S. Environmental Protection Agency (EPA) have classified DEP as a substance of concern, particularly in applications involving direct human exposure. This has led to a decline in its use in cosmetics, food packaging, and medical products, prompting manufacturers to seek compliant alternatives. However, DEP remains widely used in industrial applications where exposure risks are minimal. The industry is also witnessing a shift toward REACH-compliant and phthalate-free formulations, driven by both regulatory mandates and consumer demand for safer materials.What Are the Key Growth Drivers of the Diethyl Phthalate Market?

The growth in the diethyl phthalate market is driven by several factors, including the continued demand for plasticizers in industrial applications, expansion of the packaging industry, and the need for solvent-based formulations in cosmetics and pharmaceuticals. The increasing consumption of flexible plastics in automotive interiors, consumer electronics, and medical devices has sustained the demand for DEP-based plasticizers. Additionally, the rise in global fragrance production, particularly in personal care and household products, continues to fuel the use of DEP as a stabilizer. The ongoing research into biodegradable and non-toxic alternatives is also expected to create opportunities for innovation while maintaining market relevance. Despite regulatory challenges, the adaptability of DEP in various industrial processes ensures its continued presence in the chemical manufacturing sector.Report Scope

The report analyzes the Diethyl Phthalate market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Industrial Grade Diethyl Phthalate, Cosmetic Grade Diethyl Phthalate); Application (Plasticizer Application, Solvent Application, Cosmetic Ingredient Application, Alcohol Denaturant Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Industrial Grade Diethyl Phthalate segment, which is expected to reach US$94.2 Million by 2030 with a CAGR of a 3.5%. The Cosmetic Grade Diethyl Phthalate segment is also set to grow at 2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $39.2 Million in 2024, and China, forecasted to grow at an impressive 5.4% CAGR to reach $33.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Diethyl Phthalate Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Diethyl Phthalate Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Diethyl Phthalate Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AdvaCare Pharma, Balance of Nature, BELLWAY INC, Better Nutritionals, Church & Dwight Co., Inc. (vitafusion) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Diethyl Phthalate market report include:

- Aekyung Petrochemical Co., Ltd.

- BASF SE

- ChemCeed LLC

- Eastman Chemical Company

- GJ Chemical

- GreenChem Industries LLC

- Henan GP Chemicals Co., Ltd.

- I G Petrochemicals Ltd.

- KLJ Group

- LG Chem Ltd.

- Nan Ya Plastics Corporation

- Nishant Organics Pvt. Ltd.

- Sanyo Corporation of America

- Shandong Qilu Plasticizers Co., Ltd.

- Shree Vitthal Chemicals

- The Chemical Company

- Twin Specialties Corp.

- UPC Technology Corporation

- Vigon International, LLC

- Wego Chemical Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aekyung Petrochemical Co., Ltd.

- BASF SE

- ChemCeed LLC

- Eastman Chemical Company

- GJ Chemical

- GreenChem Industries LLC

- Henan GP Chemicals Co., Ltd.

- I G Petrochemicals Ltd.

- KLJ Group

- LG Chem Ltd.

- Nan Ya Plastics Corporation

- Nishant Organics Pvt. Ltd.

- Sanyo Corporation of America

- Shandong Qilu Plasticizers Co., Ltd.

- Shree Vitthal Chemicals

- The Chemical Company

- Twin Specialties Corp.

- UPC Technology Corporation

- Vigon International, LLC

- Wego Chemical Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 282 |

| Published | February 2026 |

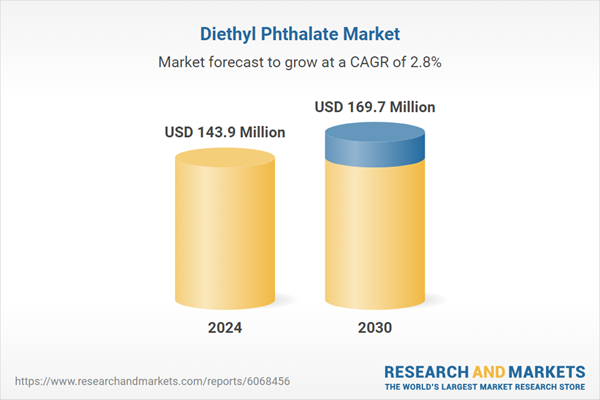

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 143.9 Million |

| Forecasted Market Value ( USD | $ 169.7 Million |

| Compound Annual Growth Rate | 2.8% |

| Regions Covered | Global |