Global Bispecific Antibody Therapeutics Contract Manufacturing Market - Key Trends & Drivers Summarized

Why Is Contract Manufacturing Becoming Essential for Bispecific Antibody Therapeutics?

The rise of bispecific antibody (BsAb) therapeutics has created a significant demand for specialized contract manufacturing services, as biopharmaceutical companies seek scalable, cost-effective, and technologically advanced solutions for complex biologic drug production. Bispecific antibodies, which simultaneously bind to two different antigens or epitopes, offer superior therapeutic efficacy, particularly in oncology, autoimmune diseases, and infectious diseases. However, their intricate molecular structures, stability challenges, and stringent regulatory requirements make large-scale production highly complex. As a result, contract development and manufacturing organizations (CDMOs) have become crucial partners for biopharma firms looking to streamline BsAb production while ensuring quality, compliance, and scalability.The rapid expansion of the biopharmaceutical industry, coupled with growing clinical pipelines of bispecific antibody therapeutics, has led to an increasing reliance on CDMOs for process development, cell line optimization, and large-scale manufacturing. Many biotech companies, particularly startups and mid-sized firms, lack the in-house infrastructure needed for high-yield biologic production, prompting them to outsource manufacturing to specialized CDMOs with expertise in advanced bioprocessing techniques. Additionally, the rising costs of biologic drug development and the need for flexible manufacturing capacity have further accelerated the shift toward contract manufacturing for bispecific antibody therapeutics.

How Are Technological Advancements Improving Bispecific Antibody Contract Manufacturing?

Significant advancements in bioprocessing technology, protein engineering, and automation are transforming bispecific antibody manufacturing, enabling CDMOs to enhance efficiency, yield, and product quality. One of the most notable innovations is the development of high-throughput cell line engineering techniques, including gene editing and synthetic biology, which improve BsAb expression in mammalian cell cultures. Additionally, the adoption of single-use bioreactors and continuous manufacturing systems is revolutionizing large-scale biologic production, reducing contamination risks, increasing flexibility, and lowering overall manufacturing costs.Another major breakthrough in BsAb contract manufacturing is the integration of artificial intelligence (AI) and process analytical technology (PAT) for real-time monitoring and optimization. AI-driven process control enables CDMOs to predict deviations, optimize upstream and downstream bioprocessing parameters, and ensure consistent product quality. Furthermore, novel purification techniques, such as multi-column chromatography and membrane-based separations, are improving the efficiency of BsAb purification, addressing the challenges of complex molecular structures and reducing manufacturing bottlenecks. As regulatory agencies impose stricter guidelines on biosimilar and biologic drug manufacturing, CDMOs are also investing in digital quality management systems (QMS) to ensure compliance with global regulatory standards.

Which Market Trends Are Driving Growth in the Bispecific Antibody Contract Manufacturing Industry?

The increasing demand for bispecific antibodies in immuno-oncology and targeted therapies is one of the most significant trends fueling the growth of contract manufacturing for BsAb therapeutics. With bispecific antibodies showing remarkable success in hematologic malignancies, solid tumors, and autoimmune diseases, pharmaceutical companies are rapidly expanding their pipelines, necessitating large-scale production capabilities. The rise of combination therapies, where BsAbs are used alongside immune checkpoint inhibitors or CAR-T cell therapies, is further driving demand for specialized manufacturing services.Another key trend shaping the market is the expansion of CDMO partnerships and strategic alliances. Many large biopharma companies are outsourcing BsAb manufacturing to CDMOs with expertise in complex biologics production, rather than investing in expensive in-house facilities. Additionally, the growing adoption of modular and flexible manufacturing platforms is allowing CDMOs to cater to small-batch, personalized medicine applications, particularly for bispecific antibodies used in rare diseases and cell therapy enhancements. The increasing penetration of biosimilars in global markets is also contributing to the demand for contract manufacturing, as companies seek to develop cost-competitive BsAb alternatives to existing biologics.

What Are the Key Growth Drivers Shaping the Future of the Bispecific Antibody Contract Manufacturing Market?

The growth in the bispecific antibody therapeutics contract manufacturing market is driven by several factors, including rising R&D investments, increasing regulatory approvals, and the demand for cost-efficient biologic production. One of the most significant drivers is the growing number of bispecific antibody clinical trials, with many late-stage candidates nearing commercialization. As regulatory agencies provide clearer pathways for BsAb approval, pharmaceutical companies are ramping up manufacturing efforts, further fueling demand for CDMO services.Another crucial driver shaping the market is the rapid advancement of next-generation biologic platforms, including trispecific and multi-specific antibody formats. The complexity of these novel biologics necessitates highly specialized manufacturing capabilities, positioning CDMOs as critical players in the drug development ecosystem. Additionally, the push for faster market entry and global expansion is prompting biopharma companies to leverage contract manufacturing for accelerated regulatory submissions and scalable production. As demand for targeted biologics continues to grow, CDMOs specializing in bispecific antibody therapeutics will play a pivotal role in ensuring efficient, high-quality, and cost-effective drug manufacturing, shaping the future of immunotherapy and precision medicine.

Report Scope

The report analyzes the Bispecific Antibody Therapeutics Contract Manufacturing market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Indication Type (Cancer, Infectious Diseases, Autoinflammatory and Autoimmune Diseases, CNS Conditions, Other Indication Types); Administration Route (Intravenous Route, Subcutaneous Route, Other Administration Routes); End-Use (Pharmaceutical Companies End-Use, Biopharmaceutical Companies End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cancer Indication segment, which is expected to reach US$28.2 Billion by 2030 with a CAGR of a 41.4%. The Infectious Diseases Indication segment is also set to grow at 36.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.9 Billion in 2024, and China, forecasted to grow at an impressive 47.5% CAGR to reach $18.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Bispecific Antibody Therapeutics Contract Manufacturing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Bispecific Antibody Therapeutics Contract Manufacturing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Bispecific Antibody Therapeutics Contract Manufacturing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Bispecific Antibody Therapeutics Contract Manufacturing market report include:

- AbbVie, Inc.

- AGC Biologics

- Amgen, Inc.

- Context Therapeutics

- Creative Biolabs

- Cytovance Biologics

- F. Hoffmann-La Roche AG

- IQVIA, Inc.

- Janssen Pharmaceuticals, Inc.

- Johnson & Johnson Services, Inc.

- KBI Biopharma

- Lonza Group Ltd.

- Novavax, Inc.

- Oxford Biomedica PLC

- Sino Biological, Inc.

- Thermo Fisher Scientific, Inc.

- WuXi Biologics

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AbbVie, Inc.

- AGC Biologics

- Amgen, Inc.

- Context Therapeutics

- Creative Biolabs

- Cytovance Biologics

- F. Hoffmann-La Roche AG

- IQVIA, Inc.

- Janssen Pharmaceuticals, Inc.

- Johnson & Johnson Services, Inc.

- KBI Biopharma

- Lonza Group Ltd.

- Novavax, Inc.

- Oxford Biomedica PLC

- Sino Biological, Inc.

- Thermo Fisher Scientific, Inc.

- WuXi Biologics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 382 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

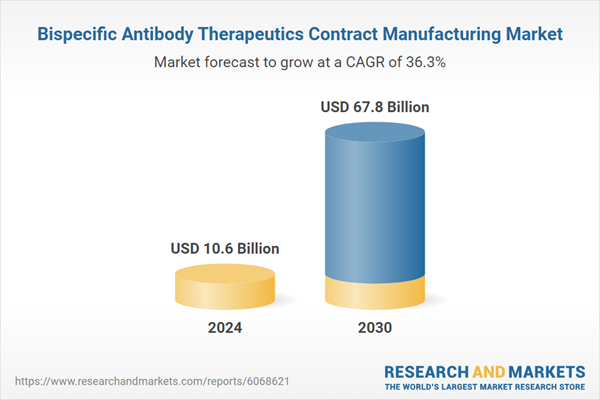

| Estimated Market Value ( USD | $ 10.6 Billion |

| Forecasted Market Value ( USD | $ 67.8 Billion |

| Compound Annual Growth Rate | 36.3% |

| Regions Covered | Global |