Global HVDC Cables Market - Key Trends & Drivers Summarized

Why Are HVDC Cables Gaining Priority in Long-Distance Power Transmission and Grid Modernization?

High-voltage direct current (HVDC) cables are playing an increasingly vital role in modern energy infrastructure due to their ability to transmit large volumes of electricity over long distances with minimal energy losses. Unlike AC transmission systems, HVDC networks enable point-to-point power transfer with higher efficiency and lower line losses - making them particularly advantageous for connecting remote renewable energy sources, offshore wind farms, and geographically dispersed power grids. As nations accelerate their transition toward renewable energy and decarbonization, HVDC cable systems are emerging as critical enablers of inter-regional and cross-border energy exchange, supporting the reliable delivery of clean power from production sites to urban load centers.The rapid integration of wind and solar power - often generated far from demand hubs - is prompting grid operators to deploy HVDC solutions that offer greater control, stability, and capacity over long distances or undersea routes. HVDC cables are also essential for grid interconnectors that enhance energy trading, load balancing, and system redundancy across national borders. These capabilities are aligned with global efforts to build smarter, more flexible, and high-capacity transmission networks that can accommodate fluctuating renewable inputs while reducing dependency on fossil fuels. As grid resilience and transmission efficiency become national priorities, HVDC cables are being recognized as a cornerstone technology for next-generation energy systems.

How Are Technological Advancements and Material Innovations Enhancing HVDC Cable Performance?

Technological innovation in HVDC cable design and materials is expanding the capabilities and reliability of both land and submarine installations. Mass-impregnated non-draining (MIND) cables and cross-linked polyethylene (XLPE) insulated cables have become standard technologies, offering high thermal stability, low dielectric losses, and mechanical robustness. XLPE cables, in particular, are favored for their lightweight construction, environmental compatibility, and ability to support voltages exceeding ± 500 kV. These attributes are driving their adoption in large-scale offshore wind projects and underground urban transmission corridors where space, safety, and environmental constraints are paramount.Further advancements in conductor materials - such as high-purity copper and aluminum - along with innovations in cable sheathing, jointing techniques, and thermal management systems are boosting current-carrying capacity and operational lifespan. Research into superconducting HVDC cables and hybrid AC/DC grid integration is also gaining traction as utilities explore future-ready transmission systems with ultra-high efficiency. Moreover, advanced monitoring and diagnostic tools - such as real-time thermal modeling, partial discharge detection, and cable condition monitoring - are enhancing preventive maintenance and operational transparency. These innovations are collectively enabling longer transmission distances, deeper sea deployments, and greater voltage scalability, solidifying HVDC cables as both a mature and forward-looking transmission technology.

What Policy, Energy Transition, and Interconnection Trends Are Shaping HVDC Cable Deployment Globally?

Government policies supporting renewable integration, grid decarbonization, and transnational energy trade are significantly accelerating HVDC cable deployment. In Europe, the EU’ s Green Deal and Trans-European Networks for Energy (TEN-E) policy are funding a wave of cross-border HVDC interconnectors that support electricity market integration and renewable distribution across the continent. Similar initiatives are underway in Asia-Pacific, where China, India, and Southeast Asian countries are deploying ultra-high voltage (UHV) HVDC lines to transport renewable energy from interior regions to coastal industrial hubs. In North America, offshore wind development along the East Coast and interregional power transfer initiatives are creating a robust pipeline for HVDC cable projects, particularly for subsea and underground routes.The global emphasis on energy security and diversification is also increasing interest in intercontinental HVDC links, such as the ambitious proposals connecting North Africa’ s solar capacity with European grids. As distributed energy generation, electric vehicle adoption, and electrification of heating and transport place additional stress on existing AC networks, HVDC cables offer a scalable solution to avoid congestion and improve system flexibility. Regulatory frameworks supporting public-private partnerships, streamlined permitting processes, and technology neutrality are further enabling large-scale HVDC deployment. These structural and policy trends are not only expanding the market for HVDC cables but also embedding them as a strategic infrastructure priority for decarbonized, interconnected power systems.

What Is Driving the Growth of the HVDC Cables Market Across Project Types and Global Regions?

The growth in the HVDC cables market is driven by surging investment in renewable energy infrastructure, expanding offshore wind capacity, and the global modernization of transmission networks. Offshore wind power - particularly in Europe, China, and the U.S. - is a major growth catalyst, as HVDC technology provides a more efficient and cost-effective solution for connecting large-scale offshore farms to distant onshore grids. Submarine HVDC cables are also gaining importance in linking island grids, crossing fjords or mountain ranges, and interconnecting countries to support energy trading and grid balancing. These high-value projects require robust, tailor-engineered cable systems capable of operating in harsh environmental conditions.Land-based HVDC cable installations are witnessing strong demand in densely populated or environmentally sensitive areas where overhead AC lines are not feasible. Urban energy corridors, data center clusters, industrial parks, and high-speed rail electrification projects are increasingly specifying underground HVDC cables to minimize footprint and enhance safety. Regionally, Europe continues to lead in HVDC deployment due to mature regulatory frameworks and interconnector ambitions, while Asia-Pacific is emerging as a volume-driven market with high-voltage, high-capacity megaprojects led by state utilities. The Middle East and Africa are also exploring HVDC to export surplus renewable energy and stabilize regional grids. As the global energy transition accelerates and cross-border collaboration intensifies, the HVDC cable market is poised for sustained growth, backed by technological maturity, policy alignment, and rising global energy interdependence.

Report Scope

The report analyzes the HVDC Cables market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Voltage (35 kV - 475 kV, 475 kV - 600 kV, Above 600 kV); Installation (Overhead lines, Submarine, Underground); Application (Intra-Regional, Cross Border, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the 35 kV - 475 kV Cables segment, which is expected to reach US$14.5 Billion by 2030 with a CAGR of a 13.5%. The 475 kV - 600 kV Cables segment is also set to grow at 15.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.0 Billion in 2024, and China, forecasted to grow at an impressive 19.1% CAGR to reach $5.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global HVDC Cables Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global HVDC Cables Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global HVDC Cables Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aggreko, Air on Location Inc. (Dex Media), Air Solutions LLC, Andrews Sykes Group Plc, Big Ten Rentals and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this HVDC Cables market report include:

- ABB Ltd.

- Hitachi Energy Ltd.

- LS Cable & System Ltd.

- Nexus Technologies & Cable Ltd

- NKT A/S

- Prysmian S.p.A

- Siemens Energy AG

- Sumitomo Electric Industries Ltd.

- SunCable

- Taihan Cable & Solution Co. Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd.

- Hitachi Energy Ltd.

- LS Cable & System Ltd.

- Nexus Technologies & Cable Ltd

- NKT A/S

- Prysmian S.p.A

- Siemens Energy AG

- Sumitomo Electric Industries Ltd.

- SunCable

- Taihan Cable & Solution Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 367 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

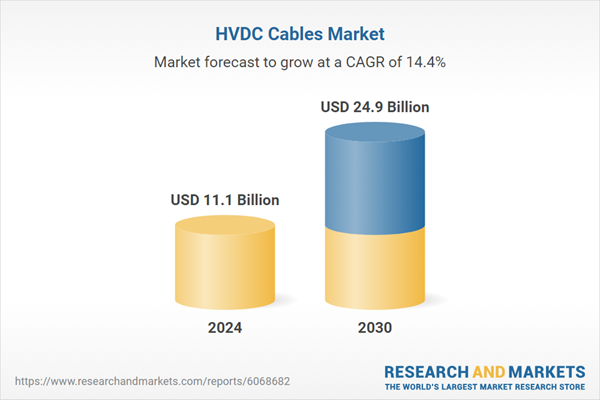

| Estimated Market Value ( USD | $ 11.1 Billion |

| Forecasted Market Value ( USD | $ 24.9 Billion |

| Compound Annual Growth Rate | 14.4% |

| Regions Covered | Global |