Global Cell and Gene Therapy Clinical Trial Services Market - Key Trends & Drivers Summarized

Why Is the Demand for Cell and Gene Therapy Clinical Trial Services Increasing?

The demand for cell and gene therapy clinical trial services is increasing due to the growing number of innovative therapies entering the development pipeline, the rise of personalized medicine, and the expanding regulatory support for advanced therapeutic products. Cell and gene therapies have shown significant potential in treating previously untreatable conditions, including rare genetic disorders, cancers, and neurodegenerative diseases. As pharmaceutical and biotech companies continue investing in regenerative medicine, the need for specialized clinical trial services has grown exponentially.Advancements in genetic engineering, CRISPR-based technologies, and autologous and allogeneic cell therapies have further accelerated research and development efforts in this field. With a rise in clinical trials targeting rare diseases and oncology, contract research organizations and specialized trial service providers are playing a critical role in ensuring regulatory compliance, patient recruitment, and trial execution. Additionally, global regulatory agencies such as the FDA and EMA are introducing streamlined approval pathways for cell and gene therapies, increasing the demand for clinical trial expertise to navigate the complex regulatory landscape.

How Are Technological Advancements Improving Cell and Gene Therapy Clinical Trials?

Technological innovations in clinical trial design, real-time monitoring, and patient data analytics are revolutionizing the execution of cell and gene therapy studies. One of the most significant advancements is the use of artificial intelligence and machine learning to optimize patient recruitment and predictive modeling for therapy outcomes. AI-driven trial design helps identify suitable candidates, improve trial efficiency, and reduce time-to-market for breakthrough therapies.Another major breakthrough is the integration of decentralized clinical trials, which enable remote patient monitoring and reduce the logistical challenges associated with traditional study designs. Wearable biosensors, telemedicine platforms, and electronic patient-reported outcomes are making trials more patient-centric, ensuring better compliance and data collection. Additionally, advancements in cryopreservation and logistics for cell-based therapies are enhancing the ability to conduct multi-site and global trials. With increasing automation in laboratory processes and bioinformatics tools for genomic analysis, cell and gene therapy trials are becoming more precise, scalable, and efficient.

Which Market Trends Are Driving Growth in the Cell and Gene Therapy Clinical Trial Services Industry?

The increasing number of clinical trials focused on rare diseases and oncology is one of the most influential trends shaping the cell and gene therapy clinical trial services market. Many of these therapies target small patient populations, requiring specialized recruitment strategies and trial designs tailored to complex treatment protocols. The expansion of regenerative medicine and immunotherapy-based treatments has also led to a growing need for customized trial services that address the unique challenges of cell-based interventions.Another key trend influencing market growth is the rise of global collaborations between pharmaceutical companies, research institutions, and contract research organizations. As cell and gene therapy trials require specialized facilities, skilled personnel, and advanced manufacturing capabilities, companies are increasingly outsourcing clinical trial management to experienced service providers. Additionally, regulatory harmonization across different regions is facilitating faster approvals, allowing companies to conduct multi-center trials more efficiently. The increasing role of real-world evidence in therapy assessment is also shaping clinical trial methodologies, integrating long-term patient outcomes into approval and reimbursement strategies.

What Are the Key Growth Drivers Shaping the Future of the Cell and Gene Therapy Clinical Trial Services Market?

The growth in the cell and gene therapy clinical trial services market is driven by several factors, including increased investment in regenerative medicine, the rise of advanced biomanufacturing techniques, and evolving regulatory frameworks supporting novel therapies. One of the primary growth drivers is the significant funding from both public and private sectors into cell and gene therapy research, with governments and venture capital firms heavily investing in next-generation treatments.Another crucial driver shaping the market is the expansion of clinical trial infrastructure, including specialized research centers and manufacturing hubs dedicated to advanced therapies. As the demand for personalized treatments increases, trial service providers are focusing on adaptive trial designs and precision medicine approaches to improve therapy efficacy and patient outcomes. Additionally, the increasing acceptance of decentralized and hybrid trial models is enabling wider patient participation and reducing trial costs. As the field of cell and gene therapy continues to evolve, clinical trial services will remain essential in bringing transformative treatments to market, addressing complex diseases, and advancing the future of precision medicine.

Report Scope

The report analyzes the Cell and Gene Therapy Clinical Trial Services market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Phase (Phase I, Phase II, Phase III, Phase IV); Indication (Oncology Indication, CNS Indication, Cardiology Indication, Ophthalmology Indication, Immunology and Inflammation Indication, Hematology Indication, Musculoskeletal Indication, Endocrine, Metabolic, Genetic Indication, Infectious Diseases Indication, Other Indications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Phase I Clinical Trial Services segment, which is expected to reach US$15.1 Billion by 2030 with a CAGR of a 17.9%. The Phase II Clinical Trial Services segment is also set to grow at 15.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.1 Billion in 2024, and China, forecasted to grow at an impressive 15.3% CAGR to reach $4.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cell and Gene Therapy Clinical Trial Services Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cell and Gene Therapy Clinical Trial Services Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cell and Gene Therapy Clinical Trial Services Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 9 Meters Biopharma, Inc., Anokion SA, Barinthus Biotherapeutics, Chugai Pharmaceutical Co., Ltd., Cour Pharmaceuticals and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Cell and Gene Therapy Clinical Trial Services market report include:

- Charles River Laboratories

- Clinipace

- Covance Inc.

- ICON plc

- IQVIA Biotech

- KCR

- Labcorp Drug Development

- Linical Co., Ltd.

- Medpace

- Novotech

- Parexel International

- Pivotal Clinical Research

- PPD (Thermo Fisher Scientific)

- PRA Health Sciences

- Premier Research

- Syneos Health

- Synteract

- Veristat

- Worldwide Clinical Trials

- WuXi AppTec

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Charles River Laboratories

- Clinipace

- Covance Inc.

- ICON plc

- IQVIA Biotech

- KCR

- Labcorp Drug Development

- Linical Co., Ltd.

- Medpace

- Novotech

- Parexel International

- Pivotal Clinical Research

- PPD (Thermo Fisher Scientific)

- PRA Health Sciences

- Premier Research

- Syneos Health

- Synteract

- Veristat

- Worldwide Clinical Trials

- WuXi AppTec

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 154 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

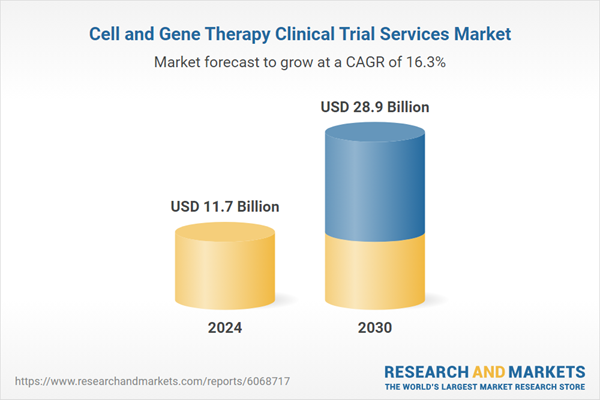

| Estimated Market Value ( USD | $ 11.7 Billion |

| Forecasted Market Value ( USD | $ 28.9 Billion |

| Compound Annual Growth Rate | 16.3% |

| Regions Covered | Global |