Global Targeted DNA RNA Sequencing Market - Key Trends & Drivers Summarized

Why Is Targeted DNA RNA Sequencing Gaining Ground Over Whole Genome and Transcriptome Approaches?

In the era of precision medicine and high-throughput genomics, targeted DNA and RNA sequencing has emerged as a practical and efficient alternative to whole genome and transcriptome sequencing. By focusing on specific genomic regions or transcript subsets of interest, this method offers a highly cost-effective, scalable, and clinically relevant way to interrogate genetic variation, expression profiles, and molecular biomarkers. Unlike whole genome sequencing, which can generate enormous amounts of irrelevant data and require intensive computational resources, targeted sequencing enables researchers and clinicians to zero in on known genes, regulatory elements, or mutation hotspots linked to disease pathways. In oncology, for example, targeted sequencing panels allow clinicians to identify actionable mutations across cancer-relevant genes with faster turnaround and better interpretability. In infectious disease research, targeted RNA sequencing enables pathogen-specific transcript analysis, aiding in strain identification and drug resistance profiling. Additionally, hereditary disease diagnostics, pharmacogenomics, and immune repertoire profiling are increasingly reliant on targeted assays for precise, repeatable insights. As the healthcare and life sciences industries seek clinically actionable, time-sensitive genetic data, targeted sequencing methods are bridging the gap between research and clinical utility, offering the depth and specificity needed to answer high-impact biological questions without the burden of excessive data noise.How Are Technology Innovations Enhancing the Efficiency and Accuracy of Targeted Sequencing?

Advancements in sequencing chemistry, probe design, amplification protocols, and bioinformatics are driving significant improvements in the sensitivity, specificity, and throughput of targeted DNA and RNA sequencing. Techniques such as hybrid capture and amplicon-based enrichment are becoming more refined, enabling accurate targeting of low-frequency variants and structurally complex genomic regions. Adaptive sampling technologies now allow for real-time target selection on nanopore sequencing platforms, reducing wasted reads and increasing efficiency. Multiplexed library preparation kits and automation-friendly workflows are cutting down turnaround times and reducing sample handling errors, while low-input and FFPE-compatible kits are expanding usability in clinical and degraded samples. On the data analysis front, integrated bioinformatics pipelines and AI-powered variant callers are enhancing the reliability of read mapping, mutation detection, and transcript quantification, even in difficult-to-sequence regions. Cloud-based platforms are facilitating collaborative research, secure data storage, and streamlined reporting for clinical labs. Furthermore, the development of dual DNA/RNA panels is supporting integrated genomic and transcriptomic profiling from a single sample, which is particularly useful in oncology and immune profiling applications. Combined with increasing read accuracy, faster sequencers, and more affordable reagent kits, these innovations are making targeted sequencing not just a focused method, but a technically sophisticated and widely deployable solution for precision diagnostics and translational research.Where Is Targeted DNA RNA Sequencing Being Adopted, and What Are the Emerging Use Cases?

Targeted DNA and RNA sequencing is being adopted across a wide range of clinical, academic, and industrial settings, with applications extending well beyond traditional genomics research. In clinical oncology, targeted sequencing panels are now routine for solid tumors and hematologic malignancies, helping identify actionable mutations, guide therapy selection, and monitor minimal residual disease. In reproductive health and rare disease diagnostics, targeted assays enable rapid screening for pathogenic variants across defined gene sets, improving diagnostic yield while reducing costs and turnaround times. In infectious disease research, pathogen-specific RNA sequencing is being used for rapid identification of emerging variants, antimicrobial resistance markers, and transcriptional responses to therapeutic agents. The immunology and vaccine development fields are leveraging targeted T-cell and B-cell receptor sequencing to study immune repertoires and response dynamics. Beyond healthcare, agrigenomics researchers use targeted sequencing to analyze plant and livestock traits, while in environmental monitoring, RNA panels help track microbial activity in ecosystems and industrial bioreactors. Drug development pipelines are increasingly incorporating targeted sequencing for biomarker discovery and companion diagnostic development. Geographically, adoption is strong in North America and Western Europe, where clinical genomics is more mature, while Asia-Pacific is witnessing rapid growth driven by expanding research funding, genomics startup ecosystems, and government initiatives in precision medicine. With sequencing instruments becoming more portable and data analysis more accessible, small to mid-sized labs in academia and diagnostics are also embracing targeted methods, expanding market reach and diversity of use cases.What's Fueling the Accelerated Growth of the Global Targeted DNA RNA Sequencing Market?

The growth of the targeted DNA RNA sequencing market is being driven by the convergence of clinical demand, research prioritization, cost-efficiency, and rapid technological maturation. The global rise in chronic diseases, cancer incidence, and interest in personalized medicine is increasing demand for quick, actionable genetic insights that targeted sequencing is well-equipped to provide. Compared to whole genome approaches, targeted methods offer significantly lower sequencing costs, reduced data complexity, and faster reporting timelines - making them more accessible for routine diagnostics, especially in resource-constrained settings. The integration of multi-omic strategies and growing interest in spatial and single-cell sequencing are further fueling adoption, as researchers seek ways to combine high-throughput precision with data relevance. Regulatory approvals of targeted NGS panels for clinical use, especially in oncology, pharmacogenomics, and inherited diseases, are validating the utility of these approaches and accelerating clinical deployment. Rising funding in genomics research, coupled with government initiatives aimed at national sequencing projects and biobank development, is broadening the infrastructure and support ecosystem. Partnerships between academic institutions, biotech firms, and diagnostic labs are fostering innovation and commercialization of specialized panels tailored for specific populations or diseases. At the same time, the availability of automated, user-friendly NGS platforms and integrated analysis software is democratizing access for mid-sized and decentralized laboratories. As demand for precision, speed, and affordability grows in molecular diagnostics and translational research, targeted DNA RNA sequencing is positioned to play an increasingly central role in shaping the next generation of genomic medicine.Report Scope

The report analyzes the Targeted DNA RNA Sequencing market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (NGS, Others); Workflow (Pre-sequencing, Sequencing, Data); Type (DNA-based Targeted Sequencing, RNA-based Targeted Sequencing); Application (Human Biomedical Research, Plant & Animal Sciences, Drug Discovery, Others); End-Use (Academic Research, Hospitals & Clinics, Pharma & Biotech Companies, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the NGS segment, which is expected to reach US$17 Billion by 2030 with a CAGR of a 15.8%. The Other Products segment is also set to grow at 20.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.2 Billion in 2024, and China, forecasted to grow at an impressive 23.2% CAGR to reach $6.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Targeted DNA RNA Sequencing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Targeted DNA RNA Sequencing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Targeted DNA RNA Sequencing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABAC Air Compressors, Atlas Copco AB, BAC Compressors, Bitzer SE, BOGE Kompressoren Otto Boge GmbH & Co. KG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Targeted DNA RNA Sequencing market report include:

- Agilent Technologies, Inc.

- Azenta Life Sciences (GENEWIZ)

- BGI Genomics

- Bio-Rad Laboratories, Inc.

- CD Genomics

- Element Biosciences

- F. Hoffmann-La Roche Ltd

- Genomatix Software GmbH

- GeneDx

- HudsonAlpha Institute for Biotechnology

- Illumina, Inc.

- Integrated DNA Technologies, Inc.

- Macrogen, Inc.

- New England Biolabs

- Novogene Corporation

- Nugen Technologies, Inc.

- Oxford Nanopore Technologies plc

- Pacific Biosciences of California, Inc.

- Paragon Genomics

- PerkinElmer, Inc.

- PierianDx

- QIAGEN N.V.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Agilent Technologies, Inc.

- Azenta Life Sciences (GENEWIZ)

- BGI Genomics

- Bio-Rad Laboratories, Inc.

- CD Genomics

- Element Biosciences

- F. Hoffmann-La Roche Ltd

- Genomatix Software GmbH

- GeneDx

- HudsonAlpha Institute for Biotechnology

- Illumina, Inc.

- Integrated DNA Technologies, Inc.

- Macrogen, Inc.

- New England Biolabs

- Novogene Corporation

- Nugen Technologies, Inc.

- Oxford Nanopore Technologies plc

- Pacific Biosciences of California, Inc.

- Paragon Genomics

- PerkinElmer, Inc.

- PierianDx

- QIAGEN N.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 568 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

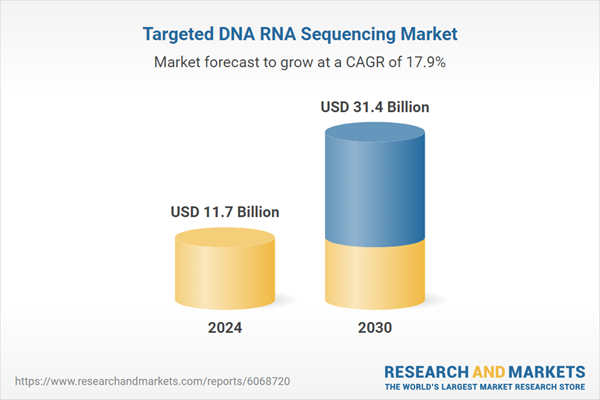

| Estimated Market Value ( USD | $ 11.7 Billion |

| Forecasted Market Value ( USD | $ 31.4 Billion |

| Compound Annual Growth Rate | 17.9% |

| Regions Covered | Global |