Global Primary Water and Wastewater Treatment Equipment Market - Key Trends & Drivers Summarized

Why Is Primary Water and Wastewater Treatment Equipment Essential for Environmental Sustainability?

Primary water and wastewater treatment equipment play a crucial role in maintaining environmental sustainability by removing suspended solids, organic matter, and harmful contaminants from water sources. As urbanization and industrialization expand, the demand for effective water treatment solutions has surged to prevent water pollution and protect public health. Primary treatment processes, including sedimentation, screening, and flotation, are the first steps in water purification, ensuring that wastewater meets regulatory discharge standards before secondary and tertiary treatments. Municipalities and industries, particularly in the food and beverage, pharmaceutical, and chemical sectors, are investing in advanced treatment systems to comply with stringent environmental laws and promote sustainable water management practices. Additionally, the rising incidence of waterborne diseases and the growing global water crisis have intensified the need for efficient water recycling and conservation efforts. As technology advances, water treatment equipment is becoming more automated, energy-efficient, and capable of handling large volumes of wastewater with minimal operational costs.What Challenges Are Hindering the Growth of the Water and Wastewater Treatment Equipment Market?

Despite its critical importance, the water and wastewater treatment equipment industry faces several challenges that impact market expansion and accessibility. One of the primary concerns is the high cost of installation and maintenance, which can deter small municipalities and industries from investing in advanced treatment systems. Additionally, outdated infrastructure in developing countries limits the adoption of modern treatment technologies, resulting in inefficient wastewater management and environmental contamination. Another significant challenge is the presence of emerging pollutants, such as pharmaceuticals, microplastics, and industrial chemicals, which require specialized treatment methods beyond conventional primary treatment. Regulatory complexities and compliance requirements also pose barriers to market growth, as companies must adhere to evolving water quality standards that vary across regions. Furthermore, energy consumption remains a key issue, as many traditional treatment processes rely on electricity-intensive operations, increasing operational costs. Addressing these challenges requires strategic investments in cost-effective treatment solutions, regulatory harmonization, and the integration of sustainable energy-efficient technologies.How Are Technological Innovations Enhancing Primary Water and Wastewater Treatment?

Advancements in water treatment technology are revolutionizing the efficiency, sustainability, and effectiveness of primary wastewater treatment systems. The development of automated filtration systems, AI-driven monitoring solutions, and smart water management platforms is improving operational efficiency while reducing manual intervention. Innovations in high-efficiency clarifiers and sedimentation tanks have enhanced the removal of suspended solids, minimizing the burden on secondary treatment processes. The integration of IoT-enabled sensors and real-time data analytics is allowing wastewater facilities to optimize chemical dosing, detect system inefficiencies, and predict maintenance needs. Additionally, the emergence of decentralized water treatment systems is gaining traction in rural and remote areas, enabling localized water purification with minimal infrastructure requirements. The adoption of renewable energy-powered treatment plants, such as solar-powered filtration systems, is also addressing sustainability concerns by reducing energy dependency and lowering operational costs. As technological advancements continue, primary water and wastewater treatment equipment is becoming more accessible, reliable, and environmentally friendly.What Is Driving the Growth of the Primary Water and Wastewater Treatment Equipment Market?

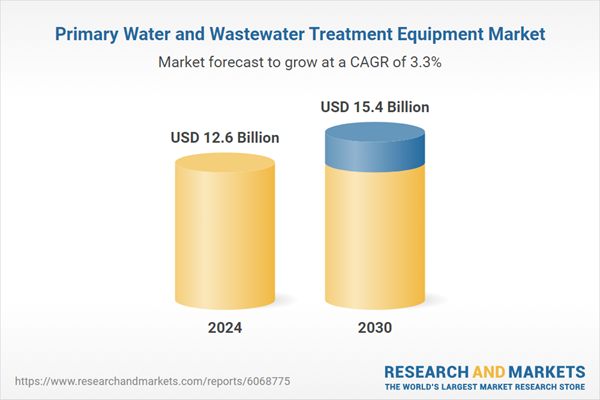

The growth in the primary water and wastewater treatment equipment market is driven by several factors, including increasing regulatory enforcement of water quality standards, rising industrial wastewater generation, and growing concerns over freshwater scarcity. Governments worldwide are implementing stringent discharge regulations to control water pollution, compelling industries and municipalities to invest in modern treatment technologies. The expansion of industrial sectors such as manufacturing, mining, and pharmaceuticals is also contributing to market growth, as these industries generate significant volumes of wastewater that require proper treatment. Additionally, climate change-induced water shortages are pushing for the adoption of water recycling and reuse initiatives, further boosting demand for primary treatment systems. The rise of public-private partnerships (PPPs) in infrastructure development is facilitating large-scale investments in water treatment projects, enhancing market penetration. As water security becomes a global priority, the demand for efficient and cost-effective primary water and wastewater treatment equipment is expected to witness sustained growth, driving innovation and sustainability in water management practices.Report Scope

The report analyzes the Primary Water and Wastewater Treatment Equipment market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Equipment Type (Primary Clarifier Equipment, Sludge Removal Equipment, Grit Removal Equipment, Pre-Treatment, Other Equipment Types); Application (Municipal Application, Industrial Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Some of the 44 companies featured in this Primary Water and Wastewater Treatment Equipment market report include -

- Aquatech International

- Bluewater Bio Ltd.

- Calgon Carbon Corporation

- Corix Water Systems

- Dow Water & Process Solutions

- Ecolab Inc.

- Evoqua Water Technologies

- Fluence Corporation Limited

- GE Water & Process Technologies

- Kemira Oyj

- Kurita Water Industries Ltd.

- Lenntech B.V.

- Napier-Reid Ltd.

- Pall Corporation

- Parkson Corporation

- Pentair plc

- SUEZ

- Veolia Water Technologies

- WPL Limited

- Xylem Inc.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Primary Clarifier Equipment segment, which is expected to reach US$6.2 Billion by 2030 with a CAGR of a 4.2%. The Sludge Removal Equipment segment is also set to grow at 2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.4 Billion in 2024, and China, forecasted to grow at an impressive 6.3% CAGR to reach $3.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Primary Water and Wastewater Treatment Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Primary Water and Wastewater Treatment Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Primary Water and Wastewater Treatment Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AbbVie Inc., Bristol-Myers Squibb Company, Calliditas Therapeutics AB, CymaBay Therapeutics, Escient Pharmaceuticals and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Select Competitors (Total 44 Featured):

- Aquatech International

- Bluewater Bio Ltd.

- Calgon Carbon Corporation

- Corix Water Systems

- Dow Water & Process Solutions

- Ecolab Inc.

- Evoqua Water Technologies

- Fluence Corporation Limited

- GE Water & Process Technologies

- Kemira Oyj

- Kurita Water Industries Ltd.

- Lenntech B.V.

- Napier-Reid Ltd.

- Pall Corporation

- Parkson Corporation

- Pentair plc

- SUEZ

- Veolia Water Technologies

- WPL Limited

- Xylem Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aquatech International

- Bluewater Bio Ltd.

- Calgon Carbon Corporation

- Corix Water Systems

- Dow Water & Process Solutions

- Ecolab Inc.

- Evoqua Water Technologies

- Fluence Corporation Limited

- GE Water & Process Technologies

- Kemira Oyj

- Kurita Water Industries Ltd.

- Lenntech B.V.

- Napier-Reid Ltd.

- Pall Corporation

- Parkson Corporation

- Pentair plc

- SUEZ

- Veolia Water Technologies

- WPL Limited

- Xylem Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 284 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 12.6 Billion |

| Forecasted Market Value ( USD | $ 15.4 Billion |

| Compound Annual Growth Rate | 3.3% |

| Regions Covered | Global |