Global Citrus Gummies Market - Key Trends & Drivers Summarized

Why Are Citrus Gummies Capturing Consumer Attention in the Functional Format Revolution?

Citrus gummies are rapidly emerging as one of the most dynamic product formats in the global health, wellness, and nutrition space, combining the sensory appeal of confectionery with the functional benefits of botanical and nutraceutical ingredients. The convergence of convenience, taste, and wellness is driving a major shift in how consumers interact with dietary supplements, moving away from traditional capsules and tablets toward chewable, flavorful alternatives. Citrus gummies - infused with natural citrus extracts, concentrates, or flavors from oranges, lemons, limes, and grapefruits - are gaining strong traction due to their association with immune health, vitamin C fortification, and natural taste. Unlike conventional supplements that often suffer from low compliance due to poor palatability or complex intake schedules, citrus gummies offer a pleasant, easy-to-consume format that appeals to adults, children, and seniors alike. Moreover, the growing focus on personalization and lifestyle nutrition is fueling the rise of gummies targeted at specific health benefits such as immunity, digestion, energy, stress relief, beauty-from-within, and metabolic wellness - many of which are enhanced with citrus-based bioactives like bioflavonoids, pectin, or essential oils. As consumers look for functional solutions that seamlessly integrate into their daily routines, citrus gummies are poised to become a preferred delivery mechanism in the broader functional and preventive health landscape.How Are Clean Label Expectations and Flavor Preferences Reshaping Citrus Gummy Innovation?

Citrus gummies are evolving well beyond the conventional “ vitamin C chewable” archetype, as brands respond to increasingly sophisticated consumer expectations around clean label formulations, ingredient transparency, and sensory quality. Today’ s health-aware consumers are demanding gummy supplements that are plant-based, low in sugar, free from synthetic colors, gelatin-free, and formulated with natural flavors and sweeteners. Citrus, being a universally loved and naturally tangy flavor profile, fits seamlessly into this clean label trend - offering a bright, refreshing taste while reinforcing a healthy and natural product perception. Innovations in citrus flavoring, including the use of cold-pressed citrus oils, citrus peel extracts, and citrus-derived pectins, are allowing formulators to enhance both taste and nutritional positioning. The use of pectin, a naturally derived gelling agent from citrus fruits, is also enabling vegan and vegetarian formulations that avoid traditional gelatin, further widening the consumer base. In response to growing sugar reduction demands, manufacturers are incorporating natural sweeteners such as stevia, monk fruit, and fruit juice concentrates, ensuring better glycemic profiles without compromising flavor. Additionally, dual-layered gummies, sugar-free options, and novel shapes and textures are being introduced to add novelty and differentiation in a competitive market. As flavor becomes a critical factor in product repeatability and brand loyalty, citrus gummies are increasingly becoming the standard bearer of clean, refreshing, and functional indulgence in wellness nutrition.Is Technology Unlocking the Next Phase of Functional Performance in Citrus Gummies?

Technological innovation is playing a central role in elevating citrus gummies from a simple chewable format to a sophisticated delivery system for complex health ingredients. Advances in microencapsulation, controlled-release systems, and nanoemulsion technologies are enabling better stability and bioavailability of sensitive nutrients such as vitamin C, zinc, magnesium, melatonin, and botanical extracts - many of which are used in combination with citrus flavors or actives. These technologies are also allowing citrus gummies to deliver enhanced therapeutic outcomes while maintaining taste integrity and shelf life. Furthermore, the use of citrus-derived functional ingredients such as citrus bioflavonoids, hesperidin, and pectin not only improves product efficacy but also supports the “ natural functionality” narrative. This technological sophistication is extending to the manufacturing side as well, with improved molding systems, moisture control, and active ingredient dispersion techniques ensuring consistent quality, appearance, and dosage accuracy. Multi-active gummies, which combine several health ingredients in a single unit, are becoming more feasible due to advancements in ingredient compatibility and stability. Smart packaging solutions, including moisture-resistant containers and portion-controlled sachets, are enhancing product usability and longevity - particularly important in e-commerce and export markets. These breakthroughs are helping citrus gummy manufacturers offer not just flavorful and fun supplements, but clinically relevant and highly efficacious wellness products that appeal to a broad range of consumer needs, from immunity and gut health to stress management and cognitive performance.What’ s Fueling the Strong Growth Trajectory of the Global Citrus Gummies Market?

The growth in the citrus gummies market is driven by several factors tied directly to end-use sector diversification, evolving consumer behavior, product format innovation, and ingredient advancements. First, the rising demand for convenient, on-the-go nutrition formats has made gummies one of the fastest-growing delivery systems in the dietary supplement space. Citrus gummies, with their vibrant flavor profile and natural health associations, are particularly benefiting from this trend. Second, increasing consumer awareness around immune health, especially post-pandemic, has led to a surge in vitamin C-centric products, where citrus remains the preferred source for flavor, branding, and functional association. Third, the expansion of gummy applications into new health categories - such as sleep, energy, mood, and skin health - is creating a broader market canvas for citrus-infused formulations. Additionally, consumer shifts toward clean label, plant-based, sugar-free, and allergen-free products are pushing formulators to use citrus-based ingredients like pectin and essential oils as both functional and positioning tools. On the retail front, the rise of e-commerce and D2C wellness brands is amplifying consumer access, allowing niche citrus gummy products to reach global markets quickly. Moreover, product personalization trends - enabled by subscription models and AI-driven health profiling - are leading to curated gummy offerings that often incorporate citrus for flavor and function. Finally, technological improvements in active ingredient delivery, shelf-life stability, and scalable production systems are making citrus gummies not just a sensory novelty but a serious functional wellness format. These interlinked market drivers are creating a robust, high-growth trajectory for citrus gummies, ensuring they remain at the forefront of innovation in functional nutrition and consumer health.Report Scope

The report analyzes the Citrus Gummies market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Fruit Type (Orange Gummies, Lemon Gummies, Lime Gummies, Grapefruit Gummies, Other Fruits Gummies); Form (Traditional Gummies, Chewy Candies, Sour Gummies, Sugar-Free Gummies); Packaging Type (Jars Packaging, Bottles Packaging, Pouches Packaging, Blister Packs Packaging, Other Packaging Types).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Orange Gummies segment, which is expected to reach US$122.8 Million by 2030 with a CAGR of a 5.5%. The Lemon Gummies segment is also set to grow at 4.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $56.0 Million in 2024, and China, forecasted to grow at an impressive 8.7% CAGR to reach $57.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Citrus Gummies Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Citrus Gummies Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Citrus Gummies Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AMC Group, BASF SE, Cargill, Incorporated, Carolina Ingredients, CEAMSA (Compañía Española de Algas Marinas S.A.) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Citrus Gummies market report include:

- Airo Brands

- Albanese Confectionery Group, Inc.

- Albanese Confectionery Group, Inc.

- Dixie Brands Inc.

- eFrutti

- Extract Labs

- Ferrara Candy Company

- Haribo GmbH & Co. KG

- Jelly Belly Candy Company

- Kasugai Co., Ltd.

- Kiva Confections

- Lotte Confectionery

- Lume Cannabis Co.

- Mars Wrigley

- Meiji Co., Ltd.

- Mondelez International

- Nestlé S.A.

- Perfetti Van Melle

- Trolli GmbH

- VVN Naturals

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Airo Brands

- Albanese Confectionery Group, Inc.

- Albanese Confectionery Group, Inc.

- Dixie Brands Inc.

- eFrutti

- Extract Labs

- Ferrara Candy Company

- Haribo GmbH & Co. KG

- Jelly Belly Candy Company

- Kasugai Co., Ltd.

- Kiva Confections

- Lotte Confectionery

- Lume Cannabis Co.

- Mars Wrigley

- Meiji Co., Ltd.

- Mondelez International

- Nestlé S.A.

- Perfetti Van Melle

- Trolli GmbH

- VVN Naturals

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 390 |

| Published | February 2026 |

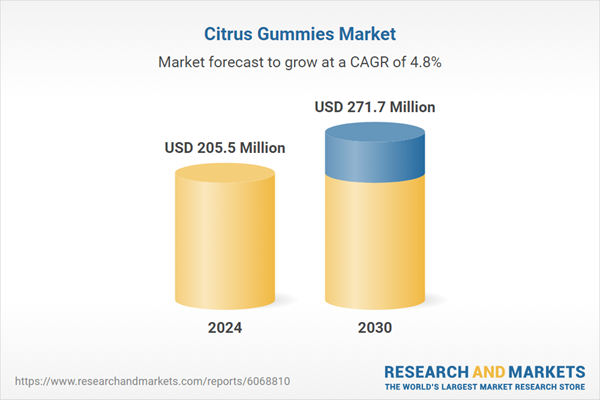

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 205.5 Million |

| Forecasted Market Value ( USD | $ 271.7 Million |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |