Global Battery Testing, Inspection, and Certification Market - Key Trends & Drivers Summarized

Why Are Testing, Inspection, and Certification Crucial for Battery Safety and Performance?

Battery testing, inspection, and certification (TIC) have become critical processes in an era where batteries power everything from electric vehicles (EVs) to renewable energy systems and consumer electronics. These services ensure that batteries meet rigorous safety, quality, and performance standards, safeguarding consumers, manufacturers, and the environment. Testing identifies potential safety hazards, such as overheating, short-circuiting, or thermal runaway, before batteries reach the market. Inspection during production helps maintain consistency and detect anomalies in battery packs, modules, and cells. Certification ensures compliance with international and regional regulations, including ISO, IEC, and UL standards, which are mandatory for batteries used in EVs and grid storage. As battery technologies grow increasingly complex, particularly with advancements in solid-state and next-generation chemistries, TIC processes are evolving to address unique risks and challenges. Without robust TIC protocols, the risks of battery failure, safety recalls, and environmental damage escalate, highlighting the indispensable role of these services in the global battery ecosystem.How Are Technological Innovations Enhancing Testing and Certification Processes?

The battery TIC market is undergoing a technological transformation, driven by advancements that improve accuracy, efficiency, and adaptability. Automation is revolutionizing inspection processes, with automated optical inspection (AOI) systems rapidly detecting defects in battery manufacturing lines. Advanced diagnostic tools, such as X-ray imaging and ultrasonic testing, enable non-invasive inspection of battery interiors to identify defects in electrodes, separators, or electrolyte layers. Machine learning and artificial intelligence (AI) are being integrated into testing systems to analyze large datasets, predict failure modes, and optimize testing protocols for faster results. Digital twins are also emerging as a powerful tool, allowing manufacturers to simulate battery behavior under various conditions without physical testing. Moreover, real-time monitoring systems integrated with IoT technologies ensure that batteries in use are continuously assessed for safety and performance, providing immediate alerts in case of anomalies. These technological advancements not only enhance testing efficiency but also reduce costs and accelerate time-to-market for battery manufacturers while ensuring the highest quality standards.Which Industries Are Driving Demand for Battery TIC Services?

The demand for battery testing, inspection, and certification is surging across diverse industries, with the automotive sector leading the way. The rapid adoption of EVs has placed immense pressure on automakers to ensure the safety, reliability, and performance of battery systems, as any failure could lead to costly recalls and reputational damage. Renewable energy storage is another significant segment, as grid-scale battery systems require rigorous TIC processes to meet safety and durability standards under varying load conditions. Consumer electronics, including smartphones, laptops, and wearables, rely on TIC services to ensure compact batteries deliver consistent performance without safety compromises. Aerospace and defense sectors demand stringent TIC protocols due to the critical nature of battery applications in unmanned systems, satellites, and military-grade equipment. Additionally, industrial applications, such as robotics and heavy machinery, require TIC services to meet operational demands in extreme conditions. As battery-powered systems proliferate, the need for comprehensive TIC solutions is expanding across all these sectors, ensuring safety, compliance, and sustainability.What Factors Are Driving Growth in the Battery Testing, Inspection, and Certification Market?

The growth in the Battery Testing, Inspection, and Certification market is driven by several factors, including the rising adoption of electric vehicles, advancements in battery technologies, and stringent safety regulations across industries. The increasing global push for clean energy and sustainable transportation has led to the widespread adoption of EVs, necessitating rigorous TIC processes to ensure battery safety and performance. Advancements in battery chemistries, such as solid-state batteries and lithium-sulfur technologies, have introduced new testing and certification challenges, driving demand for specialized services. Stringent government regulations, particularly in North America, Europe, and Asia-Pacific, mandate compliance with safety and environmental standards, further fueling the need for TIC services. Additionally, consumer expectations for reliable, high-performance batteries in electronics and industrial applications are prompting manufacturers to adopt comprehensive testing protocols. The growing focus on battery recycling and second-life applications has also created demand for TIC services to ensure recycled batteries meet quality benchmarks. Lastly, partnerships between TIC providers, battery manufacturers, and research organizations are fostering innovation, further driving market growth and ensuring the industry keeps pace with evolving battery technologies and applications.Report Scope

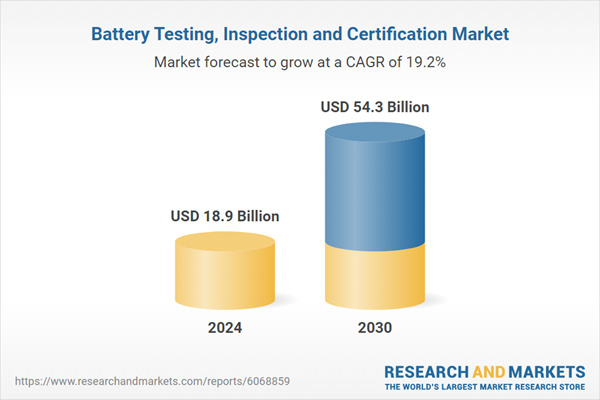

The report analyzes the Battery Testing, Inspection and Certification market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Testing Type (Safety Testing, EMC Testing, Performance Testing, Other Testing Types); Sourcing Type (In-House Sourcing, Outsourced); Battery Type (Lithium-ion Battery, Lead-Acid Battery, Nickel-Metal-Hydride Battery, Other Battery Types); Application (Electric Vehicles Application, ICE Vehicles Application, Consumer Electronics Application, Industrial Equipment Application, Medical Devices Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Safety Testing segment, which is expected to reach US$26.9 Billion by 2030 with a CAGR of a 21.4%. The EMC Testing segment is also set to grow at 18.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.2 Billion in 2024, and China, forecasted to grow at an impressive 25.5% CAGR to reach $12.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Battery Testing, Inspection and Certification Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Battery Testing, Inspection and Certification Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Battery Testing, Inspection and Certification Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ametek Scientific Instruments, Arbin Instruments, BioLogic Sciences Instruments, Bitrode Corporation, Century Yuasa Batteries Pty Ltd and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Battery Testing, Inspection and Certification market report include:

- ATIC (Guangzhou) Co., Ltd.

- Care Labs

- CIRS Group

- Dekra SE

- DNV AS

- Element Materials Technology

- Intertek Group Plc

- Labtest Certification

- SGS SA

- TUV SUD America, Inc.

- UL, LLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ATIC (Guangzhou) Co., Ltd.

- Care Labs

- CIRS Group

- Dekra SE

- DNV AS

- Element Materials Technology

- Intertek Group Plc

- Labtest Certification

- SGS SA

- TUV SUD America, Inc.

- UL, LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 485 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 18.9 Billion |

| Forecasted Market Value ( USD | $ 54.3 Billion |

| Compound Annual Growth Rate | 19.2% |

| Regions Covered | Global |