Global Automotive Head Gaskets Market - Key Trends & Drivers Summarized

Why Are Head Gaskets Critical in Automotive Engines?

Automotive head gaskets are vital components in internal combustion engines, forming a seal between the engine block and cylinder head. Their primary function is to maintain pressure within the combustion chamber, prevent coolant and oil leakage, and ensure the smooth functioning of the engine. By withstanding extreme temperatures, high pressures, and constant vibrations, head gaskets play a critical role in engine efficiency, reliability, and longevity. The importance of head gaskets has grown as engines have become more compact, powerful, and fuel-efficient. Modern engines often operate under higher compression ratios and generate greater heat, making advanced head gasket designs essential for maintaining performance and preventing failures. Furthermore, the rise of hybrid and turbocharged engines has increased the demand for high-performance head gaskets that can endure the unique stresses of these systems.How Are Market Trends Shaping the Demand for Automotive Head Gaskets?

The automotive head gasket market is influenced by several key trends that are reshaping engine design and maintenance practices. One significant trend is the growing adoption of downsized and turbocharged engines. Automakers are increasingly using smaller engines with turbochargers to meet stringent emissions and fuel economy standards. These engines operate at higher pressures and temperatures, requiring advanced head gasket materials and designs to prevent leakage and ensure durability. The rising focus on vehicle reliability and reduced maintenance costs has also contributed to the demand for high-quality head gaskets. Modern consumers expect vehicles to deliver consistent performance over extended periods with minimal downtime. As a result, automakers are prioritizing durable, long-lasting components such as multi-layer steel (MLS) head gaskets, which provide superior sealing capabilities and withstand extreme operating conditions.The transition to hybrid and electric powertrains is another notable trend affecting the head gasket market. While hybrid vehicles still rely on internal combustion engines, their unique operating cycles, characterized by frequent start-stop functionality, place additional stress on engine components. This has led to increased demand for head gaskets that can handle thermal cycling and maintain sealing performance under variable conditions. The growth of the automotive aftermarket is also a significant factor. As vehicle ownership increases, particularly in emerging markets, the need for replacement head gaskets has risen. Older vehicles often require gasket replacements due to wear and tear, creating opportunities for aftermarket suppliers to cater to this demand.

What Role Does Technology Play in Advancing Head Gasket Design?

Technological advancements have revolutionized the design and performance of automotive head gaskets, enabling them to meet the challenges of modern engine architectures. One of the most significant innovations is the widespread adoption of MLS head gaskets. These gaskets consist of multiple layers of steel and elastomer coatings, offering superior sealing capabilities and durability. MLS gaskets are particularly effective in handling the high pressures and temperatures of turbocharged and high-performance engines. Another key development is the use of advanced materials, such as graphite and reinforced composites, to enhance gasket performance. These materials provide excellent heat resistance, flexibility, and sealing properties, making them suitable for a wide range of engine applications. For hybrid engines, gaskets with improved thermal cycling resistance have been developed to ensure consistent performance during frequent temperature fluctuations.Precision manufacturing techniques, including computer-aided design (CAD) and finite element analysis (FEA), have further improved head gasket reliability. These technologies allow engineers to optimize gasket designs for specific engine geometries, ensuring a perfect fit and minimizing the risk of leaks. Additionally, the use of laser cutting and automated assembly processes ensures consistent quality and reduces production variability. Innovations in coating technology have also enhanced head gasket performance. Advanced coatings reduce friction, improve heat dissipation, and enhance the gasket’ s ability to maintain a seal under extreme conditions. These coatings also prevent corrosion and chemical degradation, extending the lifespan of the gasket and reducing the need for replacements.

What Factors Are Driving Growth in This Market?

The growth in the automotive head gasket market is driven by several interconnected factors stemming from advancements in engine technology, regulatory requirements, and evolving consumer expectations. One of the primary drivers is the increasing adoption of downsized and turbocharged engines. These engines require robust head gaskets capable of withstanding high pressures and temperatures, creating demand for advanced designs such as MLS gaskets. The rising popularity of hybrid vehicles is another significant growth driver. Hybrid powertrains place unique demands on head gaskets due to their frequent start-stop operation and thermal cycling. As hybrid vehicle sales continue to grow globally, the need for high-performance gaskets that can handle these stresses is increasing. The growing focus on vehicle longevity and reliability is also fueling market growth. Consumers are placing greater emphasis on durable components that reduce maintenance costs and extend vehicle lifespan. Automakers are responding by incorporating premium gaskets into their engines, ensuring better performance and lower warranty claims.Regulatory requirements for fuel efficiency and emissions are driving automakers to innovate in engine design, including the adoption of advanced combustion technologies. These innovations require high-quality sealing solutions, boosting demand for precision-engineered head gaskets. Additionally, the increasing prevalence of aluminum engine blocks, which are lighter and more thermally efficient than cast iron, has created a need for gaskets with enhanced thermal compatibility. The aftermarket segment is another critical growth area, particularly in regions with aging vehicle fleets. Head gasket replacements are a common repair for older vehicles, and aftermarket suppliers are expanding their offerings to meet this demand. Advancements in gasket materials and manufacturing have also improved the availability of cost-effective, high-quality replacement options. With continued innovation in engine technologies, stricter emissions regulations, and the growing popularity of hybrid vehicles, the automotive head gasket market is poised for sustained growth. These factors, combined with the increasing focus on performance and durability, ensure the ongoing relevance of head gaskets in the evolving automotive landscape.

Report Scope

The report analyzes the Automotive Head Gaskets market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Material (Multilayer Steel Material, Composite Material, Copper Material, Elastomer Material, Other Materials); Sales Channel (OEM Sales Channel, Aftermarket Sales Channel); Vehicle Type (Passenger Cars, Commercial Vehicles).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Multilayer Steel Material segment, which is expected to reach US$919.0 Million by 2030 with a CAGR of a 5.2%. The Composite Material segment is also set to grow at 4.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $608.0 Million in 2024, and China, forecasted to grow at an impressive 7.9% CAGR to reach $590.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Head Gaskets Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Head Gaskets Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Head Gaskets Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Some of the 34 companies featured in this Automotive Head Gaskets market report include:

- Banco Gaskets (India) Ltd

- Best Gasket

- Conta-San Conta Sanayi ve Tic. Ltd. Sti.

- Dana Limited. (Victor Reinz)

- E. DOBSON & CO. (GASKETS) LTD

- ElringKlinger AG

- Fixer Gaskets

- Ishikawa Gasket Co., Ltd.

- JAPAN METAL GASKET Co., Ltd.

- Kia Corporation

- KMP Brand

- MEGA Communication Industry Co., Ltd.

- Nippon Gasket Co., Ltd.

- Tonyco Gasket Manufacturer Co.,Ltd

- Viva Exim Pvt. Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Banco Gaskets (India) Ltd

- Best Gasket

- Conta-San Conta Sanayi ve Tic. Ltd. Sti.

- Dana Limited. (Victor Reinz)

- E. DOBSON & CO. (GASKETS) LTD

- ElringKlinger AG

- Fixer Gaskets

- Ishikawa Gasket Co., Ltd.

- JAPAN METAL GASKET Co., Ltd.

- Kia Corporation

- KMP Brand

- MEGA Communication Industry Co., Ltd.

- Nippon Gasket Co., Ltd.

- Tonyco Gasket Manufacturer Co.,Ltd

- Viva Exim Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 367 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

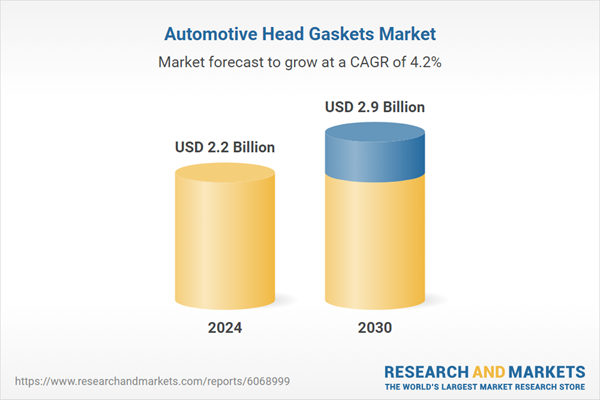

| Estimated Market Value ( USD | $ 2.2 Billion |

| Forecasted Market Value ( USD | $ 2.9 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |