Global Media Asset Management Market - Key Trends & Drivers Summarized

How Is the Digital Content Explosion Transforming Media Asset Management?

The proliferation of digital content across diverse platforms has fundamentally reshaped the media landscape, placing media asset management (MAM) solutions at the heart of content operations. The surge in video-on-demand platforms, social media content, live broadcasting, and user-generated content has pushed enterprises to adopt robust systems capable of storing, indexing, retrieving, and distributing large volumes of multimedia assets. Broadcasters, OTT platforms, advertising agencies, and even corporations with in-house media teams now depend on MAM systems to streamline workflows and enhance collaboration among geographically dispersed teams. As digital content continues to grow in complexity and volume, the demand for AI-enabled metadata tagging, automated content categorization, and cloud-based storage solutions is soaring, making MAM a strategic necessity for digital-era content management.Why Are Cloud-Native Platforms and AI Integration Dominating Conversations?

With legacy systems falling short in addressing the dynamic needs of modern media workflows, cloud-native MAM solutions have emerged as a game-changer. These platforms offer scalability, flexibility, and real-time access to assets across multiple locations, which is vital for global media enterprises. Additionally, the integration of artificial intelligence and machine learning has enabled automated tagging, facial and object recognition, speech-to-text transcription, and sentiment analysis, significantly reducing manual intervention. AI-driven search capabilities allow users to locate specific scenes, characters, or spoken lines almost instantly. These advancements are revolutionizing how media content is archived and repurposed, empowering content creators and media companies to extract more value from their digital assets while ensuring faster time-to-market for multimedia products.Can Media Asset Management Systems Keep Up With Evolving Consumer Behavior?

The way consumers access and engage with content has seen dramatic shifts, pushing media companies to pivot rapidly in response. With increasing demand for personalized, real-time, and omnichannel content delivery, MAM platforms are being retooled to support multi-format outputs for mobile, desktop, smart TVs, and virtual reality environments. The growth of short-form video and interactive content formats on platforms like TikTok and Instagram has forced asset managers to deal with vast numbers of smaller, high-turnover media files. Additionally, content localization, including multilingual subtitling and dubbing, is now critical to penetrating global markets - functions that MAM systems increasingly facilitate through automated language detection and AI-driven translation tools. As consumer expectations for immediacy and personalization continue to rise, MAM systems are evolving to enable more agile, responsive content delivery infrastructures.What’ s Fueling the Rise of the Media Asset Management Market?

The growth in the media asset management market is driven by several factors that reflect the convergence of technology evolution, end-user demand, and operational needs. The exponential rise in OTT streaming services and digital broadcast platforms has created an urgent need for centralized asset control and fast content monetization. Media production houses and broadcasters are investing in MAM solutions to improve remote collaboration, especially in post-pandemic hybrid work environments. The increasing adoption of 4K and 8K content formats, as well as immersive media such as augmented and virtual reality, necessitates systems capable of managing extremely high-resolution files with efficiency. Additionally, the growth of e-learning, digital publishing, and corporate training sectors has driven demand for secure, accessible, and searchable video content archives. Regulatory compliance regarding content rights, licenses, and data privacy also plays a crucial role, as MAM solutions offer tools to track and manage content usage rights effectively. Together, these factors underscore the strategic importance of media asset management in an increasingly media-centric digital economy.Report Scope

The report analyzes the Media Asset Management market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Deployment (On-Premise, Cloud); Organization Size (Large enterprises, SMEs); Application (Multi-platform distribution, Advertising & marketing, Automating & optimizing, Secure access & content sharing, Others); End-Use (BFSI, Education, Healthcare, Government, Media & entertainment, Corporate, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the On-Premise Deployment segment, which is expected to reach US$3.9 Billion by 2030 with a CAGR of a 17.5%. The Cloud Deployment segment is also set to grow at 14% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $601.6 Million in 2024, and China, forecasted to grow at an impressive 15.3% CAGR to reach $872.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Media Asset Management Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Media Asset Management Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Media Asset Management Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Audemars Piguet, Breitling, Cartier, Chopard, Girard-Perregaux and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Media Asset Management market report include:

- Adobe Inc.

- Amazon Web Services (AWS)

- Aprimo

- Bynder

- Canto

- Cloudinary

- Dalet

- IBM Corporation

- Imagen Ltd.

- Microsoft Corporation

- OpenText Corporation

- Oracle Corporation

- Prime Focus Technologies

- Quantum Corporation

- Shutterstock

- Sony Group Corporation

- Tedial

- VSN Video Stream Networks

- Widen Enterprises

- WPP plc

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Adobe Inc.

- Amazon Web Services (AWS)

- Aprimo

- Bynder

- Canto

- Cloudinary

- Dalet

- IBM Corporation

- Imagen Ltd.

- Microsoft Corporation

- OpenText Corporation

- Oracle Corporation

- Prime Focus Technologies

- Quantum Corporation

- Shutterstock

- Sony Group Corporation

- Tedial

- VSN Video Stream Networks

- Widen Enterprises

- WPP plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 215 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

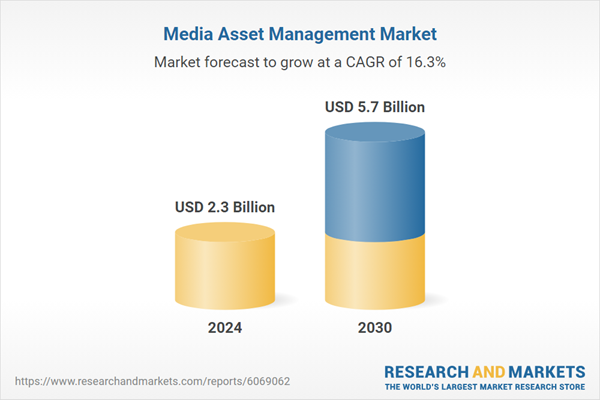

| Estimated Market Value ( USD | $ 2.3 Billion |

| Forecasted Market Value ( USD | $ 5.7 Billion |

| Compound Annual Growth Rate | 16.3% |

| Regions Covered | Global |