Global Continuous Bioprocessing Market - Innovations & Key Growth Drivers

Why is Continuous Bioprocessing Transforming Biopharmaceutical Manufacturing?

Continuous bioprocessing is redefining the landscape of biopharmaceutical manufacturing, offering a more efficient, cost-effective, and scalable alternative to traditional batch processing. As the demand for biologics, including monoclonal antibodies, vaccines, and cell and gene therapies, continues to rise, the biopharmaceutical industry is under increasing pressure to optimize production processes while maintaining high product quality. Traditional batch processing, which involves stepwise production in separate phases, often leads to long cycle times, increased operational costs, and variability in product quality. In contrast, continuous bioprocessing enables real-time, uninterrupted production, allowing for greater consistency, higher yields, and reduced production time.One of the main drivers behind the adoption of continuous bioprocessing is the growing focus on process intensification and operational efficiency. By integrating continuous upstream and downstream processing techniques, manufacturers can significantly reduce the footprint of biomanufacturing facilities, optimize resource utilization, and minimize waste generation. Furthermore, regulatory agencies such as the FDA and EMA are increasingly supporting the transition to continuous manufacturing due to its potential to enhance process control, improve scalability, and ensure robust product quality. As the industry moves toward personalized medicine and rapid vaccine development, continuous bioprocessing is emerging as a game-changing approach that accelerates drug production while maintaining stringent regulatory compliance.

How Are Technological Advancements Driving the Evolution of Continuous Bioprocessing?

Technological advancements are at the core of the rapid adoption of continuous bioprocessing, enabling greater automation, real-time monitoring, and enhanced process control. The integration of perfusion bioreactors, single-use technologies, and advanced chromatography systems has played a crucial role in making continuous processing a viable alternative to traditional batch methods. Perfusion bioreactors, in particular, allow for the constant renewal of culture media while maintaining cell viability and productivity, ensuring higher yields of biologics with reduced process interruptions.The implementation of process analytical technology and real-time monitoring systems has further revolutionized continuous bioprocessing. Advanced sensor technologies, AI-driven data analytics, and digital twins are being utilized to continuously monitor critical process parameters, such as pH, dissolved oxygen, nutrient levels, and cell density. This real-time data collection enables predictive process control, early detection of deviations, and immediate corrective actions, reducing the risk of batch failures and product inconsistencies. Additionally, single-use bioprocessing systems are gaining traction in continuous manufacturing, allowing for greater flexibility, reduced contamination risks, and lower capital expenditures. With the increasing convergence of bioprocess automation, machine learning, and digital biomanufacturing, continuous processing is rapidly evolving into a fully integrated, highly efficient, and cost-effective production model.

What Are the Key Industry Applications of Continuous Bioprocessing?

Continuous bioprocessing is being widely adopted across multiple segments of the biopharmaceutical industry, where efficiency, scalability, and process reliability are paramount. One of the primary areas of application is in the manufacturing of monoclonal antibodies, where the ability to maintain a stable cell culture and continuously harvest high-quality biologics has significantly improved production efficiency. With the rising demand for targeted therapies and biosimilars, continuous processing is enabling biopharma companies to produce monoclonal antibodies at a lower cost while maintaining high purity and potency.Another major application of continuous bioprocessing is in vaccine production, particularly with the growing need for rapid response platforms for pandemic preparedness. Traditional vaccine manufacturing often faces challenges related to scale-up limitations and long production cycles, but continuous processes allow for faster, more adaptable production that can meet emergency demands efficiently. Similarly, cell and gene therapy manufacturing is increasingly leveraging continuous bioprocessing approaches to enhance viral vector production, improve cell expansion techniques, and reduce time-to-market for personalized therapies. The biologics contract manufacturing sector is also witnessing a surge in demand for continuous production solutions, as companies seek to optimize large-scale biomanufacturing while ensuring compliance with evolving regulatory standards.

What Factors Are Driving Growth in the Continuous Bioprocessing Market?

The growth in the continuous bioprocessing market is driven by several factors, including the increasing global demand for biologics, advancements in bioprocessing technology, regulatory support for continuous manufacturing, and the need for cost-efficient production solutions. With the expansion of biosimilars and personalized medicine, pharmaceutical companies are under pressure to develop more flexible and scalable manufacturing processes that can accommodate varying production demands. Continuous bioprocessing enables manufacturers to achieve higher productivity, reduced cycle times, and lower operating costs, making it an attractive investment for biopharma companies seeking long-term process efficiency.Another key driver is the growing adoption of Industry 4.0 technologies, including automation, AI-driven analytics, and real-time process control, which are enhancing the precision and reliability of continuous bioprocessing systems. The increasing focus on sustainable biomanufacturing is also playing a significant role, as continuous processing minimizes energy consumption, reduces waste generation, and improves overall resource utilization. Additionally, the biopharmaceutical industry’ s shift toward modular and single-use bioprocessing facilities is accelerating the adoption of continuous manufacturing, providing companies with greater operational flexibility and cost savings. As the need for high-speed, high-efficiency biopharmaceutical production continues to grow, continuous bioprocessing is poised to become the future of biologics manufacturing, ensuring faster drug development, higher quality standards, and greater accessibility of life-saving therapies worldwide.

Report Scope

The report analyzes the Continuous Bioprocessing market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Bioprocessing Instruments, Bioprocessing Consumables); Scale of Operation (Commercial Operation, Research and Development Operation); Process Type (Downstream Bioprocess, Upstream Bioprocess); Application (Monoclonal Antibodies Application, Vaccines Application, Cell and Gene Therapy Application, Other Applications); End-Use (Pharmaceutical and Biotechnology Companies End-Use, CMOs and CROs End-Use, Research and Academic Institutes End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Bioprocessing Instruments segment, which is expected to reach US$514.3 Million by 2030 with a CAGR of a 23.3%. The Bioprocessing Consumables segment is also set to grow at 14% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $68.4 Million in 2024, and China, forecasted to grow at an impressive 27.4% CAGR to reach $180.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Continuous Bioprocessing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Continuous Bioprocessing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Continuous Bioprocessing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Buffer, ContentStudio, Curata, Inc., Emplifi, Inc., OptinMonster and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Continuous Bioprocessing market report include:

- 3M Company

- AGC Biologics

- Biogen Inc.

- Bio-Rad Laboratories, Inc.

- Bristol-Myers Squibb Company

- Corning Incorporated

- Danaher Corporation

- Entegris, Inc.

- Enzene Biosciences Ltd.

- Eppendorf SE

- FUJIFILM Diosynth Biotechnologies

- Meissner Filtration Products, Inc.

- Merck KGaA

- Novasep

- Repligen Corporation

- Sanofi Genzyme

- Sartorius AG

- Thermo Fisher Scientific Inc.

- UCB Pharma

- WuXi Biologics

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- AGC Biologics

- Biogen Inc.

- Bio-Rad Laboratories, Inc.

- Bristol-Myers Squibb Company

- Corning Incorporated

- Danaher Corporation

- Entegris, Inc.

- Enzene Biosciences Ltd.

- Eppendorf SE

- FUJIFILM Diosynth Biotechnologies

- Meissner Filtration Products, Inc.

- Merck KGaA

- Novasep

- Repligen Corporation

- Sanofi Genzyme

- Sartorius AG

- Thermo Fisher Scientific Inc.

- UCB Pharma

- WuXi Biologics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 553 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

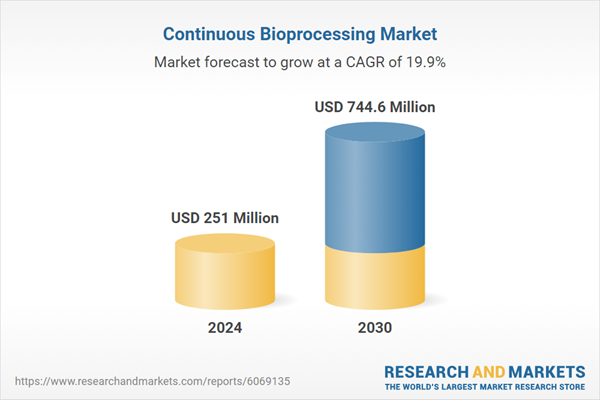

| Estimated Market Value ( USD | $ 251 Million |

| Forecasted Market Value ( USD | $ 744.6 Million |

| Compound Annual Growth Rate | 19.9% |

| Regions Covered | Global |

![Single-use Bioprocessing Market by Product (Equipment [Bioreactors, Filtration, Chromatography], Consumables [Filters, Bags, Assemblies, Sensors]), Application (Storage, Mixing), Workflow (Upstream), Molecule Type (mAbs, Vaccines) - Global Forecast to 2030 - Product Image](http://www.researchandmarkets.com/product_images/12020/12020910_60px_jpg/singleuse_bioprocessing_market.jpg)