Global Lower Extremity Implants Market - Key Trends & Drivers Summarized

What's Propelling the Medical Industry Toward Lower Extremity Implants?

The global market for lower extremity implants has witnessed significant momentum due to a growing geriatric population, increased prevalence of bone-related disorders, and an uptick in sports-related injuries. With age-related degeneration and osteoarthritis becoming more widespread, especially in developed economies, the demand for implants addressing ankle, foot, and knee complications has seen a steep incline. Additionally, the shift from invasive to minimally invasive procedures has further boosted adoption rates, with patients and surgeons favoring options that offer quicker recovery and reduced hospital stays. Technological advancements in material science - such as the development of titanium and cobalt-chromium alloys with better biocompatibility and durability - have also played a pivotal role in shaping the landscape of this sector.How Are Innovations in Design and Customization Redefining the Market?

Lower extremity implants are no longer one-size-fits-all. The advent of 3D printing and patient-specific implant design is revolutionizing how orthopedic surgeries are approached. Implants tailored to individual anatomical and biomechanical needs are yielding better post-operative outcomes and patient satisfaction. Furthermore, enhanced imaging techniques such as CT-based surgical planning and robotic-assisted surgeries are facilitating more accurate implant placement and reducing revision rates. Companies are investing heavily in R&D to produce lightweight, wear-resistant, and highly functional implants that integrate seamlessly with the human skeletal system, offering improved longevity and performance. This trend is fostering a competitive environment where constant innovation has become a prerequisite for market survival.Is the Demand for Elective Surgeries Influencing Implant Uptake?

The growing acceptance of elective orthopedic surgeries is contributing significantly to the rise in lower extremity implant procedures. As awareness about treatment options improves and waiting times in public healthcare systems lengthen, more patients are opting for private, elective surgeries. This trend is particularly evident in regions like North America and Europe, where healthcare infrastructure supports advanced orthopedic interventions. Moreover, an increasing number of younger patients - especially athletes and active individuals - are seeking early treatment to maintain their quality of life. This has led to a surge in ankle and foot reconstructions using innovative implant designs that cater to both functional recovery and aesthetic appeal, thereby broadening the target demographic for manufacturers.What's Fueling the Surge in Market Growth Worldwide?

The growth in the lower extremity implants market is driven by several factors, including the rising incidence of diabetes-related foot complications, a strong rise in trauma and accident cases globally, and the increasing focus on outpatient orthopedic procedures. On the technological front, the integration of smart implants capable of monitoring healing progress is opening new frontiers. In terms of end-users, ambulatory surgical centers and specialty orthopedic hospitals are gaining prominence due to their focus on efficiency and shorter procedural times. Consumer behavior is also shifting, with patients increasingly prioritizing mobility, functionality, and lifestyle quality - pressuring manufacturers to create high-performance, aesthetically pleasing implants. Additionally, favorable reimbursement frameworks in developed countries and growing investments in emerging markets across Asia-Pacific and Latin America are amplifying access to cutting-edge solutions, reinforcing global market expansion.Report Scope

The report analyzes the Lower Extremity Implants market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Knee, Hip, Foot & Ankle); Biomaterial (Metallic Biomaterials, Ceramic Biomaterials, Polymeric Biomaterials, Natural Biomaterials); End-Use (Hospitals, Ambulatory Surgery Centers, Clinics).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Knee Implants segment, which is expected to reach US$17.9 Billion by 2030 with a CAGR of a 2.3%. The Hip Implants segment is also set to grow at 1.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7.2 Billion in 2024, and China, forecasted to grow at an impressive 4.1% CAGR to reach $5.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Lower Extremity Implants Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Lower Extremity Implants Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Lower Extremity Implants Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Arthrex, Inc., CeramTec GmbH, Conformis, Inc., CONMED Corporation, DePuy Synthes (Johnson & Johnson MedTech) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Lower Extremity Implants market report include:

- Arthrex, Inc.

- CeramTec GmbH

- Conformis, Inc.

- CONMED Corporation

- DePuy Synthes (Johnson & Johnson MedTech)

- DJO Global, Inc. (Colfax Corporation)

- Exactech, Inc.

- Extremity Medical LLC

- Globus Medical, Inc.

- ITS Implant

- Madison Ortho

- Medacta International SA

- MicroPort Orthopedics

- NuVasive, Inc.

- Orthofix Medical Inc.

- Smith & Nephew plc

- Stryker Corporation

- TriMed, Inc.

- Wright Medical Group N.V.

- Zimmer Biomet Holdings, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Arthrex, Inc.

- CeramTec GmbH

- Conformis, Inc.

- CONMED Corporation

- DePuy Synthes (Johnson & Johnson MedTech)

- DJO Global, Inc. (Colfax Corporation)

- Exactech, Inc.

- Extremity Medical LLC

- Globus Medical, Inc.

- ITS Implant

- Madison Ortho

- Medacta International SA

- MicroPort Orthopedics

- NuVasive, Inc.

- Orthofix Medical Inc.

- Smith & Nephew plc

- Stryker Corporation

- TriMed, Inc.

- Wright Medical Group N.V.

- Zimmer Biomet Holdings, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 380 |

| Published | January 2026 |

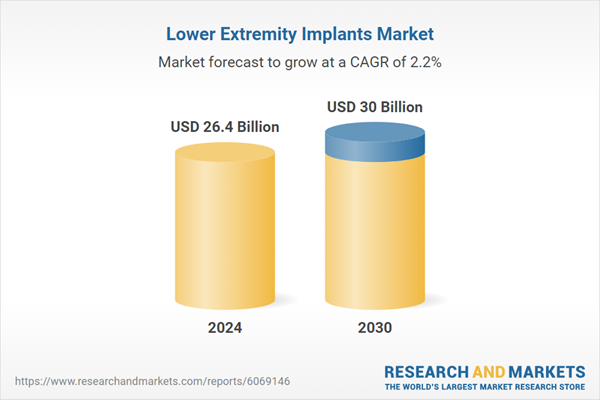

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 26.4 Billion |

| Forecasted Market Value ( USD | $ 30 Billion |

| Compound Annual Growth Rate | 2.2% |

| Regions Covered | Global |