Global Crypto Trading Platform Market - Key Trends & Growth Drivers Summarized

Why Are Crypto Trading Platforms Becoming the Backbone of Digital Asset Markets?

Crypto trading platforms have emerged as the primary gateway for investors, institutions, and retail traders to engage with the rapidly expanding digital asset market. These platforms provide users with the ability to buy, sell, and trade cryptocurrencies through various mechanisms, including spot trading, margin trading, and futures contracts. The increasing mainstream acceptance of cryptocurrencies has driven demand for these platforms, as both individual traders and institutional investors seek access to digital assets for portfolio diversification and speculative investments. Centralized exchanges (CEXs), such as Binance, Coinbase, and Kraken, dominate the market due to their liquidity, fiat on-ramp capabilities, and robust security measures. However, decentralized exchanges (DEXs) are gaining traction by offering users greater privacy, control over their assets, and reduced reliance on intermediaries. This shift toward decentralized finance (DeFi) is reshaping the traditional trading model, allowing for greater financial inclusivity and innovation.The rapid evolution of crypto trading platforms is also driven by the increasing integration of blockchain-based financial services. Many platforms are expanding beyond simple crypto-to-crypto trading to offer staking, lending, yield farming, and NFT marketplaces, creating all-in-one financial ecosystems. This expansion is attracting users who want to maximize their crypto holdings through passive income opportunities. Furthermore, the rise of regulatory-compliant trading platforms has made cryptocurrencies more accessible to institutional investors, encouraging greater participation from hedge funds, asset managers, and corporations. While concerns over regulatory uncertainty, cyber threats, and exchange hacks persist, advancements in security protocols and compliance frameworks are helping to build trust in crypto trading platforms. As adoption continues to grow, these platforms will play a central role in bridging the gap between traditional finance and the digital asset economy.

What Are the Latest Technological Innovations Transforming Crypto Trading Platforms?

The crypto trading industry is undergoing a technological revolution, with innovations aimed at enhancing security, scalability, and user experience. One of the most impactful advancements is the adoption of high-frequency trading (HFT) algorithms, which enable institutional traders to execute trades in milliseconds, optimizing market opportunities and liquidity. Additionally, artificial intelligence (AI) and machine learning are being leveraged to provide predictive analytics, market sentiment analysis, and automated trading strategies.Another key technological development is the rise of hybrid trading models, which combine the best features of centralized and decentralized exchanges. Hybrid platforms offer users the liquidity and speed of CEXs while providing the security and transparency of DEXs. Enhanced security measures, such as multi-signature authentication, cold storage solutions, and zero-knowledge proofs (ZKPs), are becoming industry standards to mitigate risks associated with hacks and unauthorized access. Additionally, the growing adoption of mobile trading applications with intuitive interfaces and biometric security features is making crypto trading more accessible to mainstream users. As blockchain technology evolves, the integration of decentralized identity verification (DID) systems and tokenized asset trading will further revolutionize the crypto trading platform landscape, creating a more secure, transparent, and user-friendly trading environment.

How Are Regulatory and Market Trends Influencing the Crypto Trading Industry?

Regulatory frameworks are playing an increasingly influential role in shaping the crypto trading industry, as governments and financial authorities seek to establish clear guidelines for digital asset markets. In major economies such as the United States, the European Union, and Japan, regulatory agencies have introduced measures requiring trading platforms to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. These rules are designed to prevent illicit activities such as fraud, money laundering, and terrorist financing, increasing the legitimacy of crypto trading platforms in the eyes of regulators and institutional investors. Additionally, the emergence of Security Token Offerings (STOs) and regulated digital assets is driving demand for compliant trading platforms that can operate within established financial frameworks. However, the regulatory landscape remains fragmented, with different countries adopting varying approaches to crypto oversight, leading to operational challenges for global trading platforms.Market trends are also reshaping the crypto trading industry, with a growing emphasis on institutional adoption and integration with traditional financial markets. Institutional investors, including hedge funds, pension funds, and publicly traded companies, are increasingly viewing cryptocurrencies as viable investment assets, driving demand for professional-grade trading platforms with enhanced security and compliance features. The integration of crypto assets into traditional financial instruments, such as exchange-traded funds (ETFs) and derivatives, is further bridging the gap between traditional and digital finance. Meanwhile, the rise of decentralized trading solutions reflects a broader trend toward financial sovereignty, with users seeking greater control over their assets through non-custodial wallets and decentralized exchanges. As regulatory clarity improves and institutional adoption grows, the crypto trading industry is expected to become more structured and resilient, solidifying its position as a major component of the global financial system.

What Is Driving the Growth of the Crypto Trading Platform Market?

The growth in the crypto trading platform market is driven by several factors, including increasing adoption of digital assets, advancements in trading technology, and the rise of decentralized finance (DeFi). The growing global interest in cryptocurrencies as both an investment and a means of transaction has led to a surge in demand for reliable, secure, and user-friendly trading platforms. Institutional investors are also playing a significant role in market growth, as more hedge funds, asset management firms, and publicly traded companies incorporate cryptocurrencies into their portfolios. Additionally, the rise of stablecoins, such as USDT and USDC, has helped address volatility concerns, making crypto trading more accessible to mainstream users. The expansion of mobile trading applications with seamless user interfaces and real-time market data has further contributed to the growing adoption of crypto trading platforms.Technological advancements in blockchain scalability, security, and interoperability are also driving market expansion. The development of interoperable blockchain networks is enabling seamless cross-chain trading, improving liquidity, and reducing transaction costs. The rise of decentralized finance (DeFi) applications has created new opportunities for traders to engage in yield farming, liquidity mining, and decentralized lending, further boosting platform engagement. Additionally, the introduction of automated market-making (AMM) protocols and algorithmic trading strategies is enhancing trading efficiency, attracting both retail and institutional traders. As more industries recognize the potential of digital assets, partnerships between crypto trading platforms and traditional financial institutions are becoming more common, facilitating mainstream adoption. With continued innovation and increasing global acceptance of cryptocurrencies, the crypto trading platform market is poised for sustained growth, shaping the future of digital finance.

Report Scope

The report analyzes the Crypto Trading Platform market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Platform Type (Centralized Exchanges, Decentralized Exchanges, Hybrid Platforms); End-User (Retail Investors, Institutional Investors, Professional Traders, Crypto Enthusiasts/Miners).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Centralized Exchanges segment, which is expected to reach US$36.5 Billion by 2030 with a CAGR of a 15.1%. The Decentralized Exchanges segment is also set to grow at 12.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7.7 Billion in 2024, and China, forecasted to grow at an impressive 12.7% CAGR to reach $9.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Crypto Trading Platform Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Crypto Trading Platform Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Crypto Trading Platform Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AlfaCoins, BitPay, Block (formerly Square), BVNK, Coinbase Commerce and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 37 companies featured in this Crypto Trading Platform market report include:

- Binance

- Bitfinex

- Bitflyer

- Bitget

- Bitstamp

- Bittrex

- Bybit

- Coinbase

- Coincheck

- Crypto.com Exchange

- Gate.io

- Gemini

- Huobi Global

- Kraken

- KuCoin

- LBank

- MEXC Global

- OKX

- Poloniex

- Robinhood

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Binance

- Bitfinex

- Bitflyer

- Bitget

- Bitstamp

- Bittrex

- Bybit

- Coinbase

- Coincheck

- Crypto.com Exchange

- Gate.io

- Gemini

- Huobi Global

- Kraken

- KuCoin

- LBank

- MEXC Global

- OKX

- Poloniex

- Robinhood

Table Information

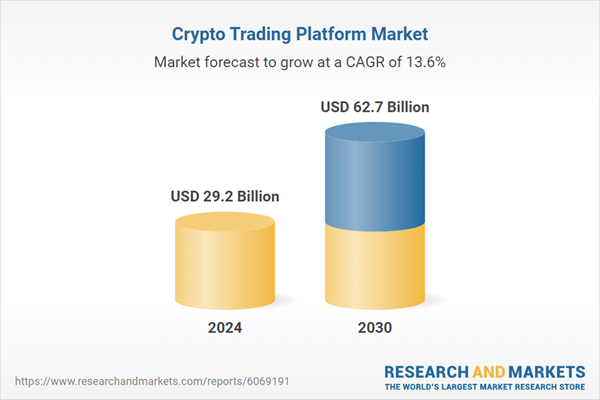

| Report Attribute | Details |

|---|---|

| No. of Pages | 139 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 29.2 Billion |

| Forecasted Market Value ( USD | $ 62.7 Billion |

| Compound Annual Growth Rate | 13.6% |

| Regions Covered | Global |