Global Online Investment Platform Market - Key Trends & Drivers Summarized

Why Are Online Investment Platforms Redefining How People Build Wealth?

Online investment platforms are dramatically transforming personal finance by democratizing access to financial markets and empowering individuals to take control of their wealth-building strategies. Traditionally, investing was reserved for affluent individuals working through financial advisors or brokers, often with high entry thresholds and complex procedures. Today, digital investment platforms have dismantled these barriers by offering low-cost, user-friendly, and highly accessible tools that allow anyone with an internet connection to invest in stocks, bonds, mutual funds, ETFs, cryptocurrencies, and more. These platforms cater to a wide spectrum of investors, from first-timers to seasoned traders, by offering educational content, portfolio analysis, and robo-advisory services. Many also provide zero-commission trading, fractional share purchases, and instant account setup - features that have attracted millions of users, especially among younger, tech-savvy demographics. Social media influence, financial literacy campaigns, and increased interest in passive income have further fueled adoption. Moreover, during market volatility and global economic uncertainty, users turn to these platforms for real-time information, risk management tools, and opportunities for portfolio diversification. The sheer convenience, transparency, and flexibility offered by online investment platforms are fundamentally changing how individuals engage with financial markets, making investing a daily, app-based activity rather than a once-a-year event.How Are Technology and Automation Enhancing Investment Accessibility and Performance?

Technology is the backbone of the online investment platform revolution, delivering seamless user experiences, intelligent automation, and>Can Shifting Investor Demographics and Behavioral Trends Sustain Market Momentum?

The rise of digital-first, financially aware investor demographics is a key force sustaining the momentum behind online investment platforms. Millennials and Gen Z investors, raised on mobile apps and social connectivity, expect high levels of transparency, low fees, and instant gratification from financial services. These generations are more likely to trust algorithmic decision-making over human advisors and are drawn to platforms that align with their values - such as ESG (Environmental, Social, Governance) investing, impact funds, and ethical portfolio options. The popularity of “ investing as self-expression” is also growing, as users seek to align their financial activities with social and environmental causes. Additionally, social trading features, where users can follow, learn from, or mimic the strategies of experienced investors, are building vibrant digital communities that drive engagement and stickiness. The gamification of investing - through rewards, progress tracking, and milestone-based learning - is reducing financial anxiety and increasing participation from traditionally underserved segments, including women and younger investors. Behavioral analytics are helping platforms better understand and nudge users toward long-term financial health, offering budgeting tools, goal trackers, and risk assessments. Meanwhile, the shift toward long-term wealth accumulation over short-term speculation, coupled with rising awareness of retirement planning, is deepening user commitment. These behavioral trends, supported by platform innovation and educational tools, are helping reshape the global investing culture - away from exclusivity and toward inclusivity, transparency, and purpose-driven participation.What’ s Fueling the Rapid Global Growth of Online Investment Platforms?

The growth in the online investment platform market is driven by a convergence of factors rooted in technological advancement, financial democratization, market accessibility, and evolving investor behavior. One major catalyst is the declining trust in traditional financial intermediaries, combined with growing demand for self-directed investment tools that offer full transparency and control. The COVID-19 pandemic accelerated digital adoption, pushing millions to explore remote financial solutions and reevaluate their personal finance habits, triggering a massive influx of retail investors across markets. The availability of commission-free trading, fractional investing, and round-up micro-investment models has lowered entry barriers, encouraging participation from low- and middle-income users globally. Meanwhile, government support for fintech innovation, open banking regulations, and financial literacy initiatives are enabling faster platform expansion and deeper integration with the formal financial system. Strategic partnerships between fintech startups, legacy institutions, and global payment providers are opening new user channels and increasing platform trust. In emerging markets, rising smartphone penetration, digital payment infrastructure, and youth-dominated populations are creating fertile ground for user acquisition. Furthermore, global access to alternative assets - such as cryptocurrencies, REITs, and thematic ETFs - is broadening investment horizons beyond domestic stock markets. Together, these trends are fueling sustained and widespread growth in the online investment platform market, reshaping how individuals across the world build, manage, and diversify their financial futures.Report Scope

The report analyzes the Online Investment Platform market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Solution (Portfolio Management Solution, Funds & Trading Management Solution, Risk Management Solution, Order Management Solution, Compliance Management Solution, Reporting Solution, Other Solutions); Service (Advisory Services, System Integration & Deployment Services, Technical Support Services, Managed Services); Deployment (Mobile-based Deployment, Web-based Deployment); End-Use (Banks End-Use, Investment Management Firms End-Use, Trading & Exchange Firms End-Use, Brokerage Firms End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Portfolio Management Solution segment, which is expected to reach US$2.3 Billion by 2030 with a CAGR of a 17%. The Funds & Trading Management Solution segment is also set to grow at 11.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $788.5 Million in 2024, and China, forecasted to grow at an impressive 13.2% CAGR to reach $1.0 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Online Investment Platform Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Online Investment Platform Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Online Investment Platform Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Badoo, Bumble Inc., Christian Mingle, Coffee Meets Bagel, eHarmony, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Online Investment Platform market report include:

- AJ Bell

- Charles Schwab

- E*TRADE

- eToro

- Fidelity Investments

- Freetrade

- Futu Holdings

- Hargreaves Lansdown

- Interactive Brokers

- M1 Finance

- Merrill Edge

- Moomoo

- Revolut

- Robinhood Markets

- Saxo Bank

- SoFi Invest

- TD Ameritrade

- Trading 212

- Vanguard

- Webull

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AJ Bell

- Charles Schwab

- E*TRADE

- eToro

- Fidelity Investments

- Freetrade

- Futu Holdings

- Hargreaves Lansdown

- Interactive Brokers

- M1 Finance

- Merrill Edge

- Moomoo

- Revolut

- Robinhood Markets

- Saxo Bank

- SoFi Invest

- TD Ameritrade

- Trading 212

- Vanguard

- Webull

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 212 |

| Published | February 2026 |

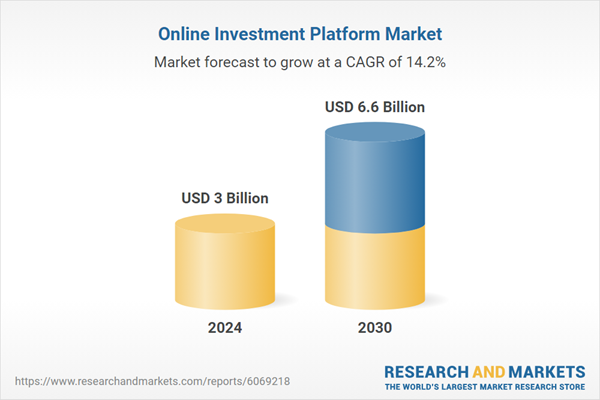

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3 Billion |

| Forecasted Market Value ( USD | $ 6.6 Billion |

| Compound Annual Growth Rate | 14.2% |

| Regions Covered | Global |