Global Central Labs Market - Key Trends & Drivers Summarized

Why Is the Demand for Central Labs Increasing?

Central laboratories play a critical role in clinical trials, providing standardized and high-quality testing services essential for drug development and regulatory approvals. The increasing number of clinical trials, particularly in oncology, neurology, and infectious diseases, is driving the demand for central lab services. Pharmaceutical and biotechnology companies are outsourcing laboratory functions to central labs to ensure consistency, compliance, and efficiency in diagnostic testing and biomarker analysis. Additionally, the complexity of clinical trials has increased, requiring specialized testing services such as pharmacokinetics, genomics, and companion diagnostics. The need for reliable and scalable laboratory services that can handle multi-site trials is pushing sponsors and contract research organizations (CROs) toward central lab partnerships. As the global clinical research landscape expands, the role of central labs in supporting precision medicine initiatives is becoming increasingly significant.How Are Technological Advancements Transforming Central Labs?

Technological innovations in laboratory automation, artificial intelligence (AI), and digital pathology are revolutionizing central lab operations. Advanced liquid chromatography-mass spectrometry (LC-MS), next-generation sequencing (NGS), and high-throughput screening techniques are enabling more precise and rapid analysis of clinical samples. These technologies are not only improving test accuracy but also enhancing data integrity and reproducibility in clinical trials. The adoption of cloud-based laboratory information management systems (LIMS) is another key development, allowing real-time data sharing and integration across multiple trial sites. AI-driven data analytics are also playing a crucial role in improving trial efficiency by identifying patterns in clinical data and optimizing trial protocols. With increasing regulatory scrutiny and the demand for high-quality clinical trial data, central labs are leveraging technology to enhance compliance, efficiency, and reliability in test results.What Market Trends Are Driving the Growth of Central Labs?

One of the major trends influencing the central labs market is the growing emphasis on biomarker-driven drug development. Precision medicine approaches require sophisticated laboratory testing to identify disease-specific biomarkers, leading to increased collaboration between pharmaceutical companies and central labs. The rise of decentralized and virtual clinical trials is also impacting the market, with central labs adapting to provide remote sample collection and real-time diagnostic services. Another notable trend is the expansion of central lab networks in emerging markets. As clinical trial activity grows in regions such as Asia-Pacific and Latin America, leading central labs are establishing facilities in these locations to support global trials. Additionally, regulatory authorities are placing greater emphasis on Good Clinical Laboratory Practices (GCLP), driving central labs to invest in quality assurance programs and accreditation initiatives. These trends are expected to further shape the evolution of central lab services in the coming years.What Are the Key Growth Drivers in the Central Labs Market?

The growth in the Central Labs market is driven by several factors, including the increasing complexity of clinical trials, the growing demand for precision medicine, and the rising volume of biomarker-driven research. The outsourcing trend in pharmaceutical R&D is also playing a pivotal role, as companies seek specialized laboratory expertise to accelerate drug development timelines and reduce operational costs. Additionally, the expansion of global clinical trial activity, particularly in rare diseases and biologics, is fueling demand for specialized central lab services. Regulatory requirements mandating rigorous laboratory testing protocols are further reinforcing the market’ s growth. As the healthcare and life sciences industries continue to embrace digital transformation and AI-powered analytics, central labs will remain essential partners in ensuring the success of clinical trials and drug development programs.Report Scope

The report analyzes the Central Labs market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Service Type (Genetic Services, Biomarker Services, Microbiology Services, Anatomic Pathology/Histology, Specimen Management and Storage, Special Chemistry Services, Other Services); End-Use (Pharmaceutical Companies, Biotechnology Companies, Academic and Research Institutes).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Genetic Services segment, which is expected to reach US$1.4 Billion by 2030 with a CAGR of a 6.2%. The Biomarker Services segment is also set to grow at 5.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $924.0 Million in 2024, and China, forecasted to grow at an impressive 8.5% CAGR to reach $931.0 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Central Labs Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Central Labs Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Central Labs Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aestura, Aromatica, Barr Cosmetics, Beauty of Joseon, Benton and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Central Labs market report include:

- ACM Global Laboratories

- Agilent Technologies

- ALS Limited

- BioAgilytix Labs

- Bioanalytical Systems Inc. (BASi)

- Bioclinica

- BioReliance (Now part of Merck KGaA)

- Celerion

- Cerba Research

- Charles River Laboratories

- Covance (Now part of Labcorp)

- CRL Central Laboratory

- Eurofins Scientific

- Frontage Laboratories

- ICON plc

- IQVIA

- LabConnect

- Labcorp

- Medpace

- Medpace Reference Laboratories

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ACM Global Laboratories

- Agilent Technologies

- ALS Limited

- BioAgilytix Labs

- Bioanalytical Systems Inc. (BASi)

- Bioclinica

- BioReliance (Now part of Merck KGaA)

- Celerion

- Cerba Research

- Charles River Laboratories

- Covance (Now part of Labcorp)

- CRL Central Laboratory

- Eurofins Scientific

- Frontage Laboratories

- ICON plc

- IQVIA

- LabConnect

- Labcorp

- Medpace

- Medpace Reference Laboratories

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 290 |

| Published | February 2026 |

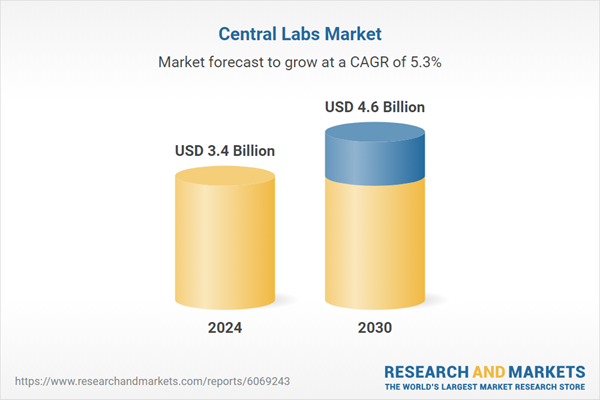

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.4 Billion |

| Forecasted Market Value ( USD | $ 4.6 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |