Global Furandicarboxylic Acid Market - Key Trends & Drivers Summarized

Why is Furandicarboxylic Acid Gaining Traction in the Bioplastics Industry?

Furandicarboxylic acid (FDCA) has emerged as a critical component in the development of bio-based polymers, primarily due to its ability to replace traditional petrochemical-derived plastics with sustainable alternatives. As industries increasingly shift toward eco-friendly materials, FDCA has gained significant attention as a precursor to polyethylene furanoate (PEF), a bio-based polymer that offers superior performance and biodegradability compared to polyethylene terephthalate (PET). With governments worldwide enforcing stricter regulations on plastic waste and carbon emissions, companies are actively exploring FDCA as a renewable and recyclable alternative in packaging, textiles, and industrial applications.The beverage and food packaging sector, in particular, has shown a growing interest in FDCA-derived PEF due to its excellent gas barrier properties, which enhance the shelf life of packaged goods. Additionally, PEF’ s mechanical strength and thermal resistance make it an ideal material for lightweight, high-performance packaging solutions. As major brands commit to sustainable packaging initiatives, the demand for FDCA is expected to rise exponentially. The increasing investments in bio-refineries and green chemistry research have further accelerated the development of cost-effective FDCA production methods, making it more accessible to industries looking to transition toward bio-based plastics.

How are Technological Advancements Improving FDCA Production and Applications?

Significant progress has been made in the production of FDCA, with new catalytic processes and biotechnological advancements enabling more efficient and cost-effective synthesis. Traditionally, FDCA has been produced through chemical oxidation of 5-hydroxymethylfurfural (HMF), a derivative of plant-based carbohydrates such as fructose and glucose. However, recent developments in enzymatic and microbial fermentation methods have improved yields, reduced byproducts, and minimized environmental impact. These advancements have paved the way for large-scale commercial production of FDCA, making it a more competitive alternative to petroleum-based monomers.Beyond packaging, FDCA is also being explored in high-performance coatings, adhesives, and engineering plastics. The automotive and electronics industries have recognized its potential for developing lightweight, durable components that align with sustainability goals. Moreover, the integration of FDCA in composite materials is enhancing mechanical properties in applications ranging from construction to aerospace. With ongoing R&D efforts focusing on optimizing catalytic pathways and improving feedstock utilization, the versatility and commercial viability of FDCA are expected to expand further, solidifying its role as a cornerstone of the bio-based materials revolution.

Which Industries and Market Segments Are Driving the Demand for FDCA?

The packaging industry remains the largest consumer of FDCA, driven by the urgent need for sustainable alternatives to PET plastics. The beverage sector, in particular, is witnessing rapid adoption of FDCA-based PEF bottles due to their enhanced barrier properties and recyclability. Consumer goods companies are also exploring FDCA applications in personal care and household product packaging, aligning with their sustainability targets. Additionally, the textiles and apparel industries are leveraging FDCA-derived materials to produce eco-friendly fibers that offer improved durability and biodegradability compared to conventional polyester.Beyond packaging and textiles, the automotive and aerospace sectors are incorporating FDCA-based composites in lightweight vehicle components, contributing to fuel efficiency and reduced carbon footprints. The adhesives and coatings industry is also benefiting from FDCA’ s high-performance characteristics, leading to the development of sustainable, high-strength materials for industrial applications. Furthermore, biotechnology firms are investing in FDCA research to unlock new applications in biodegradable medical implants, pharmaceutical coatings, and bio-based specialty chemicals. As sustainability becomes a key business priority across multiple industries, FDCA’ s market penetration is expected to increase significantly.

What Key Factors Are Driving Market Growth?

The growth in the furandicarboxylic acid (FDCA) market is driven by several factors, including the rising demand for bio-based plastics, advancements in green chemistry, and increasing regulatory support for sustainable materials. Governments and environmental agencies worldwide are implementing stringent policies to reduce plastic waste and encourage the adoption of biodegradable alternatives, creating a favorable market environment for FDCA. Additionally, major multinational corporations are setting ambitious sustainability goals, driving investments in FDCA-based polymer research and production. The increasing consumer preference for eco-friendly packaging solutions has further accelerated FDCA adoption, particularly in the food and beverage industry.Technological breakthroughs in catalytic and enzymatic conversion processes have also contributed to market expansion, making FDCA production more cost-effective and scalable. The expansion of bio-refineries and circular economy initiatives has further strengthened the supply chain for renewable feedstocks used in FDCA production. Additionally, the growing emphasis on carbon footprint reduction has prompted industries to explore FDCA as a key component in developing next-generation sustainable materials. With continuous innovation in polymer science and bio-manufacturing, FDCA is set to play a crucial role in shaping the future of the global bio-based chemicals market.

Report Scope

The report analyzes the Furandicarboxylic Acid market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Vertical (PET Vertical, Polyamides Vertical, Polycarbonates Vertical, Plasticizers Vertical, Polyester Polyols Vertical, Other Verticals).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the PET Vertical segment, which is expected to reach US$4.0 Billion by 2030 with a CAGR of a 38%. The Polyamides Vertical segment is also set to grow at 27.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $650.1 Million in 2024, and China, forecasted to grow at an impressive 42.7% CAGR to reach $3.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Furandicarboxylic Acid Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Furandicarboxylic Acid Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Furandicarboxylic Acid Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aqua Cultured Foods, Atlast Food Co., Bosque Foods, Ecovative Design, ENOUGH and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Furandicarboxylic Acid market report include:

- Alfa Aesar GmbH & Co KG

- AstaTech Inc.

- AVA Biochem AG

- Avalon Industries AG

- Avantium

- BASF SE

- BioAmber Inc.

- Carbone Scientific

- Chemsky (Shanghai) International Co., Ltd.

- Clearsynth

- Corbion

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- Novamont SpA

- Synbias Pharma

- Synvina

- TCL America

- Tokyo Chemical Industry Co., Ltd.

- Toronto Research Chemicals Inc.

- V & V Pharma Industries

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alfa Aesar GmbH & Co KG

- AstaTech Inc.

- AVA Biochem AG

- Avalon Industries AG

- Avantium

- BASF SE

- BioAmber Inc.

- Carbone Scientific

- Chemsky (Shanghai) International Co., Ltd.

- Clearsynth

- Corbion

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- Novamont SpA

- Synbias Pharma

- Synvina

- TCL America

- Tokyo Chemical Industry Co., Ltd.

- Toronto Research Chemicals Inc.

- V & V Pharma Industries

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

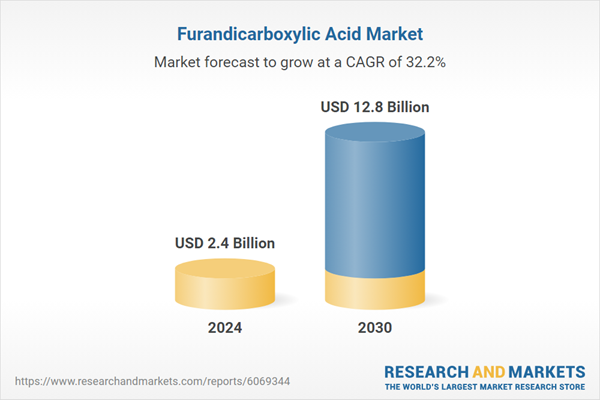

| Estimated Market Value ( USD | $ 2.4 Billion |

| Forecasted Market Value ( USD | $ 12.8 Billion |

| Compound Annual Growth Rate | 32.2% |

| Regions Covered | Global |