Global Polyurethane Catalyst Market - Key Trends & Drivers Summarized

What Is a Polyurethane Catalyst and Why Is It Critical to the Industry?

A polyurethane catalyst is a chemical compound used to accelerate the reaction between polyols and isocyanates during the production of polyurethane (PU) materials. These catalysts are essential in ensuring the appropriate speed, consistency, and control over PU foam formation, curing, and mechanical properties. Available in both amine-based and metal-based (such as tin, bismuth, and zinc) forms, polyurethane catalysts can be tailored to suit different applications, including flexible and rigid foams, elastomers, coatings, adhesives, sealants, and binders. Their selection and concentration have a direct impact on the final product's density, cell structure, reactivity, and environmental compliance.Polyurethane catalysts are indispensable in producing a wide range of products used across industries such as automotive, construction, electronics, furniture, textiles, and packaging. For example, in the automotive sector, they enable the production of lightweight and high-performance cushioning, acoustic insulation, and structural parts. In construction, catalysts are crucial in manufacturing thermal insulation panels and sealants with specific fire resistance and durability characteristics. As global industries continue to pursue more efficient production cycles and higher-performance materials, the demand for tailored catalytic solutions remains high.

How Are Regulations and Technological Shifts Reshaping Catalyst Innovation?

One of the most significant trends shaping the polyurethane catalyst market is the global regulatory shift toward safer, low-emission, and environmentally friendly chemicals. With increasing scrutiny on volatile organic compounds (VOCs), heavy metals, and toxic intermediates, manufacturers are being pushed to develop non-toxic and sustainable catalyst alternatives, especially those free of tin and mercury. In response, there has been a notable rise in the development of bismuth- and zinc-based catalysts as safer substitutes. These alternatives deliver comparable reactivity with improved environmental and health profiles, making them suitable for use in consumer-facing applications such as furniture, bedding, and automotive interiors.Meanwhile, advancements in smart manufacturing and the push for precise control over reaction kinetics have led to the development of next-generation catalysts that offer higher selectivity, thermal stability, and compatibility with renewable polyols. Formulators are now able to fine-tune reaction profiles for faster curing, improved flow properties, or longer working times, depending on the application. Furthermore, the increasing use of bio-based polyurethanes in green construction and automotive applications is prompting a demand for catalysts optimized for plant-based inputs. The integration of catalysts into automated, digital production systems in PU manufacturing also highlights the growing role of catalysts in enhancing process efficiency and waste reduction.

The Growth in the Polyurethane Catalyst Market Is Driven by Several Factors……

The growth in the polyurethane catalyst market is driven by several factors, beginning with the surging demand for polyurethane-based insulation and construction materials, especially in energy-efficient buildings. As green building codes and sustainable infrastructure projects gain momentum globally, the need for optimized catalytic systems to produce rigid foams and high-performance sealants continues to rise. The automotive industry's shift toward lightweight, durable, and energy-absorbing materials is another major driver, as polyurethane catalysts enable the production of integral components like seating, headrests, and NVH (noise, vibration, and harshness) solutions.Moreover, the expansion of the furniture and bedding sectors, driven by rising urbanization and consumer preference for ergonomic and comfort-focused products, is increasing demand for flexible foams that rely heavily on amine-based catalysts. In addition, growing investments in electronics and appliance manufacturing are boosting the use of PU encapsulants and coatings, where catalyst precision is critical to performance. The push for low-emission and metal-free catalyst formulations in response to environmental regulations is fostering innovation in green chemistry, further expanding application areas. Lastly, emerging markets in Asia-Pacific, Latin America, and the Middle East are witnessing rapid industrial and infrastructural growth, providing fertile ground for catalyst deployment across a broad spectrum of polyurethane applications.

Report Scope

The report analyzes the Polyurethane Catalyst market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Amine Catalyst, Metal Catalyst); Functionality (Gelling Catalyst, Blowing Catalyst, Curing Catalyst, Foam Stabilizing Catalyst, Cross Linking Catalyst, Other Functionalities); Application (Foams Application, Sealant & Adhesive Application, Coating Application, Elastomer Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Amine Catalyst segment, which is expected to reach US$2.2 Billion by 2030 with a CAGR of a 5.8%. The Metal Catalyst segment is also set to grow at 3.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $644.5 Million in 2024, and China, forecasted to grow at an impressive 9.1% CAGR to reach $670.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Polyurethane Catalyst Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Polyurethane Catalyst Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Polyurethane Catalyst Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Avient Corporation, Borealis AG, Borealis Compounds Inc., ExxonMobil Corporation, GS Caltex Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Polyurethane Catalyst market report include:

- Air Products and Chemicals, Inc.

- Albemarle Corporation

- BASF SE

- Carpenter Co.

- Covestro AG

- Dorf Ketal Chemicals

- Evonik Industries AG

- Gulbrasnson Chemical Pvt. Ltd.

- Huntsman International LLC

- Kao Corporation

- King Industries, Inc.

- Manali Petrochemicals Limited

- Momentive Performance Materials Inc.

- Polychemie Asia Pacific Permai

- Shepherd Chemical Company

- Suzhou Xiangyuan Special Fine Chemical Co., Ltd.

- The Dow Chemical Company

- Tosoh Corporation

- Wanhua Chemical Group Co., Ltd.

- Zhangjiagang Dawei Assistants Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Air Products and Chemicals, Inc.

- Albemarle Corporation

- BASF SE

- Carpenter Co.

- Covestro AG

- Dorf Ketal Chemicals

- Evonik Industries AG

- Gulbrasnson Chemical Pvt. Ltd.

- Huntsman International LLC

- Kao Corporation

- King Industries, Inc.

- Manali Petrochemicals Limited

- Momentive Performance Materials Inc.

- Polychemie Asia Pacific Permai

- Shepherd Chemical Company

- Suzhou Xiangyuan Special Fine Chemical Co., Ltd.

- The Dow Chemical Company

- Tosoh Corporation

- Wanhua Chemical Group Co., Ltd.

- Zhangjiagang Dawei Assistants Co., Ltd.

Table Information

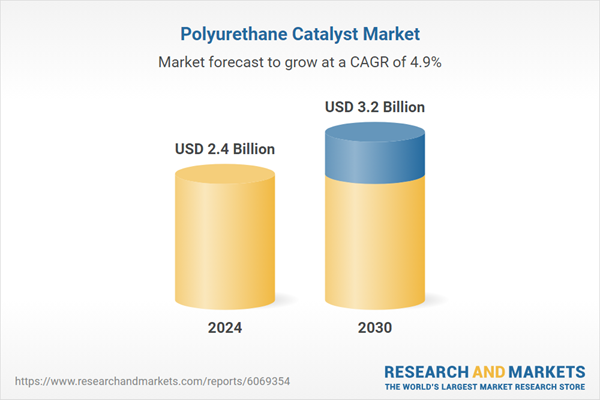

| Report Attribute | Details |

|---|---|

| No. of Pages | 386 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.4 Billion |

| Forecasted Market Value ( USD | $ 3.2 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |