Global Airborne Optronics Market - Key Trends & Drivers Summarized

How Is Cutting-Edge Technology Revolutionizing Airborne Optronics?

The airborne optronics market is undergoing a significant transformation, driven by advancements in sensor technologies and optical systems. Modern airborne optronics systems leverage sophisticated imaging technologies, such as infrared, multispectral, and hyperspectral sensors, to enhance situational awareness and target acquisition capabilities. These systems are integral to intelligence, surveillance, and reconnaissance (ISR) missions, enabling aircraft to operate effectively in complex and dynamic environments.Advancements in miniaturization have allowed manufacturers to develop compact, lightweight optronics systems that are highly effective yet minimally intrusive on aircraft performance. The integration of artificial intelligence (AI) has further enhanced the functionality of these systems, allowing for real-time image processing and automated target recognition. These technological leaps are ensuring that airborne optronics remain a critical asset for both military and civilian aviation.

What Drives the Rising Demand for Airborne Optronics in Defense and Security?

The defense sector continues to dominate the airborne optronics market, fueled by increasing geopolitical tensions and the need for enhanced national security. Nations across the globe are investing heavily in advanced military aircraft equipped with state-of-the-art optronics systems to maintain a strategic edge. These systems are vital for precision targeting, threat detection, and battlefield surveillance, ensuring mission success and minimizing collateral damage.Unmanned aerial vehicles (UAVs) represent another significant growth area within the defense segment. Optronics systems tailored for UAVs provide unparalleled imaging and tracking capabilities, making them indispensable for reconnaissance and strike missions. Beyond military applications, airborne optronics are being adopted for border security, disaster management, and law enforcement, showcasing their versatility and expanding their market potential.

How Are Commercial Applications Expanding the Scope of Airborne Optronics?

While defense remains the primary driver, commercial applications are steadily contributing to the growth of the airborne optronics market. Industries such as oil and gas, agriculture, and environmental monitoring are leveraging these systems for a wide range of applications. High-resolution imaging from optronics systems is being used to monitor pipeline integrity, assess crop health, and track wildlife populations.Moreover, the aviation industry is exploring the use of optronics for enhanced navigation and obstacle detection in adverse weather conditions. This is particularly relevant for autonomous aircraft and urban air mobility (UAM) solutions, where situational awareness is paramount. As the adoption of drone technology grows in commercial sectors, the demand for lightweight and cost-effective optronics systems is expected to rise significantly.

What Factors Are Fueling Growth in the Airborne Optronics Market?

The growth in the airborne optronics market is driven by several factors. The increasing adoption of UAVs in both military and commercial applications has created a robust demand for advanced imaging and targeting systems. The ongoing development of stealth aircraft and the need for counter-stealth capabilities have also fueled investments in optronics that can detect low-observable targets.In the commercial sector, the proliferation of smart farming and precision agriculture is driving the need for high-performance imaging systems. Similarly, environmental agencies and research organizations are leveraging airborne optronics for climate monitoring and disaster response. Furthermore, the integration of AI and machine learning is enabling smarter, more autonomous optronics systems, meeting the rising demand for real-time analytics and decision-making. These drivers collectively underscore the dynamic and fast-growing nature of the airborne optronics market, setting the stage for continued innovation and adoption.

Report Scope

The report analyzes the Airborne Optronics market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Military Application, Commercial Application, Space Application); End-User (OEM End-User, Aftermarket End-User).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Military Application segment, which is expected to reach US$2.7 Billion by 2030 with a CAGR of a 14.9%. The Commercial Application segment is also set to grow at 12% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $673.5 Million in 2024, and China, forecasted to grow at an impressive 17.7% CAGR to reach $1.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Airborne Optronics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Airborne Optronics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Airborne Optronics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ASELSAN AS, Bharat Electronics Limited (BEL), General Dynamics Mission Systems, Inc., Israel Aerospace Industries Ltd., Leonardo S.p.A and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Airborne Optronics market report include:

- Collins Aerospace (A Business of RTX)

- Excelitas Technologies Corp.

- Headwall Photonics, Inc.

- HENSOLDT South Africa

- Kappa Optronics GmbH

- Leonardo S.p.A

- OSI Optoelectronics

- RAFAEL Advanced Defense Systems Ltd.

- Reliance Defence Limited

- Safran Group

- Teledyne FLIR LLC

- Thales Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Collins Aerospace (A Business of RTX)

- Excelitas Technologies Corp.

- Headwall Photonics, Inc.

- HENSOLDT South Africa

- Kappa Optronics GmbH

- Leonardo S.p.A

- OSI Optoelectronics

- RAFAEL Advanced Defense Systems Ltd.

- Reliance Defence Limited

- Safran Group

- Teledyne FLIR LLC

- Thales Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 281 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

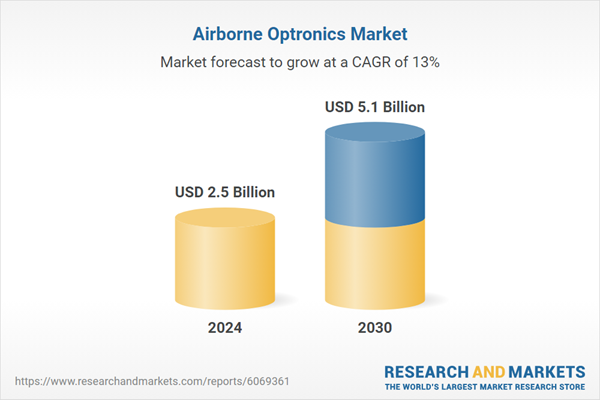

| Estimated Market Value ( USD | $ 2.5 Billion |

| Forecasted Market Value ( USD | $ 5.1 Billion |

| Compound Annual Growth Rate | 13.0% |

| Regions Covered | Global |