Global Positive Airway Pressure (PAP) Devices Market - Key Trends & Drivers Summarized

Why Are Positive Airway Pressure (PAP) Devices Essential for Treating Sleep and Respiratory Disorders?

Positive Airway Pressure (PAP) devices are non-invasive respiratory support systems designed to keep the airway open by delivering a continuous or variable stream of pressurized air. These devices are primarily used for treating obstructive sleep apnea (OSA), central sleep apnea (CSA), and chronic respiratory disorders such as chronic obstructive pulmonary disease (COPD) and neuromuscular diseases. As the prevalence of sleep apnea and respiratory conditions continues to rise worldwide, PAP devices have become an essential part of modern healthcare, improving patient outcomes, sleep quality, and overall quality of life.With an estimated 1 billion people affected by sleep apnea globally, PAP therapy remains the gold standard treatment for moderate to severe OSA. The demand for these devices has surged due to increasing awareness of sleep-related health risks, growing obesity rates, and the rising number of elderly patients requiring long-term respiratory support. Additionally, the COVID-19 pandemic highlighted the importance of non-invasive ventilation for patients with mild to moderate respiratory distress, further boosting the adoption of PAP devices across home care settings, hospitals, and sleep clinics.

How Are Technological Innovations Enhancing PAP Device Performance and Patient Compliance?

Technological advancements in auto-adjusting pressure delivery, noise reduction, connectivity, and mask design have significantly improved the effectiveness and patient adherence of PAP therapy. One of the most important breakthroughs is the development of Auto-Adjusting Positive Airway Pressure (APAP) devices, which dynamically modify pressure levels based on real-time breathing patterns. These devices provide customized therapy, improving patient comfort and reducing the likelihood of airway resistance or discomfort during sleep.Another major innovation is the integration of smart connectivity features, including Bluetooth, Wi-Fi, and cloud-based monitoring systems. Modern PAP devices can sync with mobile apps and patient management platforms, allowing real-time tracking of usage, apnea events, and mask fit efficiency. This technology benefits both patients and healthcare providers, enabling remote monitoring, early intervention for therapy adjustments, and improved adherence rates. Some advanced PAP models also incorporate AI-driven analytics to provide personalized therapy recommendations and predictive maintenance alerts.

The evolution of mask design and comfort enhancements has also contributed to higher PAP therapy compliance rates. Manufacturers are introducing lightweight, minimal-contact, and memory foam cushion masks that reduce air leakage and pressure points, addressing common patient complaints about discomfort and skin irritation. Additionally, the integration of humidification technology in PAP devices helps prevent dryness, nasal congestion, and throat irritation, making therapy more tolerable for long-term users.

What Market Trends Are Driving the Expansion of PAP Devices?

One of the key trends shaping the PAP device market is the rising adoption of home-based sleep apnea management solutions. As healthcare systems shift toward remote patient monitoring (RPM) and at-home care models, there is increasing demand for portable, user-friendly, and smart-connected PAP devices. Many patients prefer home-based therapy over in-lab sleep studies, driving the adoption of wearable and travel-friendly PAP devices that offer compact designs, USB charging, and battery-powered operation for convenience.The growing focus on personalized medicine and patient-centric care is also influencing the market. Manufacturers are investing in adaptive PAP algorithms, AI-assisted sleep tracking, and biometric sensors to provide tailored therapy based on individual breathing patterns and comorbid conditions. Additionally, the rise of combination therapies, such as PAP devices integrated with oral appliances or oxygen therapy, is improving treatment outcomes for patients with complex sleep-disordered breathing conditions.

Another major trend is the expansion of PAP therapy applications beyond sleep apnea treatment. PAP devices are increasingly being used for post-surgical respiratory care, neuromuscular disease management, and non-invasive ventilation (NIV) support for patients with COVID-19 complications, pneumonia, and chronic respiratory failure. The pandemic reinforced the role of PAP devices in hospital and ICU settings, accelerating their adoption in acute care and emergency medical applications.

Additionally, government initiatives, reimbursement policies, and insurance coverage expansion are driving market growth. Many healthcare systems now recognize sleep apnea as a major public health issue, leading to broader insurance coverage for PAP therapy and greater physician advocacy for early diagnosis and treatment. Countries such as the U.S., Canada, Germany, and Japan have strengthened screening programs, subsidized PAP device purchases, and streamlined telemedicine-based sleep disorder treatments, further increasing market accessibility.

What Factors Are Driving the Growth of the PAP Device Market?

The growth in the positive airway pressure (PAP) device market is driven by several factors, including rising prevalence of sleep disorders, advancements in respiratory therapy technologies, and increasing adoption of home-based healthcare solutions. One of the primary drivers is the growing awareness of untreated sleep apnea and its impact on cardiovascular health, diabetes, and mental well-being. Studies have linked undiagnosed OSA to increased risks of stroke, hypertension, and cognitive decline, prompting more proactive screening, diagnosis, and early treatment adoption.Another major factor is the aging population and increased prevalence of respiratory diseases. With more elderly individuals requiring long-term respiratory therapy, there is a rising need for advanced PAP devices equipped with auto-adjusting pressure, humidification, and remote monitoring capabilities. Additionally, obesity-related sleep apnea cases are surging, particularly in regions such as North America, Europe, and the Middle East, further driving demand for PAP therapy solutions.

The expansion of telemedicine and online PAP therapy management platforms is also fueling market growth. Many healthcare providers and sleep specialists now offer virtual consultations, at-home sleep studies, and remote device monitoring, making PAP therapy more accessible and patient-friendly. Additionally, direct-to-consumer (DTC) PAP device sales and rental services have expanded through e-commerce platforms and medical device subscription models, increasing market reach and affordability.

Lastly, regulatory advancements and medical device innovations are playing a significant role in PAP market expansion. Leading manufacturers are focusing on FDA approvals, CE certifications, and compliance with medical safety standards, ensuring better quality assurance and patient safety. The integration of biodegradable PAP filters, noise-reduction technologies, and smart energy-efficient features is further enhancing device sustainability and eco-friendliness, aligning with global healthcare sustainability initiatives.

As the demand for effective, patient-friendly, and AI-enhanced PAP devices continues to grow, the global PAP device market is expected to witness significant expansion, with innovations in wireless connectivity, adaptive pressure therapy, and integrated sleep health solutions shaping its future trajectory.

Report Scope

The report analyzes the Positive Airway Pressure Devices market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Continuous Positive Airway Pressure Devices, Automatic Positive Airway Pressure Devices, Bi-level Positive Airway Pressure Devices); Application (Obstructive Sleep Apnea Application, Respiratory Failures Application, COPD Application); End-Use (Home Care Settings End-Use, Hospitals & Clinics End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Continuous Positive Airway Pressure Devices segment, which is expected to reach US$1.8 Billion by 2030 with a CAGR of a 2.9%. The Automatic Positive Airway Pressure Devices segment is also set to grow at 4.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $692.5 Million in 2024, and China, forecasted to grow at an impressive 6.7% CAGR to reach $628.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Positive Airway Pressure Devices Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Positive Airway Pressure Devices Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Positive Airway Pressure Devices Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Auto-Star Compusystems Inc., Block, Inc. (Square), Check Point Software Technologies Ltd., Clover Network, Inc., Epos Now and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Positive Airway Pressure Devices market report include:

- 3B Medical Inc.

- Apex Medical Corp.

- Armstrong Medical Inc.

- BMC Medical Co., Ltd.

- BPL Medical Technologies Pvt Ltd

- Compumedics Limited

- Curative Medical Inc.

- Drive DeVilbiss Healthcare LLC

- Fisher & Paykel Healthcare Limited

- ICU Medical Inc.

- Koninklijke Philips N.V.

- Lowenstein Medical GmbH & Co. KG

- Medtronic plc

- React Health (formerly 3B Medical, Inc.)

- ResMed Inc.

- Servona GmbH

- Smiths Group plc

- Somnetics International Inc.

- Vyaire Medical Inc.

- Wellell Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3B Medical Inc.

- Apex Medical Corp.

- Armstrong Medical Inc.

- BMC Medical Co., Ltd.

- BPL Medical Technologies Pvt Ltd

- Compumedics Limited

- Curative Medical Inc.

- Drive DeVilbiss Healthcare LLC

- Fisher & Paykel Healthcare Limited

- ICU Medical Inc.

- Koninklijke Philips N.V.

- Lowenstein Medical GmbH & Co. KG

- Medtronic plc

- React Health (formerly 3B Medical, Inc.)

- ResMed Inc.

- Servona GmbH

- Smiths Group plc

- Somnetics International Inc.

- Vyaire Medical Inc.

- Wellell Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 381 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

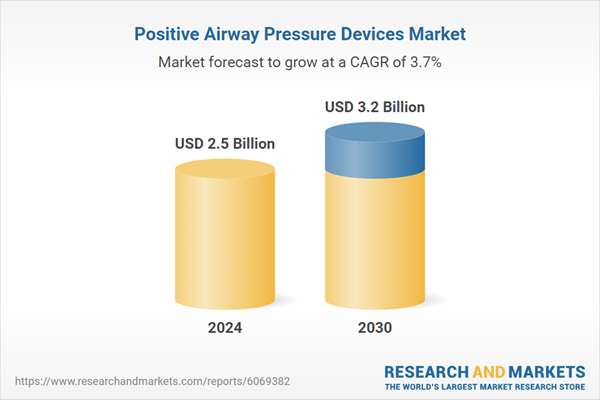

| Estimated Market Value ( USD | $ 2.5 Billion |

| Forecasted Market Value ( USD | $ 3.2 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |