Global Medical Foods for Orphan Diseases Market - Key Trends & Drivers Summarized

Can Specialized Nutrition Fill the Treatment Gaps in Rare and Complex Disorders?

The emergence of medical foods as an essential therapeutic adjunct in the management of orphan diseases represents a paradigm shift in how rare metabolic and genetic disorders are treated globally. Medical foods are specially formulated dietary products intended for the specific nutritional management of diseases with distinctive nutritional requirements that cannot be met through normal diet alone. These are not classified as drugs, yet they require physician supervision, making them a unique regulatory category. In the context of orphan diseases - typically defined as conditions affecting fewer than 200,000 people in the U.S. or less than 1 in 2,000 in the EU - conventional pharmacological solutions are often either unavailable or insufficient. Medical foods play a pivotal role in the day-to-day management of disorders such as phenylketonuria (PKU), maple syrup urine disease (MSUD), homocystinuria, urea cycle disorders, and other inborn errors of metabolism. In many of these conditions, improper processing of amino acids or fats due to enzyme deficiencies results in the accumulation of toxic substances in the body. Dietary management, through medical foods that are free of or contain modified levels of these nutrients, helps prevent irreversible damage to the brain, liver, and other organs. Despite their therapeutic relevance, market penetration has historically been limited due to regulatory ambiguity, lack of reimbursement pathways, and inadequate awareness among physicians and caregivers. However, as diagnostic precision improves and newborn screening programs expand globally, the medical foods segment for orphan conditions is gaining well-deserved recognition as a critical part of holistic patient care.How Are Regulatory and Clinical Frameworks Catalyzing Medical Food Innovation?

The global landscape for medical foods tailored to orphan diseases is undergoing transformation driven by regulatory evolution and intensified clinical validation. In the United States, medical foods are governed under the Orphan Drug Act and the Orphan Product Development Grant Program, providing a favorable backdrop for niche innovation. Unlike pharmaceutical drugs, medical foods do not require premarket approval from the FDA, but they must meet stringent labeling and manufacturing requirements under the Federal Food, Drug, and Cosmetic Act. This regulatory model has encouraged companies to develop disease-specific nutritional therapies with a faster time-to-market compared to conventional drugs. In the European Union, medical foods fall under “Foods for Special Medical Purposes” (FSMPs), and similar regulatory pathways are now being adopted in countries across Asia-Pacific and Latin America to accommodate growing pediatric and rare disease needs. Importantly, regulatory clarity has also encouraged investments in clinical research to generate robust evidence of efficacy and safety. Recent clinical trials have focused on demonstrating the metabolic control benefits and quality-of-life improvements enabled by medical foods in rare disease populations. Additionally, the development of real-world evidence (RWE) databases and patient registries is facilitating post-market surveillance and long-term outcome studies. Policymakers and advocacy groups are increasingly championing legislative initiatives to integrate medical foods into insurance reimbursement frameworks, which could further drive adoption across public and private healthcare systems. Overall, a clearer and more supportive regulatory environment is acting as a catalyst for medical food innovation, positioning the segment for sustained global expansion.Why Are End-Users Demanding More Personalized, Palatable, and Life-Compatible Nutritional Solutions?

The evolution of medical foods for orphan diseases is being increasingly influenced by consumer expectations around palatability, personalization, and lifestyle integration. Historically, patients - especially children - have struggled with the unappealing taste, texture, and limited formulation options of earlier-generation medical foods. This often led to poor compliance, compromising treatment outcomes. In response, manufacturers are now prioritizing patient-centric design, focusing on improving flavor profiles, offering diverse formats such as ready-to-drink shakes, powders, capsules, and even chewable options, and aligning dosage with daily routines. The goal is not only to meet metabolic needs but also to enhance the quality of life for patients and caregivers. Furthermore, digital health integration is opening new avenues for personalization, with AI-enabled nutritional planning tools and mobile apps allowing caregivers and clinicians to monitor intake, manage dosage, and adjust nutritional strategies in real time. The expansion of home-based care and telemedicine has also amplified demand for shelf-stable, easily transportable, and convenient-to-administer medical foods. Another important trend is the shift toward age-specific and life-stage targeted formulations. For instance, infants with metabolic disorders require different nutrient concentrations and delivery mechanisms than adolescents or adults, necessitating tailored product pipelines. Collaborations between nutritionists, metabolic specialists, and patient advocacy groups are contributing to the development of medical foods that are not only clinically effective but also socially and emotionally acceptable. Additionally, as genetic sequencing becomes more widespread and accessible, there is an increasing opportunity to fine-tune medical nutrition based on a patient's genomic and phenotypic profile. This convergence of precision medicine and specialized nutrition is redefining what patients expect - and demand - from medical food products in rare disease management.The Growth in the Medical Foods for Orphan Diseases Market Is Driven by Several Factors…

The growth in the medical foods for orphan diseases market is driven by several factors closely linked to advancements in diagnostic capabilities, targeted therapy development, and shifting healthcare delivery models. A primary driver is the expansion of newborn screening programs, which are enabling early detection of metabolic and genetic disorders, thereby prompting earlier intervention with disease-specific nutritional therapies. In tandem, the rising prevalence of rare diseases - exacerbated by improved diagnostic tools and greater genetic testing adoption - is expanding the eligible patient population for medical foods. From a technological standpoint, innovations in food science and biotechnology are enabling the development of highly specific, bioavailable, and stable nutritional compounds that can be customized for niche patient needs. End-use trends are equally influential, with the rapid growth of home healthcare and outpatient treatment centers increasing the demand for convenient, ready-to-use products that align with decentralized care protocols. Additionally, changing consumer behavior, particularly among digitally empowered caregivers and health-conscious patients, is fueling the demand for data-driven, traceable, and lifestyle-compatible medical foods. Insurance reimbursement trends are also shifting, with several payers beginning to recognize the clinical and economic benefits of early dietary intervention, leading to increased coverage of medical foods under health plans. The rise of orphan drug policies, regulatory incentives, and dedicated rare disease research funding across the U.S., Europe, and Asia-Pacific is also facilitating a more supportive commercial and R&D ecosystem. Lastly, growing collaboration between pharmaceutical companies and medical nutrition firms is leading to hybrid models of therapy, where medical foods are used alongside drugs as part of comprehensive disease management strategies. These interconnected dynamics are not only expanding the market footprint of medical foods for orphan diseases but are also reinforcing their role as essential and clinically validated components of modern therapeutic protocols.Report Scope

The report analyzes the Medical Foods for Orphan Diseases market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (Powders, Liquids, Pills, Other Products); Administration Route (Oral Administration Route, Enteral Administration Route); Sales Channel (Institutional Sales Channels, Retail Sales Channels, Online Sales Channels).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Powder Form segment, which is expected to reach US$1.6 Billion by 2030 with a CAGR of a 4.4%. The Liquid Form segment is also set to grow at 4.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $706 Million in 2024, and China, forecasted to grow at an impressive 7.7% CAGR to reach $680.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Medical Foods for Orphan Diseases Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Medical Foods for Orphan Diseases Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Medical Foods for Orphan Diseases Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Medical Foods for Orphan Diseases market report include:

- Abbott Laboratories

- Ajinomoto Cambrooke, Inc.

- Alcresta Therapeutics, Inc.

- Alfasigma S.p.A.

- BioMarin Pharmaceutical Inc.

- CANbridge Pharmaceuticals Inc.

- Cerecin Inc.

- Danone S.A.

- Fresenius Kabi AG

- Leadiant Biosciences, Inc.

- Mead Johnson & Company, LLC

- Metagenics, Inc.

- Nestlé Health Science

- Orphan Therapeutics, LLC

- Primus Pharmaceuticals, Inc.

- Relief Therapeutics

- Solace Nutrition

- Targeted Medical Pharma, Inc.

- Ultragenyx Pharmaceutical Inc.

- Vitaflo International Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- Ajinomoto Cambrooke, Inc.

- Alcresta Therapeutics, Inc.

- Alfasigma S.p.A.

- BioMarin Pharmaceutical Inc.

- CANbridge Pharmaceuticals Inc.

- Cerecin Inc.

- Danone S.A.

- Fresenius Kabi AG

- Leadiant Biosciences, Inc.

- Mead Johnson & Company, LLC

- Metagenics, Inc.

- Nestlé Health Science

- Orphan Therapeutics, LLC

- Primus Pharmaceuticals, Inc.

- Relief Therapeutics

- Solace Nutrition

- Targeted Medical Pharma, Inc.

- Ultragenyx Pharmaceutical Inc.

- Vitaflo International Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 374 |

| Published | March 2026 |

| Forecast Period | 2024 - 2030 |

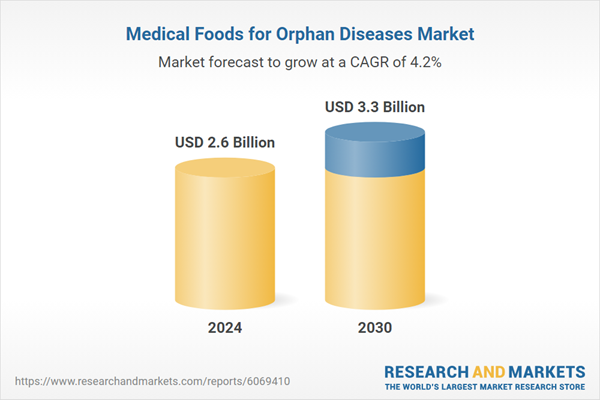

| Estimated Market Value ( USD | $ 2.6 Billion |

| Forecasted Market Value ( USD | $ 3.3 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |