Global Demolition Hammers Market - Key Trends & Drivers Summarized

How Is the Construction Boom Fueling the Demand for Demolition Hammers?

The global demolition hammers market is experiencing significant growth, driven by the booming construction and infrastructure development sectors. Demolition hammers, essential for breaking concrete, asphalt, and masonry, are widely used in both residential and commercial construction projects. The rising demand for urban redevelopment, renovation of aging infrastructure, and expansion of public works projects has fueled the adoption of powerful and efficient demolition tools. In emerging economies, rapid urbanization and increased government spending on smart city projects have further accelerated market growth. Additionally, the surge in road and bridge reconstruction projects, coupled with the growing need for earthquake-resistant structures, has led to increased utilization of demolition hammers in construction sites worldwide. With stringent safety regulations mandating proper demolition techniques, the demand for ergonomic, vibration-reduced, and noise-controlled demolition hammers is also rising.What Technological Advancements Are Revolutionizing Demolition Hammers?

Recent advancements in demolition hammer technology have significantly enhanced efficiency, durability, and operator comfort. Innovations in electric, pneumatic, and hydraulic demolition hammers have improved performance across various demolition applications. Cordless battery-powered demolition hammers are gaining traction due to their portability and reduced reliance on external power sources. Additionally, the integration of brushless motor technology has extended the lifespan of electric demolition hammers while reducing maintenance costs. Anti-vibration technology and ergonomic designs have minimized operator fatigue, improving productivity and workplace safety. The development of intelligent demolition tools with automated impact force adjustment, IoT-enabled performance tracking, and dust suppression systems has further enhanced operational efficiency. As construction firms increasingly adopt advanced power tools, the demand for high-performance demolition hammers continues to grow.How Are Regulations and Sustainability Trends Shaping the Demolition Equipment Market?

Environmental concerns and stringent demolition waste management regulations are significantly influencing the demolition hammers market. Governments worldwide are enforcing stricter guidelines on noise pollution, dust emissions, and debris disposal, prompting manufacturers to develop eco-friendly demolition solutions. The shift towards energy-efficient and low-emission demolition tools is gaining momentum, with leading manufacturers focusing on battery-powered and hybrid demolition hammers. Recycling initiatives in the construction industry are also driving demand for precision demolition tools that minimize material wastage. Additionally, rental and leasing trends in the power tools industry are expanding access to high-quality demolition hammers while reducing upfront costs for contractors. With sustainability and regulatory compliance becoming key priorities, the market is expected to see increased innovation in low-noise and dust-free demolition technologies.What Are the Key Growth Drivers in the Demolition Hammers Market?

The growth in the demolition hammers market is driven by several factors, including the rapid expansion of construction and infrastructure projects worldwide. The increasing need for building renovations, road expansions, and industrial demolition work has fueled demand for high-performance demolition tools. The adoption of cordless and battery-powered demolition hammers has surged due to their convenience and efficiency. Technological advancements such as brushless motors, anti-vibration technology, and dust suppression systems have enhanced user safety and tool longevity. Additionally, the growing trend of renting and leasing demolition equipment has made high-quality tools more accessible to small and mid-sized construction firms. Government regulations promoting sustainable demolition practices and noise-reduction technologies are further influencing product innovation. As urbanization and industrial expansion continue, the demand for advanced demolition hammers is expected to rise, shaping the future of the construction equipment market.Report Scope

The report analyzes the Demolition Hammers market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Electric Demolition Hammers, Hydraulic Demolition Hammers, Pneumatic Demolition Hammers); End-Use (Building and Construction End-Use, General Engineering and Manufacturing End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Electric Demolition Hammers segment, which is expected to reach US$1.9 Billion by 2030 with a CAGR of a 4.7%. The Hydraulic Demolition Hammers segment is also set to grow at 3.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $731.9 Million in 2024, and China, forecasted to grow at an impressive 7.7% CAGR to reach $703.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Demolition Hammers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Demolition Hammers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Demolition Hammers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AlloSource, Arthrex, Inc., Berkeley Advanced Biomaterials, Inc., Biocomposites Ltd., Bone Bank Allografts and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Demolition Hammers market report include:

- Bon Tool

- Bosch

- Chicago Pneumatic

- DeWalt

- Einhell

- Einmann

- Hilti

- Hitachi Power Tools

- Kobalt

- Makita

- Metabo

- Milwaukee Tool

- Ryobi

- Scheppach

- Silverline Tools

- Stanley Black & Decker

- TR Industrial

- VEVOR

- WEN

- XtremepowerUS

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Bon Tool

- Bosch

- Chicago Pneumatic

- DeWalt

- Einhell

- Einmann

- Hilti

- Hitachi Power Tools

- Kobalt

- Makita

- Metabo

- Milwaukee Tool

- Ryobi

- Scheppach

- Silverline Tools

- Stanley Black & Decker

- TR Industrial

- VEVOR

- WEN

- XtremepowerUS

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 278 |

| Published | February 2026 |

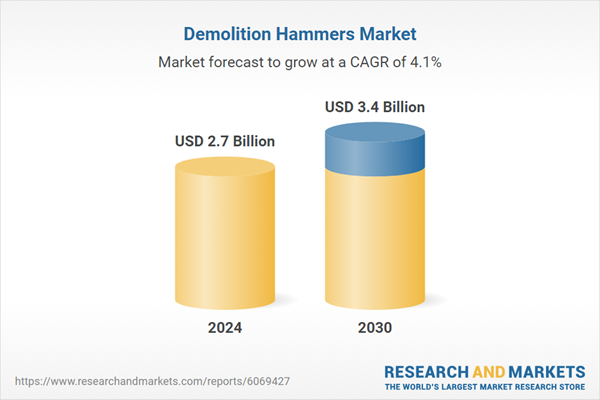

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.7 Billion |

| Forecasted Market Value ( USD | $ 3.4 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |