Global LNG Virtual Pipeline Market - Key Trends & Drivers Summarized

Why Is the LNG Virtual Pipeline Market Gaining Traction?

The concept of LNG virtual pipelines has gained significant traction in recent years as a flexible and cost-effective solution for delivering natural gas to areas without access to conventional pipeline infrastructure. Unlike traditional pipelines, virtual pipelines transport LNG via trucks, ships, rail, and ISO containers, enabling gas supply to remote industrial sites, power plants, and off-grid communities. This approach is particularly beneficial in regions with underdeveloped energy infrastructure, where extending physical pipelines is either economically unfeasible or environmentally disruptive. The increasing demand for natural gas as a cleaner alternative to coal and diesel has further accelerated the adoption of virtual pipelines, allowing industries and municipalities to transition toward lower-emission energy sources. Additionally, advancements in LNG storage and transportation technologies have improved the efficiency of virtual pipeline networks, making them a viable alternative for ensuring energy security in both developed and emerging markets.How Are Technological Innovations Improving LNG Virtual Pipeline Operations?

Technological advancements have played a crucial role in optimizing LNG virtual pipeline operations, enhancing safety, efficiency, and cost-effectiveness. The introduction of high-performance cryogenic tanks has improved LNG storage capacity and minimized boil-off gas (BOG) losses during transportation. Digital monitoring solutions, including real-time tracking and predictive analytics, have revolutionized supply chain management, enabling operators to optimize route planning and delivery schedules. Additionally, automation in LNG loading and unloading processes has reduced operational risks while improving turnaround times. The integration of AI and IoT-based sensors in LNG transportation systems has further enhanced reliability, allowing companies to monitor temperature fluctuations, detect leaks, and ensure compliance with safety regulations. The adoption of blockchain technology is also transforming the LNG virtual pipeline market by providing transparent and tamper-proof records of transactions, improving contract management, and streamlining logistics. These innovations are making LNG virtual pipelines more scalable, efficient, and attractive for energy providers looking to expand gas distribution without investing in costly fixed infrastructure.What Challenges Exist in the LNG Virtual Pipeline Market?

Despite its advantages, the LNG virtual pipeline market faces several challenges, including high transportation costs, regulatory hurdles, and limited infrastructure in some regions. The logistics of moving LNG over long distances via trucks or ships require significant investment in cryogenic transport fleets and refueling stations, which can impact overall cost-effectiveness. Additionally, stringent safety regulations governing LNG handling and transportation impose operational constraints, particularly in densely populated areas where gas distribution via road transport may be restricted. The volatility of LNG prices also presents a challenge for virtual pipeline operators, as fluctuating fuel costs can impact the affordability of gas supply contracts. However, ongoing investments in infrastructure development, such as the expansion of LNG bunkering facilities and mobile regasification units, are helping to address these issues. Government incentives promoting clean energy alternatives are also supporting the growth of virtual pipeline networks by reducing financial barriers for new entrants in the market.What Factors Are Driving Growth in the LNG Virtual Pipeline Market?

The growth in the LNG virtual pipeline market is driven by several factors, including the rising demand for clean energy, the expansion of gas-dependent industries, and technological advancements in LNG logistics. The global push toward reducing carbon emissions has accelerated the transition from coal and diesel to natural gas, increasing the need for flexible LNG distribution solutions. Industries such as manufacturing, mining, and power generation are increasingly adopting LNG as a primary fuel source, further fueling market expansion. The development of mobile regasification units and modular LNG distribution systems has made virtual pipelines more accessible and scalable, enabling faster deployment in new regions. Additionally, investments in LNG-powered transportation fleets, including trucks and ships, are creating synergies that enhance the efficiency of virtual pipeline networks. The continued growth of off-grid and island-based energy projects is also contributing to market demand, as virtual pipelines offer a reliable and cost-effective means of supplying LNG to remote locations. With governments and private sector players actively investing in LNG infrastructure, the market is expected to witness sustained growth, solidifying virtual pipelines as a key component of the future natural gas supply chain.Report Scope

The report analyzes the LNG Virtual Pipelines market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Transportation Mode (Truck, Rail, Ship, Barge); End-Use (Commercial, Industrial, Transportation).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Truck Transportation segment, which is expected to reach US$1.5 Billion by 2030 with a CAGR of a 4.1%. The Rail Transportation segment is also set to grow at 3.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $780.1 Million in 2024, and China, forecasted to grow at an impressive 7.2% CAGR to reach $729.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global LNG Virtual Pipelines Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global LNG Virtual Pipelines Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global LNG Virtual Pipelines Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ADB Global Sales, Blue Energy Motors, China FAW Group Corporation, China National Heavy Duty Truck Group Co., Ltd. (Sinotruk), Daimler Truck AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this LNG Virtual Pipelines market report include:

- Aggreko

- Air Products and Chemicals, Inc.

- Certarus Ltd

- Cheniere Energy

- Chevron Corporation

- CNG Services Limited

- Edge Energy

- Eni S.p.A.

- Equinor ASA

- ExxonMobil LNG

- FIBA Technologies, Inc.

- Galileo Technologies S.A.

- Gas Malaysia Virtual Pipeline Sdn. Bhd.

- Gas South

- Gáslink - Gás Natural, S.A.

- Hexagon Agility

- Indian Oil Corporation Limited

- INPEX Corporation

- Kinder Morgan

- Marlin Gas Services

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aggreko

- Air Products and Chemicals, Inc.

- Certarus Ltd

- Cheniere Energy

- Chevron Corporation

- CNG Services Limited

- Edge Energy

- Eni S.p.A.

- Equinor ASA

- ExxonMobil LNG

- FIBA Technologies, Inc.

- Galileo Technologies S.A.

- Gas Malaysia Virtual Pipeline Sdn. Bhd.

- Gas South

- Gáslink - Gás Natural, S.A.

- Hexagon Agility

- Indian Oil Corporation Limited

- INPEX Corporation

- Kinder Morgan

- Marlin Gas Services

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 272 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

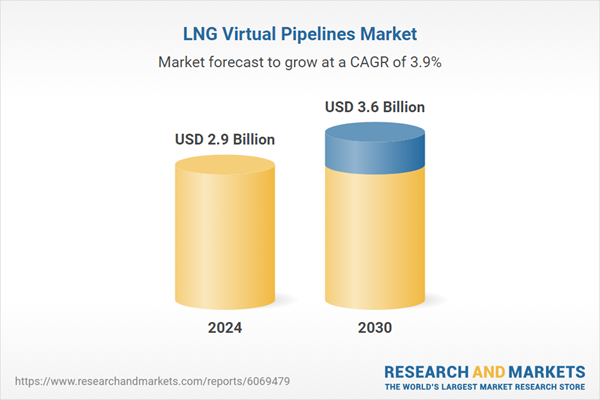

| Estimated Market Value ( USD | $ 2.9 Billion |

| Forecasted Market Value ( USD | $ 3.6 Billion |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |