Global Polypropylene Compounds Market - Key Trends & Drivers Summarized

What Are Polypropylene Compounds and Why Are They in High Demand?

Polypropylene (PP) compounds are advanced polymer materials formulated by blending polypropylene resin with various additives, fillers, reinforcements, and impact modifiers to enhance specific properties such as strength, heat resistance, flexibility, and durability. These compounds provide improved mechanical performance over standard polypropylene, making them suitable for demanding applications across industries such as automotive, packaging, electrical and electronics, construction, and consumer goods. Their ability to be customized for various functional requirements makes them one of the most widely used thermoplastics in industrial and commercial sectors.The primary advantage of polypropylene compounds lies in their lightweight nature, recyclability, and cost-effectiveness compared to alternative materials such as metals and engineering plastics. They exhibit excellent chemical resistance, low moisture absorption, and high impact strength, making them ideal for structural components, automotive interiors and exteriors, medical devices, and industrial equipment. With the increasing emphasis on sustainability and circular economy initiatives, PP compounds are also being developed with a higher content of recycled or bio-based materials to minimize environmental impact while maintaining high-performance characteristics.

How Are Technological Advancements Enhancing Polypropylene Compounds?

Innovations in polymer science and manufacturing processes have significantly enhanced the performance and versatility of polypropylene compounds, leading to broader industrial adoption. One of the key advancements is the development of high-impact polypropylene (HIPP) compounds, which are modified with elastomers to improve impact strength while maintaining excellent processability. These materials are widely used in automotive bumpers, dashboards, and appliance housings, where impact resistance and lightweight properties are essential for energy efficiency and safety.Another major innovation in polypropylene compounds is the introduction of glass fiber-reinforced PP for applications requiring higher mechanical strength and dimensional stability. These reinforced materials provide enhanced stiffness, heat resistance, and wear resistance, making them suitable for automotive under-the-hood components, electrical enclosures, and lightweight structural elements. In addition, nano-composite polypropylene compounds are being developed by incorporating nanofillers such as clay, graphene, and carbon nanotubes, further improving properties such as thermal stability, flame retardancy, and barrier performance for advanced engineering applications.

What Are the Key Market Trends Driving the Growth of Polypropylene Compounds?

The automotive industry's increasing focus on lightweight materials is one of the primary drivers of the polypropylene compounds market. With the global push toward fuel efficiency and the reduction of carbon emissions, automakers are replacing traditional metal components with lightweight polymer alternatives. Polypropylene compounds offer excellent impact resistance, cost efficiency, and recyclability, making them ideal for use in interior trims, bumpers, battery casings, and under-the-hood components. The rapid adoption of electric vehicles (EVs) is also driving demand for flame-retardant and heat-resistant PP compounds for battery housings, wiring enclosures, and charging infrastructure.Another key market trend is the growing use of polypropylene compounds in the packaging sector, particularly in food and beverage packaging, pharmaceutical containers, and flexible packaging films. The demand for sustainable, lightweight, and high-barrier materials is fueling innovation in PP compounds that offer better recyclability, bio-based content, and enhanced mechanical performance. Advances in clarified polypropylene and metallized PP films are enabling the development of high-performance packaging solutions that maintain product freshness, improve shelf-life, and reduce environmental impact.

What Are the Key Growth Drivers Behind the Polypropylene Compounds Market?

One of the key growth drivers for polypropylene compounds is the expansion of the construction and infrastructure sector, where durable and cost-effective materials are required for piping systems, insulation, roofing membranes, and structural components. PP compounds, particularly flame-retardant and UV-stabilized grades, are gaining popularity due to their ability to withstand harsh environmental conditions, temperature variations, and chemical exposure. The increasing adoption of modular construction techniques and prefabricated building solutions is further accelerating demand for PP-based materials that offer high strength-to-weight ratios and ease of processing.The electrical and electronics industry is another major driver of market growth, with PP compounds being widely used in wire and cable insulation, switch housings, circuit board enclosures, and LED lighting components. The increasing miniaturization of electronic devices and the need for thermally conductive and flame-resistant polymers are prompting manufacturers to develop specialty PP formulations that offer better heat dissipation, electrical insulation, and mechanical integrity. Additionally, the rising penetration of 5G technology and IoT devices is expanding the market for high-performance polypropylene compounds that meet stringent safety and durability requirements in electronic components and telecommunication infrastructure.

Report Scope

The report analyzes the Polypropylene Compounds market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (Mineral filled PP compounds, Compounded TPO, Compounded TPV, Glass fiber reinforced, Talc filled, Others); Application (Fiber, Film & sheet, Raffia, Others); End-Use (Automotive, Building & construction, Electrical & electronics, Textile, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Mineral-filled PP Compounds segment, which is expected to reach US$7.7 Billion by 2030 with a CAGR of a 5.2%. The Compounded TPO segment is also set to grow at 7.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $6.6 Billion in 2024, and China, forecasted to grow at an impressive 9.7% CAGR to reach $7.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Polypropylene Compounds Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Polypropylene Compounds Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Polypropylene Compounds Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Asahi Kasei Corporation, BASF SE, Celanese Corporation, Daicel Corporation, DuPont de Nemours, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Polypropylene Compounds market report include:

- Avient Corporation

- Borealis AG

- Borealis Compounds Inc.

- ExxonMobil Corporation

- GS Caltex Corporation

- IRPC Public Company Limited

- LG Chem

- LyondellBasell Industries N.V.

- Mitsui Chemicals, Inc.

- Peeco Polytech Private Limited

- Plastochem India

- Repsol S.A.

- RheTech, Inc.

- RTP Company

- SABIC (Saudi Basic Industries Corporation)

- Specialty Chemicals and Polymers

- Sumitomo Chemical Co., Ltd.

- TotalEnergies

- Trinseo S.A.

- Washington Penn

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Avient Corporation

- Borealis AG

- Borealis Compounds Inc.

- ExxonMobil Corporation

- GS Caltex Corporation

- IRPC Public Company Limited

- LG Chem

- LyondellBasell Industries N.V.

- Mitsui Chemicals, Inc.

- Peeco Polytech Private Limited

- Plastochem India

- Repsol S.A.

- RheTech, Inc.

- RTP Company

- SABIC (Saudi Basic Industries Corporation)

- Specialty Chemicals and Polymers

- Sumitomo Chemical Co., Ltd.

- TotalEnergies

- Trinseo S.A.

- Washington Penn

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 399 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

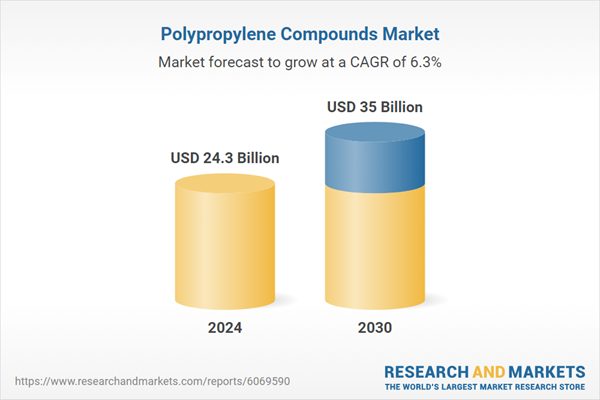

| Estimated Market Value ( USD | $ 24.3 Billion |

| Forecasted Market Value ( USD | $ 35 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |