Global PMS and Menstrual Health Supplements Market - Key Trends & Drivers Summarized

Why Is There a Growing Demand for PMS and Menstrual Health Supplements?

The demand for premenstrual syndrome (PMS) and menstrual health supplements has surged in recent years, driven by increased awareness of women's health and a proactive approach toward managing menstrual-related symptoms. PMS affects millions of individuals worldwide, with symptoms ranging from mood swings, bloating, and cramps to fatigue and migraines. While conventional treatments such as pain relievers and hormonal therapies are widely used, many consumers are turning to natural supplements as a safer and more holistic approach to menstrual wellness.The shift towards natural health solutions is a key factor fueling market growth. Women are increasingly prioritizing plant-based, hormone-free, and side-effect-free supplements that support hormonal balance and alleviate PMS symptoms. Key ingredients such as chasteberry, magnesium, evening primrose oil, vitamin B6, and adaptogenic herbs like ashwagandha and maca root have gained popularity for their ability to regulate estrogen and progesterone levels, reduce inflammation, and enhance overall well-being during the menstrual cycle. As consumer awareness of these ingredients increases, demand for targeted PMS and menstrual health supplements continues to rise.

How Are Innovations in Menstrual Health Supplements Shaping the Market?

The menstrual health supplement industry is experiencing rapid innovation, with brands focusing on scientifically backed formulations, functional blends, and personalized solutions. One of the biggest trends in this space is the rise of nutraceuticals - supplements that offer medicinal benefits beyond basic nutrition. Many companies are now incorporating clinically researched ingredients with proven efficacy in managing PMS symptoms, ensuring that their products provide tangible health benefits rather than just general wellness support.Another emerging trend is the integration of probiotics and gut health solutions in menstrual health supplements. Research has shown a strong link between gut microbiota and hormone regulation, leading to the development of supplements that combine probiotics with key nutrients to improve digestion, reduce bloating, and enhance hormone metabolism. Additionally, CBD-infused menstrual health supplements are gaining traction as an alternative remedy for cramps, inflammation, and mood imbalances, reflecting a broader acceptance of cannabis-derived wellness products.

Personalized nutrition is also transforming the market, with brands offering customized supplement regimens based on hormonal imbalances, cycle irregularities, and individual health needs. Subscription-based supplement services, at-home hormone testing kits, and AI-driven health tracking apps are making it easier for consumers to identify their specific deficiencies and optimize their menstrual health with tailored supplement plans. These advancements are not only improving efficacy but also enhancing consumer engagement and long-term adherence to supplementation.

Why Are Lifestyle and Dietary Changes Driving the Need for Menstrual Supplements?

Modern lifestyle factors, including stress, poor diet, and environmental pollutants, are significantly impacting menstrual health, leading to an increased reliance on supplements for hormonal balance and symptom relief. High levels of stress and cortisol imbalances contribute to worsened PMS symptoms, menstrual irregularities, and more painful periods. Adaptogenic herbs such as rhodiola, ashwagandha, and holy basil have gained popularity as natural solutions to mitigate stress-induced hormonal disruptions.Dietary deficiencies are another major contributor to menstrual health concerns. Many women experience insufficient intake of essential vitamins and minerals, such as magnesium, iron, omega-3 fatty acids, and vitamin D, which play a crucial role in regulating menstrual cycles and reducing PMS severity. The modern diet, which often lacks nutrient-dense whole foods, has led to a growing need for high-quality supplements that provide these critical nutrients in bioavailable forms. Functional food-based supplements, including menstrual-supportive teas, gummies, and fortified beverages, are gaining popularity as convenient alternatives to traditional pills and capsules.

Environmental toxins, including endocrine disruptors found in plastics, pesticides, and personal care products, are also linked to hormonal imbalances and menstrual health issues. This has prompted many consumers to seek detoxifying and hormone-balancing supplements, such as DIM (diindolylmethane) and calcium D-glucarate, which support liver detoxification and estrogen metabolism. The increasing awareness of these external factors is driving demand for supplements that help counteract their negative effects, positioning the PMS and menstrual health supplement market for continued growth.

What Factors Are Driving the Growth of the PMS and Menstrual Health Supplements Market?

The growth in the PMS and menstrual health supplements market is driven by several factors, including increasing consumer awareness, scientific advancements, and the growing preference for natural health solutions. One of the primary drivers is the rise of the women's health movement, which has encouraged open discussions around menstrual wellness and the importance of proactive health management. As stigma surrounding menstrual health diminishes, more consumers are actively seeking solutions to improve their cycles, leading to a surge in demand for specialized supplements.Another key factor is the expansion of the wellness industry and the shift toward preventive healthcare. Consumers are becoming more educated about the benefits of natural and functional ingredients in managing PMS and menstrual discomfort, leading to higher adoption rates for supplements with clinically proven efficacy. The popularity of holistic health approaches, including hormone-balancing diets, mindfulness practices, and cycle-syncing strategies, has further boosted interest in menstrual-supportive supplements.

The rise of e-commerce and direct-to-consumer (DTC) brands has also played a crucial role in market expansion. Many supplement companies now offer subscription models, personalized supplement plans, and digital health platforms to cater to the growing demand for convenient and tailored menstrual health solutions. Social media marketing and influencer endorsements have amplified brand visibility, making it easier for consumers to discover and invest in high-quality menstrual health products.

Additionally, increasing investments in research and development (R&D) are leading to more advanced formulations and scientifically backed products. Pharmaceutical companies, wellness brands, and biotech firms are collaborating to develop innovative menstrual health solutions, including time-released nutrient delivery systems and bioactive compounds that enhance absorption and efficacy. As research continues to uncover the connections between nutrition, hormones, and menstrual well-being, the PMS and menstrual health supplements market is expected to experience sustained growth, providing women with more effective and natural options for managing their cycles.

Report Scope

The report analyzes the PMS and Menstrual Health Supplements market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (Single Nutritional Supplements, Combined Nutritional Supplements); Consumer Group (Premenstrual Syndrome, Perimenopause); Formulation (Capsules / Tablets, Powder, Softgels, Others); Sales Channel (Online Channel, Direct Channel, Pharmacies / Drug Stores, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Single Nutritional Supplements segment, which is expected to reach US$17.9 Billion by 2030 with a CAGR of a 3%. The Combined Nutritional Supplements segment is also set to grow at 5.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $6.7 Billion in 2024, and China, forecasted to grow at an impressive 6.9% CAGR to reach $6.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global PMS and Menstrual Health Supplements Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global PMS and Menstrual Health Supplements Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global PMS and Menstrual Health Supplements Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this PMS and Menstrual Health Supplements market report include:

- AdvaCare Pharma

- Amway

- Archer Daniels Midland

- Bonafide

- Country Life

- CVS Health

- DM Pharma

- GlaxoSmithKline plc

- GNC Holdings, Inc.

- HealthBest

- Herbalife International of America, Inc.

- Nature's Bounty

- O Positiv

- Perelel

- Pharmavite LLC

- Power Gummies

- Rael

- RBK Nutraceuticals Pty Ltd.

- USANA Health Sciences, Inc.

- Vitafusion

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AdvaCare Pharma

- Amway

- Archer Daniels Midland

- Bonafide

- Country Life

- CVS Health

- DM Pharma

- GlaxoSmithKline plc

- GNC Holdings, Inc.

- HealthBest

- Herbalife International of America, Inc.

- Nature's Bounty

- O Positiv

- Perelel

- Pharmavite LLC

- Power Gummies

- Rael

- RBK Nutraceuticals Pty Ltd.

- USANA Health Sciences, Inc.

- Vitafusion

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 476 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

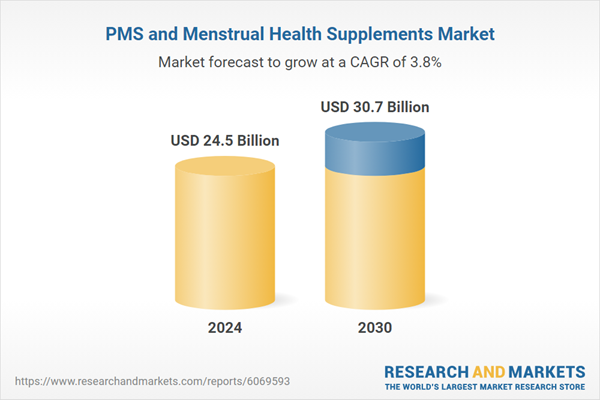

| Estimated Market Value ( USD | $ 24.5 Billion |

| Forecasted Market Value ( USD | $ 30.7 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |