Luxury Eyewear: Why Are Designer Frames the New Statement of Power and Personality?

Global Luxury Eyewear Market - Key Trends & Drivers Summarized

The global luxury eyewear market is experiencing robust growth, driven by a fusion of fashion, function, and lifestyle aspiration. Once a purely functional accessory, eyewear has evolved into a powerful symbol of personal identity and luxury status. With leading fashion houses such as Gucci, Prada, Chanel, Dior, and Cartier expanding their eyewear portfolios, luxury frames and sunglasses are now key elements of brand storytelling and seasonal fashion collections. The market encompasses prescription glasses, sunglasses, and optical lenses - all of which are being redefined through the lens of luxury and craftsmanship. A growing segment of affluent consumers view eyewear not only as a vision aid or sun protection tool but as a versatile fashion statement that aligns with their lifestyle, wardrobe, and brand allegiance.Fashion convergence has become a defining trend, as luxury eyewear moves in tandem with haute couture, streetwear, and seasonal runway collections. Limited-edition drops, celebrity endorsements, and high-profile collaborations between luxury brands and avant-garde designers have elevated eyewear into the realm of collectible fashion. Furthermore, personalization is on the rise, with customizable frames, lens tints, engravings, and even 3D printed designs offering consumers a chance to express individuality. The increasing importance of online channels - amplified by virtual try-on technologies and AR-powered eyewear fittings - is allowing brands to blend high-touch personalization with seamless digital convenience, reshaping how consumers engage with luxury eyewear from discovery to purchase.

How Is Technology Transforming the Luxury Eyewear Experience?

Technology is playing a pivotal role in reshaping the design, manufacturing, and retailing of luxury eyewear. Precision manufacturing methods such as CNC machining and laser-cutting have enabled the creation of intricate, lightweight frames using premium materials like titanium, carbon fiber, buffalo horn, and acetate blends. These materials not only enhance comfort and durability but also support sustainable production processes - an increasing priority in the luxury consumer space. Lens innovation has also accelerated, with high-definition optics, anti-glare coatings, blue light filters, and photochromic transitions now common features in luxury offerings.Smart eyewear is another fast-emerging frontier, with tech-luxury collaborations giving rise to intelligent glasses that integrate audio, AR, and fitness tracking features. Brands such as Ray-Ban (with Meta), Gentle Monster (with Huawei), and EssilorLuxottica are pioneering the fusion of wearable tech and high fashion. These developments are expanding the functionality of luxury eyewear while maintaining a sleek, non-intrusive aesthetic. Additionally, supply chain digitalization and AI-driven customization tools are helping brands reduce lead times and offer bespoke experiences. Virtual try-ons, face-shape scanning, and AI-based fitting suggestions have become integral to the omnichannel retail model, making the high-touch world of luxury accessible via smartphones and tablets.

Which Regions and Consumers Are Driving Market Demand - And Why?

While North America and Western Europe remain the traditional powerhouses of luxury eyewear consumption, the Asia-Pacific region - particularly China, Japan, and South Korea - is becoming a formidable growth engine. In China, rising disposable incomes, aspirational middle-class consumers, and strong brand consciousness are propelling the demand for high-end designer frames and sunglasses. South Korea, a global trendsetter in beauty and fashion, is fostering demand through celebrity-driven influence and a strong domestic taste for luxury accessories. Meanwhile, markets like India, Southeast Asia, and Latin America are emerging as lucrative territories due to the expansion of urban elites and increasing penetration of global fashion trends through digital platforms.Millennials and Gen Z consumers are particularly influential in reshaping demand patterns. Their affinity for limited editions, sustainable luxury, and socially visible purchases makes eyewear an ideal product category - highly visible, style-defining, and frequently updated. The rising popularity of prescription fashion eyewear, particularly in urban centers, is also adding a functional edge to what is otherwise a fashion-first product. Retail formats are evolving accordingly, with luxury eyewear boutiques offering immersive, experiential shopping environments that blend fashion, optometry, and design. Pop-up installations, co-branded stores, and curated digital showrooms are becoming effective channels to attract style-conscious, tech-literate audiences.

The Growth in the Luxury Eyewear Market Is Driven by Several Factors…

The growth in the luxury eyewear market is driven by several factors tied to design innovation, consumer behavior shifts, end-use evolution, and technological integration. A primary driver is the fashionization of eyewear, where frames and lenses are treated as key fashion accessories and status symbols. This has created recurring consumer demand across both prescription and non-prescription categories, increasing purchase frequency among fashion-forward individuals. Furthermore, advancements in frame materials - such as hypoallergenic titanium, biodegradable acetate, and 3D-printed bio-based plastics - are catering to the rising eco-consciousness of high-end consumers.End-use expansion is another critical growth driver, with eyewear increasingly used for digital eye protection, UV shielding, and fitness tracking in addition to vision correction. The fusion of wearable tech with designer aesthetics has resulted in high-margin smart eyewear that appeals to tech enthusiasts and early adopters. The luxury segment is also benefiting from optical health awareness, especially among younger demographics spending prolonged hours on digital devices. On the retail front, omnichannel innovations - including AI-guided fittings, virtual mirror tools, and curated subscription models - are enhancing customer acquisition and retention. Finally, the global rise in myopia, particularly among younger populations in Asia, is expected to sustain long-term demand for prescription luxury eyewear - blending health needs with aspirational design in a growing market.

Report Scope

The report analyzes the Luxury Eyewear market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Luxury Eyewear Eyeglasses, Luxury Eyewear Sunglasses); Shape (Round Shape, Oval Shape, Square Shape, Other Shapes); Frame Size (Small Frame Size, Medium Frame Size, Large Frame Size); End-User (Men End-User, Women End-User, Kids End-User); Distribution Channel (Online Distribution Channel, Offline Distribution Channel).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Luxury Eyeglasses segment, which is expected to reach US$19.1 Billion by 2030 with a CAGR of a 1.7%. The Luxury Sunglasses segment is also set to grow at 3.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $6.7 Billion in 2024, and China, forecasted to grow at an impressive 4.3% CAGR to reach $5.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Luxury Eyewear Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Luxury Eyewear Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Luxury Eyewear Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Acura (Honda Motor Co.), Aston Martin Lagonda, Audi AG, Bentley Motors Limited, BMW Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Luxury Eyewear market report include:

- Burberry Group plc

- Bvlgari (LVMH Group)

- Cartier (Richemont Group)

- Chanel S.A.

- De Rigo Vision S.p.A.

- Dior (LVMH Group)

- EssilorLuxottica

- Gucci (Kering Group)

- Kering Eyewear

- Luxottica Group S.p.A.

- Marchon Eyewear, Inc.

- Marcolin S.p.A.

- Maui Jim, Inc.

- Oakley, Inc.

- Oliver Peoples

- Persol

- Prada S.p.A.

- Ray-Ban

- Safilo Group S.p.A.

- Tom Ford (Estée Lauder Companies)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Burberry Group plc

- Bvlgari (LVMH Group)

- Cartier (Richemont Group)

- Chanel S.A.

- De Rigo Vision S.p.A.

- Dior (LVMH Group)

- EssilorLuxottica

- Gucci (Kering Group)

- Kering Eyewear

- Luxottica Group S.p.A.

- Marchon Eyewear, Inc.

- Marcolin S.p.A.

- Maui Jim, Inc.

- Oakley, Inc.

- Oliver Peoples

- Persol

- Prada S.p.A.

- Ray-Ban

- Safilo Group S.p.A.

- Tom Ford (Estée Lauder Companies)

Table Information

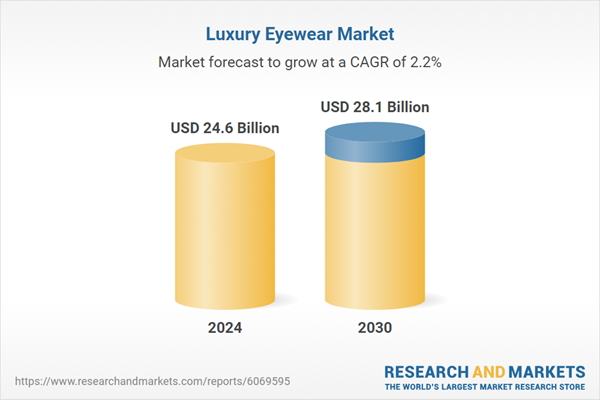

| Report Attribute | Details |

|---|---|

| No. of Pages | 554 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 24.6 Billion |

| Forecasted Market Value ( USD | $ 28.1 Billion |

| Compound Annual Growth Rate | 2.2% |

| Regions Covered | Global |