Global GaN Substrate Market - Key Trends & Drivers Summarized

Why Are GaN Substrates Becoming Essential in High-Performance Electronics?

Gallium Nitride (GaN) substrates have emerged as a critical component in high-performance electronics, enabling superior efficiency, power handling, and thermal management compared to traditional silicon and sapphire-based substrates. GaN substrates serve as the foundational material for advanced semiconductors used in high-frequency, high-power, and optoelectronic applications. Unlike conventional materials, GaN offers a wide-bandgap structure, allowing devices to operate at higher voltages, faster switching speeds, and elevated temperatures without compromising performance. These attributes have positioned GaN substrates as a game-changing technology in sectors such as radio frequency (RF) communications, power electronics, laser diodes, and next-generation display technology.One of the most significant advantages of GaN substrates is their ability to enable highly efficient power semiconductor devices, making them ideal for electric vehicles (EVs), renewable energy systems, and high-speed data transmission networks. With the increasing global push for energy-efficient power conversion systems, GaN-based transistors and diodes are replacing traditional silicon-based components in applications such as power adapters, grid infrastructure, and 5G base stations. Additionally, GaN substrates are playing a crucial role in the development of high-brightness LEDs, micro-LED displays, and deep ultraviolet (DUV) lasers used in industrial and medical applications. As demand for miniaturized, high-efficiency electronics continues to rise, GaN substrates are becoming the backbone of modern semiconductor manufacturing.

How Are Advancements in GaN Substrate Manufacturing Improving Performance and Cost Efficiency?

Technological advancements in GaN substrate production have significantly improved material quality, scalability, and cost-effectiveness, making it more viable for mass-market applications. Traditionally, GaN was primarily grown on foreign substrates such as silicon (GaN-on-Si), sapphire (GaN-on-Sapphire), or silicon carbide (GaN-on-SiC). However, these methods introduced material mismatches that led to lattice defects, affecting device performance and reliability. The development of bulk GaN substrates, which utilize native GaN crystal growth, has addressed these limitations by providing defect-free, high-purity materials that enhance electron mobility and thermal conductivity.One of the most promising innovations in GaN substrate manufacturing is Hydride Vapor Phase Epitaxy (HVPE), a technique that enables high-quality GaN wafer production with fewer dislocations and improved structural integrity. Additionally, advancements in ammonothermal growth and Metal-Organic Chemical Vapor Deposition (MOCVD) have further optimized GaN crystal synthesis, reducing production costs and increasing wafer sizes. The shift toward larger-diameter GaN substrates, such as 6-inch and 8-inch wafers, has been a significant breakthrough in reducing cost per device while improving scalability for high-volume semiconductor fabrication. With continuous improvements in deposition techniques and wafer processing, GaN substrates are becoming more accessible to industries seeking next-generation semiconductor materials.

Which Industries and Applications Are Driving the Demand for GaN Substrates?

The telecommunications and RF electronics sectors are among the largest adopters of GaN substrates, leveraging their high electron mobility and low power losses for high-frequency applications. GaN-based RF amplifiers and transistors are widely used in satellite communications, radar systems, and 5G infrastructure, where high-speed signal transmission and thermal stability are critical. The expansion of 5G networks and the increasing deployment of millimeter-wave (mmWave) technology have significantly accelerated the demand for GaN substrates in RF power devices. Additionally, the aerospace and defense industries are utilizing GaN-based components for advanced electronic warfare systems, high-power radar, and next-generation avionics.The power electronics industry is another key driver of GaN substrate adoption, particularly in electric vehicles, fast-charging power supplies, and renewable energy inverters. GaN-based power transistors and diodes offer higher efficiency and power density compared to silicon-based alternatives, reducing energy losses and enabling more compact designs. Additionally, GaN substrates are gaining traction in the optoelectronics industry, supporting the development of high-brightness LEDs, laser diodes, and micro-LED displays used in augmented reality (AR) and virtual reality (VR) devices. The growing demand for high-resolution, energy-efficient display technology is further boosting the need for high-quality GaN substrates in consumer electronics and automotive lighting applications.

What Key Factors Are Driving Market Growth?

The growth in the GaN substrate market is driven by several factors, including advancements in semiconductor fabrication technology, increasing demand for high-power and high-frequency electronics, and the expansion of 5G and EV infrastructure. The ongoing transition from silicon-based semiconductors to wide-bandgap materials such as GaN has accelerated innovation in RF communications, power conversion, and optoelectronics, creating new opportunities for GaN substrate suppliers. Additionally, the push for higher energy efficiency and miniaturization in consumer electronics has fueled investment in GaN-based components, driving market expansion.The increasing adoption of GaN substrates in electric vehicles and renewable energy systems is another critical growth driver, as automakers and energy companies seek more efficient power management solutions. The development of cost-effective, large-diameter GaN wafers has further strengthened market accessibility, allowing semiconductor manufacturers to scale production and reduce overall device costs. Furthermore, government initiatives promoting energy-efficient technologies and the shift toward sustainable power solutions have accelerated GaN adoption across multiple industries. As semiconductor research continues to push the boundaries of material science and device performance, the GaN substrate market is expected to experience sustained growth, solidifying its role in the next generation of advanced electronic systems.

Report Scope

The report analyzes the GaN Substrate market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Product (GaN-on-SiC Substrates, GaN-on-Si, Substrates, GaN-on-Sapphire Substrates, Bulk GaN Substrates, Other GaN Substrates); Wafer Size (2-inch Wafers, 4-inch Wafers, 6-inch Wafers, 8-inch Wafers & Above); Application (LEDs Application, Power Electronics Application, Radio Frequency Devices Application, Laser Diodes Application, Photodetectors Application, MEMS Application, Solar Cells Application, Sensors Application); End-Use (Consumer Electronics End-Use, Telecommunications End-Use, Automotive End-Use, Aerospace & Defense End-Use, Healthcare End-Use, Industrial End-Use, Energy & Power End-Use, Data Center End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the GaN-on-SiC Substrates segment, which is expected to reach US$97.9 Million by 2030 with a CAGR of a 6.9%. The GaN-on-Si segment is also set to grow at 6.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $70.2 Million in 2024, and China, forecasted to grow at an impressive 12.1% CAGR to reach $85.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global GaN Substrate Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global GaN Substrate Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global GaN Substrate Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Bridgelux, Inc., Changelight Co., Ltd., Cree, Inc., Dominant Opto Technologies, Epistar Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this GaN Substrate market report include:

- Ammono S.A.

- EpiGaN nv

- GaN Systems Inc.

- Infineon Technologies AG

- Innoscience Technology

- IQE plc

- IQE plc

- Kyma Technologies, Inc.

- Kyocera Corporation

- Mitsubishi Chemical Corporation

- NGK Insulators, Ltd.

- Nichia Corporation

- Plessey Semiconductors Ltd.

- Qorvo, Inc.

- Shin-Etsu Chemical Co., Ltd.

- Soitec

- Sumitomo Chemical Co., Ltd.

- Sumitomo Electric Industries, Ltd.

- Top GaN sp. z o.o.

- Xiamen Powerway Advanced Material Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ammono S.A.

- EpiGaN nv

- GaN Systems Inc.

- Infineon Technologies AG

- Innoscience Technology

- IQE plc

- IQE plc

- Kyma Technologies, Inc.

- Kyocera Corporation

- Mitsubishi Chemical Corporation

- NGK Insulators, Ltd.

- Nichia Corporation

- Plessey Semiconductors Ltd.

- Qorvo, Inc.

- Shin-Etsu Chemical Co., Ltd.

- Soitec

- Sumitomo Chemical Co., Ltd.

- Sumitomo Electric Industries, Ltd.

- Top GaN sp. z o.o.

- Xiamen Powerway Advanced Material Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 517 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

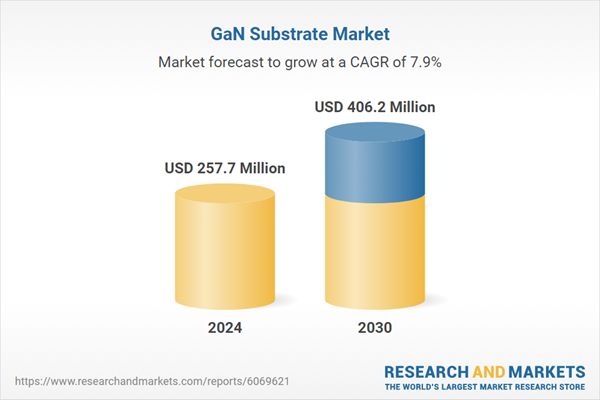

| Estimated Market Value ( USD | $ 257.7 Million |

| Forecasted Market Value ( USD | $ 406.2 Million |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |