Global Gas Analyzer Systems Market - Key Trends & Drivers Summarized

How Are Gas Analyzer Systems Transforming Industrial Safety and Efficiency?

Gas analyzer systems have become an integral part of industrial operations, playing a crucial role in safety, regulatory compliance, and process optimization. These systems are designed to detect, monitor, and quantify gases within industrial environments, ensuring that harmful emissions, leaks, or fluctuations in gas composition do not pose risks to operations or personnel. Various industries rely on gas analyzers, including oil and gas, petrochemicals, power generation, food and beverage, pharmaceuticals, and environmental monitoring. Different detection technologies such as infrared (IR) spectroscopy, paramagnetic analysis, electrochemical sensors, and gas chromatography allow for precise measurement of gases, each with its own advantages depending on the application. Infrared sensors are particularly effective in measuring hydrocarbons and greenhouse gases, while electrochemical sensors are widely used for detecting oxygen and toxic gases in confined workspaces. These technologies help industries enhance safety measures, minimize environmental impact, and improve energy efficiency by ensuring optimal gas compositions during production processes.The increasing stringency of government regulations regarding industrial emissions and workplace safety has led to the widespread adoption of gas analyzers. Regulatory bodies such as the Environmental Protection Agency (EPA), the Occupational Safety and Health Administration (OSHA), and the European Environment Agency (EEA) enforce strict guidelines on air quality and emissions. Non-compliance can result in heavy penalties and operational shutdowns, prompting industries to invest in sophisticated gas analysis systems. Furthermore, industries that operate in hazardous environments, such as chemical plants and oil refineries, utilize gas analyzers to detect leaks and ensure safe working conditions. Advances in sensor miniaturization and wireless connectivity have also contributed to the growth of portable gas analyzers, allowing real-time monitoring in remote or confined locations. These portable units are essential in emergency response scenarios, enabling rapid detection of hazardous gas levels before they reach critical thresholds. As industrial processes become increasingly complex, the demand for gas analyzers with higher accuracy, automation, and remote monitoring capabilities is expected to grow significantly.

Which Industries Are Driving the Demand for Advanced Gas Analyzer Systems?

The demand for gas analyzers varies across industries, each with unique requirements for monitoring gas compositions and emissions. In the oil and gas sector, these systems are indispensable for leak detection, hydrocarbon analysis, and combustion efficiency optimization. Refineries and offshore drilling platforms utilize high-precision gas analyzers to monitor volatile organic compounds (VOCs) and ensure compliance with environmental regulations. Similarly, the power generation industry depends on gas analyzers to optimize fuel combustion and reduce the emission of pollutants such as carbon monoxide (CO), sulfur dioxide (SO2), and nitrogen oxides (NOx). Coal-fired and natural gas power plants deploy flue gas analyzers to monitor exhaust emissions and enhance energy efficiency through combustion control. With the global transition towards cleaner energy sources, hydrogen production facilities are also increasing their reliance on gas analyzers to ensure purity levels in fuel cells and energy storage applications.The pharmaceutical and food industries also represent significant market drivers for gas analyzer systems. In pharmaceutical manufacturing, maintaining controlled environments is crucial for drug stability, vaccine production, and sterile processing. Gas analyzers are employed to monitor oxygen, carbon dioxide, and humidity levels in storage and production facilities. The food industry utilizes gas analyzers to ensure product quality and extend shelf life through Modified Atmosphere Packaging (MAP), where precise gas composition is necessary to preserve freshness. Additionally, environmental monitoring agencies are witnessing a growing need for air quality assessment tools, especially in urban areas where industrial emissions contribute to pollution. Continuous Emission Monitoring Systems (CEMS) are being widely implemented to track pollutants and enforce stricter air quality standards. As industrial activities expand globally, the necessity for reliable, real-time gas analysis solutions is becoming more pronounced across various sectors, further accelerating market growth.

What Are the Cutting-Edge Innovations Reshaping Gas Analysis Technology?

Technological advancements are significantly enhancing the precision, functionality, and efficiency of gas analyzer systems. One of the most transformative innovations is the integration of the Internet of Things (IoT) and cloud-based analytics, which enable real-time monitoring, predictive maintenance, and remote diagnostics. IoT-connected gas analyzers can transmit continuous data streams to centralized control centers, allowing industries to detect gas leaks and fluctuations before they escalate into hazardous situations. Artificial intelligence (AI) is also playing a pivotal role in optimizing gas analysis by identifying trends and anomalies in gas concentration data, leading to more accurate predictive maintenance strategies. This level of automation is crucial for industries aiming to reduce downtime, minimize operational risks, and improve energy efficiency.Laser-based detection technologies, such as Tunable Diode Laser Spectroscopy (TDLS) and Quantum Cascade Lasers (QCL), are revolutionizing gas analysis by offering highly selective and interference-free measurements. These technologies are particularly effective in detecting trace gas concentrations in industrial emissions and cleanroom environments. Additionally, advancements in electrochemical sensors have led to the development of compact, high-sensitivity gas analyzers that can operate in extreme conditions. Another emerging trend is the shift toward non-contact and optical gas analysis methods, which eliminate the need for sample extraction and reduce maintenance costs. Portable gas analyzers have also seen significant improvements in accuracy, durability, and battery life, making them invaluable for field applications such as emergency response, environmental monitoring, and industrial inspections. As industries strive for sustainability and stricter emission controls, gas analyzers equipped with advanced sensors, AI-driven analytics, and IoT connectivity will play an increasingly vital role in ensuring compliance, efficiency, and safety.

What Are the Key Factors Driving the Growth of the Gas Analyzer Systems Market?

The growth in the gas analyzer systems market is driven by several factors, including the increasing implementation of stringent environmental regulations, the expansion of industrial automation, and the growing need for real-time monitoring in critical applications. As governments worldwide enforce stricter emissions policies, industries are compelled to invest in gas analyzers to ensure compliance and avoid penalties. This is particularly evident in the power generation, oil and gas, and manufacturing sectors, where continuous emission monitoring is mandatory. The transition toward clean energy sources, including hydrogen and natural gas, is also accelerating the demand for specialized gas analyzers capable of monitoring fuel purity and combustion efficiency. Furthermore, rapid industrialization in emerging economies, particularly in Asia-Pacific and Latin America, is contributing to increased adoption of gas analysis technologies across multiple industries.Technological advancements such as AI-driven predictive maintenance, IoT-enabled gas monitoring, and miniaturized sensors are also fueling market expansion. Smart manufacturing and Industry 4.0 are reshaping the industrial landscape, requiring gas analyzers that can integrate seamlessly with automated systems for enhanced process control. In the pharmaceutical and food industries, the need for precise gas composition monitoring in production and packaging processes is further driving demand. Additionally, the growing emphasis on workplace safety and environmental monitoring is encouraging investments in portable and wireless gas analyzers for field applications. The expansion of research and development in laser-based and non-contact gas detection methods is expected to create new opportunities for market growth. As industries prioritize sustainability, efficiency, and regulatory compliance, the gas analyzer systems market is poised for significant advancements, offering cutting-edge solutions for real-time gas measurement and analysis.

Report Scope

The report analyzes the Gas Analyzer Systems market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (Electrochemical Technology, Paramagnetic Technology, Zirconia Technology, Non-Dispersive IR Technology, Other Technologies); End-Use (Oil & Gas End-Use, Chemical & Petrochemical End-Use, Healthcare End-Use, Research End-Use, Water & Wastewater End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Electrochemical Technology segment, which is expected to reach US$1.4 Billion by 2030 with a CAGR of a 3.3%. The Paramagnetic Technology segment is also set to grow at 4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $810.2 Million in 2024, and China, forecasted to grow at an impressive 6.8% CAGR to reach $741.0 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Gas Analyzer Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Gas Analyzer Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Gas Analyzer Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as All American (Wisconsin Aluminum Foundry), Breville Group Limited, Butterfly Gandhimathi Appliances Ltd., Cuisinart (Conair Corporation), Fissler GmbH and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Gas Analyzer Systems market report include:

- ABB Ltd.

- Agilent Technologies, Inc.

- Anton Paar GmbH

- APIX Analytics

- BACS

- Endress+Hauser Group

- ENVEA

- ESEGas

- Hiden Analytical Ltd.

- Interscan Corporation

- Mettler-Toledo International Inc.

- MIRO Analytical Technologies

- Nikira Lab Inc.

- RAE Systems (by Honeywell)

- Servomex Group Limited

- Siemens AG

- Sporian Microsystems Inc.

- Teledyne Analytical Instruments

- Thermo Fisher Scientific Inc.

- Virginia Diodes, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd.

- Agilent Technologies, Inc.

- Anton Paar GmbH

- APIX Analytics

- BACS

- Endress+Hauser Group

- ENVEA

- ESEGas

- Hiden Analytical Ltd.

- Interscan Corporation

- Mettler-Toledo International Inc.

- MIRO Analytical Technologies

- Nikira Lab Inc.

- RAE Systems (by Honeywell)

- Servomex Group Limited

- Siemens AG

- Sporian Microsystems Inc.

- Teledyne Analytical Instruments

- Thermo Fisher Scientific Inc.

- Virginia Diodes, Inc.

Table Information

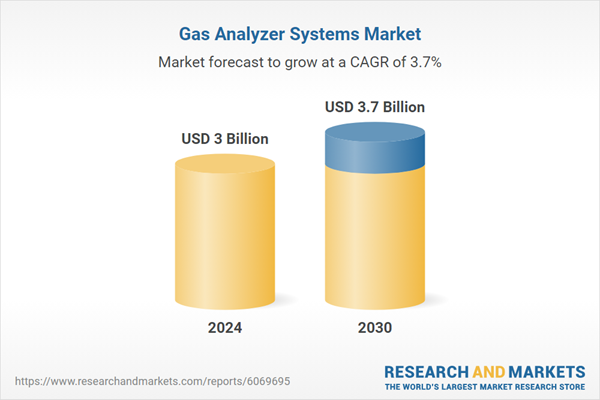

| Report Attribute | Details |

|---|---|

| No. of Pages | 288 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3 Billion |

| Forecasted Market Value ( USD | $ 3.7 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |