Global Plant Factory Market - Key Trends and Drivers Summarized

Why Are Plant Factories Positioned to Revolutionize Modern Agriculture?

Plant factories, also known as vertical farms or indoor farms, are poised to transform modern agriculture by offering a sustainable and efficient alternative to traditional farming methods. Plant factories are highly controlled indoor environments where crops are grown using artificial lighting, precise climate controls, and hydroponic or aeroponic systems. Unlike traditional agriculture, which is heavily dependent on weather, soil quality, and seasonal changes, plant factories eliminate these variables, allowing for year-round production in a compact, indoor setting. This approach not only maximizes crop yield per square meter but also uses significantly less water and eliminates the need for pesticides, making it an eco-friendly solution to the growing global demand for fresh produce. Plant factories are typically located in urban areas, reducing transportation costs and ensuring a steady supply of fresh vegetables and herbs to local markets. This proximity to consumers also allows plant factories to cater to the rising demand for locally grown, pesticide-free food. As population growth and urbanization continue to exert pressure on arable land and water resources, plant factories are emerging as a viable solution to produce high-quality, nutritious food with minimal environmental impact.What Are the Key Trends Shaping the Future of Plant Factories?

The plant factory market is rapidly evolving, driven by technological advancements, shifts in consumer preferences, and a growing focus on sustainability. One of the most notable trends is the increasing adoption of advanced LED lighting systems. These LED technologies allow for the fine-tuning of light spectra to optimize photosynthesis, enhancing crop growth, nutrient content, and even flavor profiles. As LED costs continue to decrease, more plant factories are integrating these systems to improve productivity and energy efficiency. Another significant trend is the rise of data-driven farming, where artificial intelligence (AI), machine learning, and Internet of Things (IoT) technologies are used to monitor and optimize every aspect of the growing environment. Sensors track parameters such as humidity, temperature, and nutrient levels in real-time, while AI algorithms analyze this data to adjust lighting, irrigation, and airflow for optimal plant growth. This precision agriculture approach is reducing resource use and enabling growers to achieve consistent yields with minimal human intervention. There is also a growing trend towards modular plant factory designs that can be scaled up or down to fit various spaces, from small urban buildings to large warehouses. These modular setups offer flexibility and make it easier for new entrants to adopt the technology. Additionally, the expansion of plant factories beyond leafy greens into high-value crops like strawberries, tomatoes, and medicinal plants is broadening their market potential. As plant factories diversify their crop offerings, they are becoming a key player in the broader agricultural landscape, supporting both food security and the production of specialized crops.How Are Technological Innovations Enhancing Plant Factory Efficiency?

Technological advancements are at the heart of the plant factory revolution, significantly improving their efficiency, scalability, and cost-effectiveness. One of the most impactful innovations is the use of automated systems for seeding, transplanting, and harvesting. Robotic arms and automated conveyor systems reduce labor costs and increase throughput, making it feasible to produce large quantities of crops with minimal human intervention. Additionally, innovations in sensor technology and real-time monitoring are enhancing the ability of plant factories to maintain ideal growing conditions around the clock. For example, sensors embedded in hydroponic systems measure pH and nutrient levels continuously, allowing for precise adjustments that optimize plant health and yield. AI-powered climate control systems are also playing a crucial role by predicting plant growth patterns and adjusting environmental parameters such as temperature, light intensity, and CO2 concentration to maximize photosynthesis and minimize energy use. The integration of vertical stacking systems is another breakthrough that is enabling plant factories to maximize space utilization, significantly increasing production capacity per square meter. Moreover, advancements in sustainable energy solutions, such as the use of solar panels and energy-efficient HVAC systems, are reducing the carbon footprint of these facilities, making plant factories more environmentally viable. Water recycling technologies designed capture and purify excess water are also contributing to improved resource efficiency. These innovations are not only making plant factories more productive but are also helping to overcome some of the major challenges related to high operational costs and resource consumption, thereby paving the way for wider adoption and scalability.What Factors Are Driving the Growth of the Plant Factory Market?

The growth in the plant factory market is driven by several factors, primarily influenced by advancements in technology, rising demand for sustainable food production, and changing consumer preferences. One of the main drivers is the increasing global population and the resulting pressure on traditional agriculture to meet the growing food demand. As arable land becomes scarcer and climate change disrupts conventional farming, plant factories offer a controlled environment that can produce food consistently regardless of external weather conditions. Another key factor is the rapid urbanization across the world, which is leading to the development of plant factories in and around cities to supply fresh produce to local markets. The proximity to urban consumers reduces transportation costs and carbon emissions, making it an attractive option for sustainable food distribution. Additionally, the growing demand for pesticide-free, non-GMO, and locally sourced food is driving the adoption of plant factories, as they can produce high-quality, chemical-free crops that cater to these preferences. Technological advancements in LED lighting, automated systems, and AI-driven monitoring are further supporting market growth by improving efficiency and reducing costs, making plant factories more economically viable. The rising investments from both private and public sectors in the development of vertical farming technologies are also fueling market expansion. Moreover, the flexibility of plant factories to grow a variety of crops - including leafy greens, herbs, berries, and even pharmaceutical plants - is broadening their application scope, attracting new entrants and investors. These factors, combined with a growing awareness of the environmental and social benefits of sustainable farming, are propelling the plant factory market forward, positioning it as a key innovation in the future of global food production.Report Scope

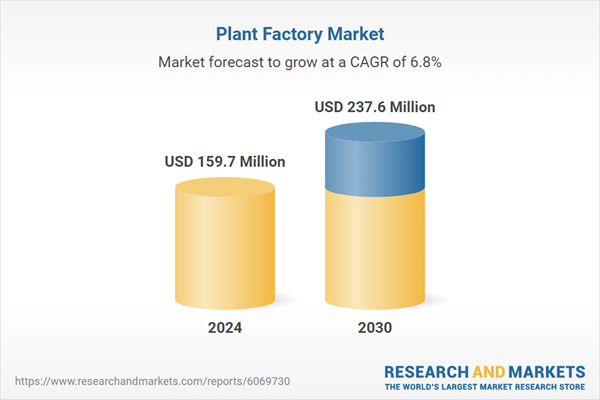

The report analyzes the Plant Factory market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Growing System (Soil-based Systems, Non Soil-based Systems, Hybrid Systems); Facility Type (Greenhouse Facilities, Indoor Farm Facilities, Other Facility Types); Crop Type (Vegetable Crops, Fruit Crops, Flowers & Ornamental Crops, Other Crop Types).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Brazil; Mexico; Rest of Latin America; Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Other Crop Types segment, which is expected to reach US$12 Million by 2030 with a CAGR of 5.8%. The Vegetable Crops segment is also set to grow at 7.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $44.2 Million in 2024, and China, forecasted to grow at an impressive 7.9% CAGR to reach $20.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Plant Factory Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Plant Factory Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Plant Factory Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AeroFarms, AppHarvest, Inc., Badia Farms, Bowery Farming, Inc., BrightFarms and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 66 companies featured in this Plant Factory market report include:

- AeroFarms

- AppHarvest, Inc.

- Badia Farms

- Bowery Farming, Inc.

- BrightFarms

- Dream Harvest: Sustainable Indoor Farming

- Farm.One, Inc.

- FARMINOVA Plant Factory

- Gotham Greens

- MIRAI Co., Ltd.

- Oishii

- Plenty Unlimited Inc.

- Sky Greens

- Taikisha Ltd.

- Vertical Harvest Farms

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AeroFarms

- AppHarvest, Inc.

- Badia Farms

- Bowery Farming, Inc.

- BrightFarms

- Dream Harvest: Sustainable Indoor Farming

- Farm.One, Inc.

- FARMINOVA Plant Factory

- Gotham Greens

- MIRAI Co., Ltd.

- Oishii

- Plenty Unlimited Inc.

- Sky Greens

- Taikisha Ltd.

- Vertical Harvest Farms

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 357 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 159.7 Million |

| Forecasted Market Value ( USD | $ 237.6 Million |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |