Global Gamma Butyrolactone (GBL) Market - Key Trends & Drivers Summarized

Why is Gamma Butyrolactone (GBL) a Critical Industrial Chemical?

Gamma Butyrolactone (GBL) is a versatile organic compound widely used in industrial applications, including solvent production, pharmaceuticals, agrochemicals, and specialty coatings. As a colorless, water-miscible liquid with strong solvency properties, GBL serves as a key intermediate in the synthesis of various chemicals, including pyrrolidones and polymers. Due to its high solvency power, it is extensively utilized in cleaning products, paint removers, and electronic component manufacturing. The increasing demand for high-performance solvents in industrial and pharmaceutical sectors has positioned GBL as a crucial chemical in global supply chains.Beyond its role as a solvent, GBL plays a significant part in the pharmaceutical and agrochemical industries. It serves as a precursor in the production of N-methyl-2-pyrrolidone (NMP) and 2-pyrrolidone, which are widely used in drug formulation, crop protection chemicals, and bio-based polymers. Additionally, GBL is gaining traction in lithium-ion battery production, where it is used in electrolyte solutions to improve battery efficiency and lifespan. With the growing demand for electric vehicles (EVs) and high-performance industrial coatings, the market for GBL is witnessing substantial growth across multiple sectors.

How Are Technological Innovations Improving the Production and Applications of GBL?

Advancements in chemical processing and green synthesis methods have significantly enhanced the efficiency and sustainability of GBL production. Traditionally, GBL is synthesized via dehydrogenation of 1,4-butanediol (BDO) or through catalytic oxidation of tetrahydrofuran (THF). However, recent innovations in bio-based synthesis pathways have enabled the production of GBL from renewable feedstocks, reducing environmental impact and reliance on petrochemical-derived raw materials.The adoption of continuous flow chemistry and catalytic process optimization has also improved the scalability and cost-effectiveness of GBL manufacturing. Additionally, researchers are developing high-purity GBL formulations with enhanced stability for pharmaceutical and electronic applications. In the coatings industry, advanced GBL-based formulations are being used to develop high-performance surface treatments with improved adhesion, durability, and environmental resistance. These technological advancements are expanding the scope of GBL applications, driving further market adoption in emerging industries.

Which Industrial Sectors and Applications Are Driving Demand for GBL?

The pharmaceutical and chemical industries are the primary consumers of GBL, utilizing it as a precursor in the synthesis of active pharmaceutical ingredients (APIs), industrial solvents, and specialty polymers. The rapid expansion of drug development and agrochemical research has fueled the demand for high-purity GBL in laboratory and production environments. Additionally, the electronics industry is leveraging GBL-based solvents for semiconductor cleaning, printed circuit board (PCB) manufacturing, and advanced materials processing.The coatings and adhesives sector is another key market for GBL, where it is used as a key ingredient in high-performance coatings, industrial paint removers, and anti-corrosion treatments. The increasing adoption of GBL in lithium-ion battery electrolytes has further driven demand, particularly as the global shift toward renewable energy and electric mobility gains momentum. Furthermore, the rise of bio-based polymer research is creating new opportunities for GBL in sustainable packaging and biodegradable materials development. With diverse applications across industrial, pharmaceutical, and electronic sectors, GBL remains an essential component in modern chemical manufacturing.

What Key Factors Are Driving Market Growth?

The growth in the gamma butyrolactone (GBL) market is driven by several factors, including increasing demand for high-performance industrial solvents, advancements in bio-based chemical synthesis, and expanding applications in pharmaceuticals and battery technology. The rise of electric vehicles and energy storage solutions has fueled the need for high-purity GBL in lithium-ion battery electrolytes, contributing to market expansion. Additionally, the growing emphasis on sustainable chemical manufacturing has encouraged the development of eco-friendly GBL production methods, reducing environmental impact while maintaining high performance.Regulatory changes and stringent safety standards have also influenced market dynamics, prompting manufacturers to focus on high-purity, compliant GBL formulations for pharmaceutical and agrochemical applications. The integration of GBL in high-tech coatings, electronics manufacturing, and specialty polymer synthesis is further expanding its industrial footprint. As research into advanced material science and green chemistry continues, the demand for GBL is expected to grow across multiple high-value sectors, reinforcing its role as a key chemical in modern industry.

Report Scope

The report analyzes the Gamma Butyrolactone market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Purity (Min 99.9%, Min 99.7%); Applications (Batteries & Capacitors Applications, Herbicides & Insecticides Applications, Sedative & Anesthetic Applications, Solvent Applications, Other Applications); End-Use (Electrical & Electronics End-Use, Agrochemical End-Use, Pharmaceutical End-Use, Chemical End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Min 99.9% Purity Gamma Butyrolactone segment, which is expected to reach US$2.4 Billion by 2030 with a CAGR of a 1.5%. The Min 99.7% Purity Gamma Butyrolactone segment is also set to grow at 2.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.0 Billion in 2024, and China, forecasted to grow at an impressive 3.9% CAGR to reach $784.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Gamma Butyrolactone Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Gamma Butyrolactone Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Gamma Butyrolactone Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Activision Blizzard, Inc., Bandai Namco Entertainment Inc., Bohemia Interactive, CAE Inc., Codemasters and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Gamma Butyrolactone market report include:

- Ashland Global Holdings Inc.

- Autech Industry Co., Limited

- BASF SE

- BCH Brühl - Chemikalien Handel GmbH

- CDH Fine Chemical

- Changzhou Xudong Chemical Co., Ltd.

- CM Fine Chemicals

- Dairen Chemical Corporation

- Hangzhou Meite Chemical Co., Ltd.

- Hangzhou Verychem Science & Technology Co., Ltd.

- Inchem GmbH

- ISP Chemicals LLC (a subsidiary of Ashland)

- LyondellBasell Industries N.V.

- Merck Schuchardt OHG

- Mitsubishi Chemical Group

- SANYO Corporation of America

- Sigma-Aldrich (a subsidiary of Merck Group)

- Twin Specialties

- Vigon International (an Azelis Company)

- World. Chem. Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ashland Global Holdings Inc.

- Autech Industry Co., Limited

- BASF SE

- BCH Brühl - Chemikalien Handel GmbH

- CDH Fine Chemical

- Changzhou Xudong Chemical Co., Ltd.

- CM Fine Chemicals

- Dairen Chemical Corporation

- Hangzhou Meite Chemical Co., Ltd.

- Hangzhou Verychem Science & Technology Co., Ltd.

- Inchem GmbH

- ISP Chemicals LLC (a subsidiary of Ashland)

- LyondellBasell Industries N.V.

- Merck Schuchardt OHG

- Mitsubishi Chemical Group

- SANYO Corporation of America

- Sigma-Aldrich (a subsidiary of Merck Group)

- Twin Specialties

- Vigon International (an Azelis Company)

- World. Chem. Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 376 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

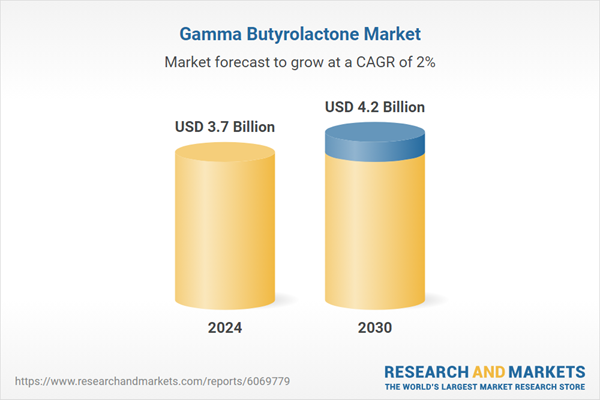

| Estimated Market Value ( USD | $ 3.7 Billion |

| Forecasted Market Value ( USD | $ 4.2 Billion |

| Compound Annual Growth Rate | 2.0% |

| Regions Covered | Global |