Global Low Voltage Industrial Distribution Substation Market - Key Trends & Drivers Summarized

Why Are Low Voltage Substations Becoming Pivotal in Modern Industrial Infrastructure?

As industrial operations evolve with increasing demands for energy efficiency and automation, low voltage industrial distribution substations are emerging as vital components in electrical power systems. These substations serve as the bridge between medium-voltage transmission networks and localized low-voltage distribution networks, ensuring a reliable, regulated, and safe supply of power for industrial equipment. Their growing relevance is largely due to rapid industrialization across developing economies, as well as the global emphasis on resilient energy infrastructure. Sectors such as manufacturing, automotive, pharmaceuticals, and chemicals are increasingly deploying advanced substation systems to support continuous operations, minimize downtime, and meet stringent safety regulations. In parallel, the modernization of aging electrical grids in mature markets has created a surge in retrofitting and upgrading existing substation infrastructure with low voltage variants.How Is Digitalization Shaping the Low Voltage Substation Ecosystem?

The integration of digital technologies into low voltage distribution substations has significantly transformed their capabilities, driving a shift from traditional to smart substations. Innovations such as real-time monitoring systems, predictive maintenance tools, IoT-enabled devices, and SCADA integration are enabling facility managers to optimize energy consumption, improve fault detection, and extend equipment lifespan. This digital transformation is further fueled by the adoption of Industry 4.0 practices, where>Are Sustainability Goals Pushing a Redesign of Substation Infrastructure?

Environmental sustainability has emerged as a powerful force influencing the design, operation, and deployment of low voltage industrial distribution substations. Industrial players are under pressure to align with global decarbonization goals, comply with environmental standards, and adopt greener practices. As a result, eco-efficient substations that utilize SF6-free insulation, energy-efficient transformers, and reduced carbon footprint components are gaining momentum. Additionally, industries are integrating renewable energy sources like solar and wind into their substation systems, necessitating hybrid configurations that can manage variable inputs while maintaining stable output. Moreover, circular economy principles are being embedded into substation design, emphasizing recyclability, modular construction, and lifecycle energy assessments. These shifts are not only reducing operational emissions but also unlocking long-term cost savings and regulatory incentives for forward-thinking businesses.What’ s Driving the Rapid Growth of the Low Voltage Industrial Distribution Substation Market?

The growth in the low voltage industrial distribution substation market is driven by several factors rooted in technological advancement, end-user needs, and changing consumption patterns. First, the surge in electrification across heavy industries and micro-enterprises alike has increased demand for compact, scalable, and efficient substation solutions. Second, the widespread implementation of automation and robotics in manufacturing facilities has elevated the need for uninterrupted, high-quality power - something low voltage substations are designed to deliver. Third, there is a noticeable shift in consumer behavior toward energy-conscious purchasing and sustainable business practices, encouraging industries to invest in energy-optimized infrastructure. Furthermore, the growing prevalence of data centers, EV charging infrastructure, and smart factories is fueling the requirement for robust low-voltage distribution networks. Finally, government mandates for grid modernization, coupled with fiscal incentives for deploying advanced electrical distribution equipment, are actively accelerating market expansion across both developed and emerging economies.Report Scope

The report analyzes the Low Voltage Industrial Distribution Substations market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Substation Automation System, Communication Network, Electrical System, Monitoring & Control System, Others); Technology (Conventional, Digital); Category (New, Refurbished).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Substation Automation System segment, which is expected to reach US$2.4 Billion by 2030 with a CAGR of a 7.5%. The Communication Network segment is also set to grow at 3.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.0 Billion in 2024, and China, forecasted to grow at an impressive 9.9% CAGR to reach $1.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Low Voltage Industrial Distribution Substations Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Low Voltage Industrial Distribution Substations Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Low Voltage Industrial Distribution Substations Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., Bel Fuse Inc., Eaton Corporation, Elcom International Pvt. Ltd., FIC Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Low Voltage Industrial Distribution Substations market report include:

- ABB Ltd.

- Avail Infrastructure Solutions

- CG Power and Industrial Solutions

- Eaton Corporation

- Efacec

- Emerson Electric Co.

- General Electric Company

- Hitachi Energy Ltd.

- Honeywell International Inc.

- Larsen & Toubro Limited

- Legrand SA

- Mitsubishi Electric Corporation

- Myers Power Products

- NR Electric Co., Ltd.

- Rockwell Automation

- Schneider Electric

- Siemens AG

- Sunten Electric Equipment Co., Ltd.

- Tesco Automation Inc.

- Texas Instruments Incorporated

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd.

- Avail Infrastructure Solutions

- CG Power and Industrial Solutions

- Eaton Corporation

- Efacec

- Emerson Electric Co.

- General Electric Company

- Hitachi Energy Ltd.

- Honeywell International Inc.

- Larsen & Toubro Limited

- Legrand SA

- Mitsubishi Electric Corporation

- Myers Power Products

- NR Electric Co., Ltd.

- Rockwell Automation

- Schneider Electric

- Siemens AG

- Sunten Electric Equipment Co., Ltd.

- Tesco Automation Inc.

- Texas Instruments Incorporated

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 367 |

| Published | January 2026 |

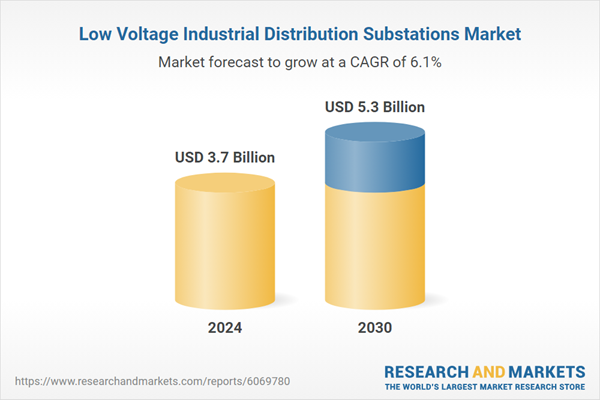

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.7 Billion |

| Forecasted Market Value ( USD | $ 5.3 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |