Global Oat Milk Market - Key Trends & Drivers Summarized

Why Is Oat Milk Taking Over Dairy and Plant-Based Beverage Aisles Worldwide?

Oat milk has rapidly evolved from a niche dairy alternative to a mainstream staple across global markets, driven by a surge in demand for plant-based, allergen-friendly, and environmentally sustainable products. Its creamy texture, naturally sweet flavor, and impressive nutritional profile - rich in fiber and beta-glucans - have made it a favorite not just among vegans but also among flexitarians and health-conscious consumers. Unlike almond or soy milk, oat milk is free from common allergens like nuts and soy, making it a go-to option for schools, café s, and public institutions. It also blends seamlessly into coffee, giving it a foamy consistency that has made it especially popular in the barista and café sector. As consumers increasingly scrutinize ingredient lists and prioritize clean-label, functional beverages, oat milk’ s minimal processing and recognizable source - whole oats - further fuel its marketability. Global brands are responding with a proliferation of oat milk-based products, including ready-to-drink beverages, flavored varieties, yogurts, ice creams, and creamers. Innovation is particularly high in packaging and shelf stability, with aseptic packaging allowing room-temperature storage that expands market reach in regions without robust cold chains. Additionally, the climate-conscious consumer base views oat milk as a more eco-friendly alternative compared to dairy and other plant-based milks, due to oats’ lower water usage and carbon footprint during cultivation. Altogether, oat milk is redefining consumer expectations for taste, nutrition, and sustainability in the non-dairy beverage segment.How Are Regional Markets Shaping the Oat Milk Consumption Landscape?

Different regions are embracing oat milk with distinct consumption drivers and growth trajectories. In North America and Europe, where plant-based lifestyles have already gained significant traction, oat milk is now a fixture in both retail and foodservice channels. Countries like Sweden, Germany, the UK, and the US are leading the charge, fueled by widespread availability, celebrity endorsements, and heightened consumer awareness of lactose intolerance and dairy sensitivities. In North America, oat milk is experiencing double-digit growth, with retailers expanding shelf space and dedicated brands like Oatly, Califia Farms, and Chobani capitalizing on shifting consumer habits. Meanwhile, in the Asia-Pacific region, oat milk is emerging as a viable alternative to traditional soy and almond milks, especially in urban centers across China, Japan, and South Korea. While still in early stages, demand here is rapidly rising, driven by a growing middle class, increasing disposable income, and a cultural shift toward Western-style diets and wellness trends. In Latin America and the Middle East, oat milk is being introduced as part of broader clean-eating movements, with major food conglomerates introducing regional adaptations to meet taste and texture preferences. These geographic variations are influencing product formulation, price points, and marketing narratives, pushing manufacturers to localize their strategies while ensuring global scalability. Strategic partnerships with local distributors, entry into foodservice channels, and private label offerings in supermarkets are helping brands penetrate new territories and solidify their global footprint.Is Sustainability the Silent Hero Behind Oat Milk's Meteoric Rise?

Sustainability is not just a buzzword in the oat milk market - it is a central value proposition that resonates deeply with modern consumers and investors alike. From farm to shelf, oat milk presents an environmentally favorable profile. Oats require significantly less water than almonds and contribute fewer greenhouse gas emissions than dairy cattle, aligning perfectly with the priorities of climate-aware buyers. Additionally, many oat milk producers are sourcing regionally grown oats, minimizing transportation-related emissions and supporting local agriculture. Some brands have gone a step further by adopting regenerative farming practices and carbon-neutral production processes, further reducing their environmental footprint. Packaging innovation is another front where sustainability is taking center stage, with recyclable, compostable, and reduced-plastic options gaining popularity across major markets. Moreover, manufacturers are increasing transparency in their sourcing and production methods, publishing impact reports and embracing certifications such as USDA Organic, Non-GMO Project Verified, and B Corp. As investors prioritize ESG-focused portfolios, companies with a strong sustainability narrative - like those in the oat milk space - are increasingly viewed as low-risk, high-potential assets. Consumer purchasing decisions are also swaying in favor of products with verifiable environmental benefits, reinforcing brand loyalty and price elasticity. In an era when sustainability is no longer optional but expected, oat milk has emerged as a frontrunner not only in environmental performance but also in communicating that performance credibly to the market.What’ s Driving the Soaring Growth of the Global Oat Milk Market?

The growth in the oat milk market is driven by several factors rooted in changing dietary preferences, retail dynamics, product innovation, and health-conscious consumer behavior. A primary catalyst is the rising incidence of lactose intolerance and dairy allergies, prompting consumers across age groups to seek plant-based alternatives. The clean-label trend has also propelled oat milk forward, as consumers seek simple, recognizable ingredients and avoid artificial additives. Retail dynamics are playing a transformative role - oat milk’ s shelf-stable formats have opened up new distribution channels including convenience stores, vending machines, and online grocery platforms. Product innovation is at an all-time high, with new formats like oat-based creamers, yogurts, cheeses, and even protein-enriched or fortified variants entering the market regularly. Consumer demand for functional beverages is also propelling oat milk growth; its high soluble fiber content, especially beta-glucan, is linked to heart health and blood sugar management, making it attractive to wellness-focused buyers. Meanwhile, the surge in veganism, especially among Gen Z and millennial consumers, is reshaping the food and beverage industry at large, encouraging restaurants, café s, and even fast-food chains to incorporate oat milk in their offerings. Strategic branding, influencer marketing, and social media visibility have significantly amplified consumer awareness and trial, while private-label growth in supermarkets has expanded access at more affordable price points. Lastly, food tech advancements and economies of scale are gradually bringing down production costs, allowing smaller brands and startups to compete effectively. These diverse, yet interconnected forces are collectively accelerating oat milk’ s transition from a trendy alternative to a global dietary mainstay.Report Scope

The report analyzes the Oat Milk market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Plain Oat Milk, Flavored Oat Milk); Source (Conventional Source, Organic Source); Packaging (Cartons Packaging, Bottle Packaging, Other Packaging); Distribution Channel (Supermarkets / Hypermarkets, Convenience Stores, Online Distribution Channel, Other Distribution Channels).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Plain Oat Milk segment, which is expected to reach US$6.0 Billion by 2030 with a CAGR of a 15.8%. The Flavored Oat Milk segment is also set to grow at 10.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.0 Billion in 2024, and China, forecasted to grow at an impressive 19.2% CAGR to reach $1.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Oat Milk Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Oat Milk Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Oat Milk Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Acelon Chemicals & Fiber Corporation, AdvanSix Inc., Asahi Kasei Corporation, BASF SE, ColossusTex and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Oat Milk market report include:

- Alpro (Danone)

- Califia Farms, LLC

- Chobani LLC

- Dream (Hain Celestial Group)

- Elmhurst 1925

- Forager Project

- Good & Gather (Target Corporation)

- Minor Figures

- MOMA Foods

- Oatly Group AB

- Oatsome (BetterBody Foods)

- Oatworks

- Pacific Foods of Oregon, LLC

- Planet Oat (HP Hood LLC)

- Pureharvest

- Rise Brewing Co.

- Rude Health

- Silk (Danone)

- Truly Family Farms

- Willa's Oat Milk

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alpro (Danone)

- Califia Farms, LLC

- Chobani LLC

- Dream (Hain Celestial Group)

- Elmhurst 1925

- Forager Project

- Good & Gather (Target Corporation)

- Minor Figures

- MOMA Foods

- Oatly Group AB

- Oatsome (BetterBody Foods)

- Oatworks

- Pacific Foods of Oregon, LLC

- Planet Oat (HP Hood LLC)

- Pureharvest

- Rise Brewing Co.

- Rude Health

- Silk (Danone)

- Truly Family Farms

- Willa's Oat Milk

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 458 |

| Published | February 2026 |

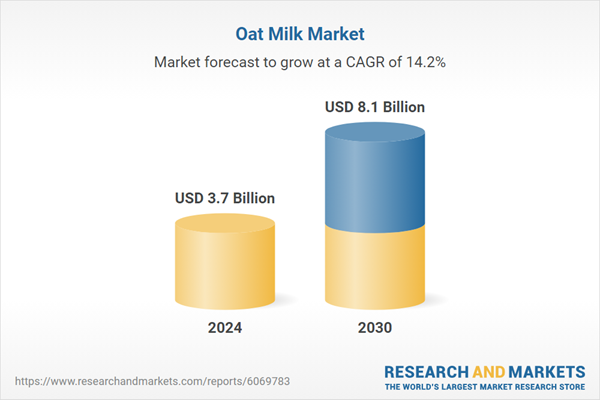

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.7 Billion |

| Forecasted Market Value ( USD | $ 8.1 Billion |

| Compound Annual Growth Rate | 14.2% |

| Regions Covered | Global |