Global Payday Loans Market - Key Trends & Drivers Summarized

Is Short-Term Credit Reshaping Personal Finance? The Rising Demand for Payday Loans

In an era of financial instability and rising living costs, payday loans have emerged as a critical financial lifeline for individuals facing short-term cash shortages. These high-interest, short-duration loans provide immediate access to funds, typically repayable on the borrower's next payday, making them an attractive option for individuals with urgent financial needs. The demand for payday loans is driven by a growing segment of underbanked and low-income consumers who lack access to traditional credit facilities. Economic uncertainties, including inflation, job insecurity, and unexpected expenses, have further intensified the reliance on payday lending services. Unlike traditional banking institutions, payday lenders offer fast approval processes, minimal documentation requirements, and same-day cash disbursement, making them a preferred choice for emergency financial needs. However, the industry has faced scrutiny over high interest rates, debt traps, and consumer protection concerns, prompting regulatory bodies to implement stricter lending policies. As financial technology (fintech) continues to disrupt the lending landscape, online payday loans, AI-driven risk assessment models, and alternative credit scoring mechanisms are reshaping how short-term credit is accessed and managed.How Is Fintech Transforming the Payday Loan Industry? AI, Automation & Alternative Credit Scoring

The payday loan industry is undergoing a digital transformation, with fintech innovations streamlining lending processes, improving risk assessment, and enhancing borrower experiences. AI-powered underwriting models are replacing traditional credit checks, enabling lenders to assess borrowers based on alternative data such as income trends, spending behavior, and employment history. Automation in loan processing has significantly reduced approval times, with digital payday loans now offering instant approvals and same-day fund transfers. Blockchain technology is also emerging in the industry, facilitating transparent, decentralized lending platforms that offer increased security and reduced fraud risks. The rise of mobile lending apps has made payday loans more accessible to consumers, allowing them to apply for loans and track repayments via smartphones. Alternative credit scoring models using big data analytics are enabling more inclusive lending, providing opportunities for individuals with limited or no credit history to access payday loans. Regulatory technology (RegTech) solutions are helping lenders maintain compliance with evolving consumer protection laws, ensuring responsible lending practices. As fintech continues to drive efficiencies, payday loan providers are evolving into digital-first entities, reducing costs, improving customer service, and expanding financial access to a broader demographic.Who Is Driving the Payday Loan Market? Understanding the Key Consumer Segments

The payday loan market caters to a diverse demographic, including low-income workers, gig economy employees, and individuals with poor or limited credit histories. A significant portion of payday loan borrowers comprises hourly wage earners who struggle with paycheck-to-paycheck living and require immediate cash for rent, utility bills, medical expenses, or unforeseen emergencies. Gig economy workers and freelancers, who often experience irregular income patterns, are increasingly relying on payday loans to bridge financial gaps between projects. Young adults and students, with limited access to traditional bank loans, are also a growing segment of payday loan users, leveraging short-term credit for tuition, living expenses, and emergency costs. Small business owners and self-employed individuals are turning to payday loans for urgent working capital needs, particularly in markets where traditional business loans have stringent approval criteria. The rise of online payday lending platforms has expanded access to remote and rural populations, allowing consumers without nearby physical bank branches to secure emergency loans digitally. As the financial landscape evolves, payday lenders are adapting their offerings to cater to emerging consumer needs, including flexible repayment plans, lower-interest microloans, and credit-building payday loan alternatives.The Growth in the Payday Loans Market Is Driven by Several Factors…

The increasing financial strain on consumers, driven by inflation, stagnant wages, and rising living costs, is fueling the demand for payday loans. The rapid expansion of fintech-driven lending platforms is making payday loans more accessible, efficient, and data-driven. The growing gig economy and freelance workforce, characterized by inconsistent income streams, is creating a sustained need for short-term credit solutions. Digital transformation in financial services, including AI-powered underwriting and mobile lending applications, is reducing friction in payday loan approvals and fund disbursement. The decline in traditional banking accessibility for underbanked populations is driving consumers toward alternative financial services, including payday lending. Regulatory changes and consumer protection laws are prompting lenders to offer more transparent, compliant, and responsible payday loan structures. The increasing acceptance of alternative credit scoring models is enabling a broader range of consumers to qualify for payday loans, expanding the market's reach. Strategic partnerships between payday lenders and financial service providers are facilitating the introduction of hybrid lending products that combine short-term credit with financial wellness tools. As financial emergencies and unexpected expenses continue to challenge consumers, the payday loan market is expected to maintain steady growth, evolving with technological advancements and regulatory shifts to meet the changing financial needs of borrowers worldwide.Report Scope

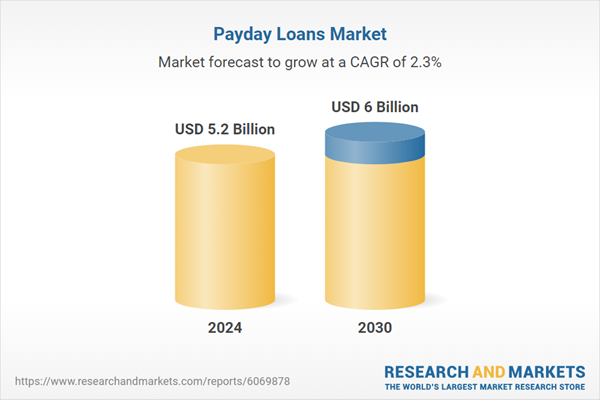

The report analyzes the Payday Loans market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Loan Type (Storefront Payday Loans, Online Payday Loans); Marital Status (Married, Single); Customer Age (Below 21 yrs, 21 - 30 yrs, 31 - 40 yrs, 41 - 50 yrs, Above 50 yrs).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Storefront Payday Loans segment, which is expected to reach US$3.6 Billion by 2030 with a CAGR of a 1.6%. The Online Payday Loans segment is also set to grow at 3.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.4 Billion in 2024, and China, forecasted to grow at an impressive 4.3% CAGR to reach $1.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Payday Loans Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Payday Loans Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Payday Loans Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ACE Cash Express, Advance America, AmeriCash Loans, Balance Credit, Check 'n Go and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 37 companies featured in this Payday Loans market report include:

- ACE Cash Express

- Advance America

- AmeriCash Loans

- Balance Credit

- Check 'n Go

- Check City

- Check Into Cash

- Fig Loans

- Kotak Mahindra Bank Limited

- Lending Bear

- LoanMart

- MoneyKey

- NetCredit

- OneMain Holdings Inc.

- Opportunity Financial LLC

- Plain Green Loans

- Possible Finance

- Rise Credit

- Speedy Cash

- Spotloan

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ACE Cash Express

- Advance America

- AmeriCash Loans

- Balance Credit

- Check 'n Go

- Check City

- Check Into Cash

- Fig Loans

- Kotak Mahindra Bank Limited

- Lending Bear

- LoanMart

- MoneyKey

- NetCredit

- OneMain Holdings Inc.

- Opportunity Financial LLC

- Plain Green Loans

- Possible Finance

- Rise Credit

- Speedy Cash

- Spotloan

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 370 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.2 Billion |

| Forecasted Market Value ( USD | $ 6 Billion |

| Compound Annual Growth Rate | 2.3% |

| Regions Covered | Global |