Global Veterinary Clinical Trials Market - Key Trends & Drivers Summarized

Why Are Veterinary Clinical Trials Gaining Prominence in Modern Animal Health Research?

Veterinary clinical trials are becoming an essential part of animal health innovation, driven by the growing demand for safe, effective, and evidence-based treatments in both companion and livestock animals. As veterinary medicine continues to evolve in complexity and sophistication - mirroring advancements in human healthcare - there is an increasing need to validate new drugs, vaccines, biologics, devices, and therapies through rigorous, structured clinical testing. These trials are critical for assessing efficacy, safety, dosing protocols, and potential side effects before commercial launch. The rise in chronic diseases, zoonotic threats, antimicrobial resistance, and age-related conditions among pets and farm animals is intensifying the pressure to bring new veterinary products to market. At the same time, pet owners and livestock producers alike are seeking improved treatment outcomes, leading to greater interest in precision veterinary medicine, personalized nutrition, and targeted therapeutics. This changing landscape has made veterinary clinical trials more relevant than ever, with a rising number of veterinary research organizations (CROs), academic institutions, pharmaceutical companies, and regulatory agencies placing strong emphasis on preclinical and clinical research that complies with global safety and ethical standards.How Is Technology Enhancing the Design and Execution of Veterinary Trials?

Technological innovation is revolutionizing how veterinary clinical trials are designed, monitored, and analyzed - making them faster, more data-driven, and compliant with evolving regulations. Electronic data capture (EDC) systems and cloud-based trial management platforms are enabling real-time data collection, remote monitoring, and secure sharing between research sites, veterinarians, and sponsors. Wearable devices and sensor-based collars are now being used to gather continuous physiological data on animals during trials, such as heart rate, activity levels, and body temperature, providing richer insights without causing stress or requiring repeated clinic visits. AI and machine learning algorithms are being applied to analyze large datasets, identify trends, and improve patient recruitment by matching animals to relevant trials based on breed, age, condition, and location. Mobile apps and telemedicine tools are also supporting virtual consultations and at-home data collection, particularly in long-term chronic disease trials. These digital tools are helping streamline trial logistics, reduce human error, and improve participant retention, while also enhancing transparency for pet owners and farm managers. Overall, these technologies are not only optimizing the operational side of veterinary trials but are also raising the standard of scientific evidence generated in veterinary medicine.Why Are Pharma Companies, CROs, and Veterinary Clinics Expanding Their Clinical Trial Activity?

Pharmaceutical companies, contract research organizations (CROs), and veterinary clinics are significantly expanding their investment in clinical trial infrastructure to meet growing regulatory demands and accelerate innovation in the veterinary therapeutics space. Animal health companies are increasingly focusing on developing specialized products for conditions like osteoarthritis, cancer, diabetes, dermatological disorders, and infectious diseases - areas that require rigorous clinical validation before entering the market. As the veterinary drug pipeline expands, CROs are partnering with veterinary practices and academic institutions to conduct multicenter trials that ensure data reliability and demographic diversity. Veterinary clinics - especially those affiliated with universities or large networks - are establishing research arms to enroll patients in trials, giving pet owners access to cutting-edge treatments while contributing to scientific advancement. Additionally, livestock producers and agribusiness stakeholders are working with animal health companies to test products that improve herd productivity, disease resistance, and food safety. Regulatory bodies such as the FDA (Center for Veterinary Medicine), EMA (CVMP), and other national authorities have strengthened guidance around Good Clinical Practice (GCP) for veterinary studies, which is increasing compliance costs but also professionalizing the entire ecosystem. This surge in collaborative, well-structured trial activity reflects a maturing market that is embracing data-backed innovation as the foundation of future animal health solutions.What's Driving the Global Growth of the Veterinary Clinical Trials Market?

The growth in the veterinary clinical trials market is driven by several interrelated factors tied to rising pet ownership, livestock health priorities, regulatory evolution, and technological advancement. One of the most significant drivers is the growing prevalence of chronic and lifestyle-related diseases in companion animals, which has increased demand for new treatment modalities and preventive solutions. Meanwhile, livestock health remains a high priority for ensuring global food security and sustainability, especially in the face of emerging diseases, climate change, and antibiotic resistance. The increasing willingness of pet owners to participate in clinical studies - fueled by better education, trust in veterinary science, and access to novel therapies - is improving recruitment and study success rates. At the same time, global harmonization of regulatory standards for veterinary products is encouraging pharmaceutical companies to invest in cross-border trials that facilitate faster approvals. The rise of veterinary-specific CROs and digital trial management tools is also improving trial scalability and efficiency, making research more accessible to clinics of all sizes. Additionally, the growth of pet insurance, specialty practices, and university-affiliated animal hospitals is creating more opportunities to conduct structured, large-scale research. These collective trends are turning veterinary clinical trials into a critical growth engine for the animal health industry, accelerating the delivery of innovative solutions for pets, livestock, and the veterinarians who care for them.Report Scope

The report analyzes the Veterinary Clinical Trials market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Animal (Companion Animal, Livestock Animal, Other Animals); Indication (Oncology, Internal Medicine, Orthopedics, Cardiology, Neurology, Ophthalmology, Dermatology, Other Indication); Intervention (Medicines, Medical Devices, Others); Sponsor (Pharma & Biopharma Companies, Academics & Research Centers, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Companion Animal segment, which is expected to reach US$4.1 Billion by 2030 with a CAGR of a 5.6%. The Livestock Animal segment is also set to grow at 7.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.4 Billion in 2024, and China, forecasted to grow at an impressive 10% CAGR to reach $1.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Veterinary Clinical Trials Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Veterinary Clinical Trials Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Veterinary Clinical Trials Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ALBA Medical Systems, Inc., Antech Diagnostics, Boehringer Ingelheim International, Bionet America, Ceva Santé Animale and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Veterinary Clinical Trials market report include:

- AGLAIA

- Animal Health Consultants

- Argenta

- Biotest Lab

- Cebiphar

- Charles River Laboratories

- Clinvet

- Cloudbyz

- ERBC

- IDEXX Laboratories

- Inotiv

- KLIFOVET GmbH

- knoell

- Labcorp Drug Development

- Löhlein & Wolf Vet Research

- Oncovet Clinical Research (OCR)

- Premier Research

- QTest Labs

- Scantox

- STATKING Clinical Services

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AGLAIA

- Animal Health Consultants

- Argenta

- Biotest Lab

- Cebiphar

- Charles River Laboratories

- Clinvet

- Cloudbyz

- ERBC

- IDEXX Laboratories

- Inotiv

- KLIFOVET GmbH

- knoell

- Labcorp Drug Development

- Löhlein & Wolf Vet Research

- Oncovet Clinical Research (OCR)

- Premier Research

- QTest Labs

- Scantox

- STATKING Clinical Services

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 492 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

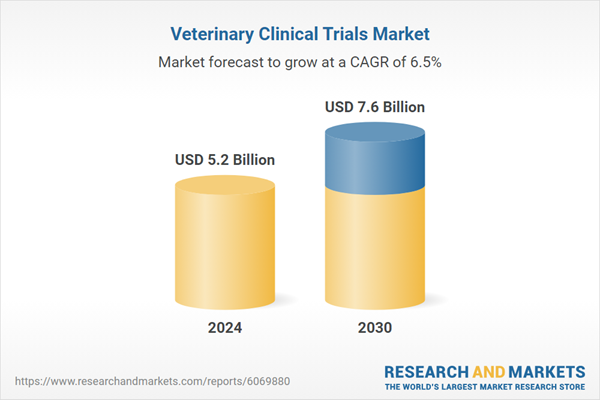

| Estimated Market Value ( USD | $ 5.2 Billion |

| Forecasted Market Value ( USD | $ 7.6 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |