Global Cleanroom Films and Bags Market - Key Trends & Drivers Summarized

Why Are Cleanroom Films and Bags Integral to Product Integrity in Controlled Manufacturing Environments?

Cleanroom films and bags play a pivotal role in maintaining sterility, preventing particulate contamination, and ensuring the integrity of critical components across highly regulated, contamination-sensitive manufacturing environments. Used primarily in sectors such as pharmaceuticals, semiconductors, biotechnology, aerospace, optics, medical devices, and advanced electronics, these packaging materials are specially designed to comply with cleanroom standards such as ISO 14644 and GMP protocols. Unlike conventional packaging materials, cleanroom-grade films and bags are produced, processed, and packaged under controlled conditions to eliminate foreign particles, residues, and microbial contaminants. Applications span across multiple use cases - ranging from double-bagging sterile instruments and transporting wafers, circuit boards, or vials, to storing raw materials and packaging pharmaceutical components. Cleanroom films and bags serve not only as physical barriers but also as tools to ensure traceability, controlled exposure, and environmental protection. As end-use industries push for greater quality assurance and zero-defect manufacturing, demand for specialized cleanroom packaging materials is growing significantly. With product sterility and contamination control becoming non-negotiable in critical industries, cleanroom films and bags have evolved into strategic components within broader cleanroom protocols and supply chain workflows.How Are Regulatory Compliance and Industry-Specific Protocols Influencing Material Design and Packaging Standards?

The development and selection of cleanroom films and bags are heavily shaped by strict regulatory requirements and industry-specific cleanliness protocols. Pharmaceutical and biopharmaceutical sectors, governed by GMP guidelines, USP chapters, and FDA regulations, demand packaging materials that are not only free from particulate and microbial contaminants but also chemically inert, non-leaching, and compliant with sterilization processes such as gamma irradiation or ethylene oxide treatment. Similarly, the semiconductor and microelectronics industries require ultra-clean packaging solutions with anti-static (ESD) properties, ion contamination control, and metal-free compositions to ensure protection of high-value, sensitive components. Cleanroom films and bags must also meet standards for outgassing, trace metal content, and surface cleanliness. In medical device manufacturing, packaging must be ISO 11607 compliant and capable of maintaining sterility throughout transportation and storage. As compliance requirements become increasingly complex, packaging manufacturers are developing cleanroom-grade films and bags using materials such as LDPE, HDPE, polypropylene, fluoropolymers, and multilayer co-extrusions with enhanced barrier properties. Double-bagging systems, peel-open pouches, resealable antistatic bags, and tamper-evident seals are being integrated into standard packaging solutions. Additionally, traceability through lot coding, cleanroom certification labeling, and barcode tracking is becoming essential for audit compliance and quality assurance. As regulations evolve across regions, the demand for rigorously validated, industry-compliant cleanroom films and bags is poised to escalate.Is Technological Advancement in Film Processing and Bag Engineering Driving Functional Innovation?

The cleanroom films and bags market is being transformed by significant advancements in polymer science, extrusion technologies, contamination control engineering, and packaging customization. Manufacturers are investing in multilayer film co-extrusion, plasma surface treatment, and cleanroom-grade converting technologies to enhance mechanical strength, particle resistance, antistatic behavior, and sterilization compatibility. Material innovations include low-outgassing polymers, metal-ion-free formulations, non-shedding surfaces, and films engineered to resist static build-up, chemical exposure, or mechanical puncture. Additionally, the integration of functional attributes - such as anti-fogging layers, moisture barriers, oxygen permeability control, and UV protection - is helping extend shelf life and ensure product stability across diverse environments. Precision bag manufacturing techniques such as heat-sealing, gusseting, venting, vacuum sealing, and custom dimensioning are being tailored to specific end-user requirements, including double-bagging procedures and aseptic transfer protocols. Furthermore, digital printing and smart labeling are enabling better traceability, batch tracking, and visual identification within cleanroom storage and logistics workflows. As the market shifts toward higher productivity and contamination-proofing, demand is rising for high-purity packaging that delivers on both functional performance and compliance. Cleanroom bag-in-box systems, peelable pouches for sterile kits, and automated bagging systems integrated into cleanroom packaging lines are pushing the envelope of packaging innovation - transforming traditional consumables into high-value engineered solutions.What’ s Fueling the Global Growth Trajectory of Cleanroom Films and Bags Across Critical Industries?

The growth in the cleanroom films and bags market is driven by multiple intersecting trends spanning healthcare innovation, semiconductor fabrication, biotech scale-up, regulatory tightening, and global manufacturing decentralization. The rapid expansion of pharmaceutical and biologics manufacturing - fueled by rising demand for sterile injectables, vaccines, cell and gene therapies, and monoclonal antibodies - is increasing the need for robust cleanroom-compatible packaging systems. Likewise, the semiconductor industry, propelled by surging global demand for chips across AI, IoT, electric vehicles, and 5G, is creating a parallel surge in demand for ultra-clean, ESD-protected packaging for wafers, masks, and substrates. Cleanroom packaging is also gaining traction in advanced optics, aerospace, nuclear research, and high-performance material science labs, where controlled handling of contamination-sensitive components is paramount. The decentralization of global manufacturing, rise of contract manufacturing organizations (CMOs), and growth of R&D facilities in Asia-Pacific and Latin America are further driving demand for portable, flexible, and standardized cleanroom packaging solutions. Additionally, sustainability considerations - such as recyclable cleanroom films, reusable antistatic bags, and low-carbon packaging materials - are influencing procurement decisions across industry sectors. As companies seek integrated contamination control solutions that align with both quality standards and environmental mandates, the cleanroom films and bags segment is poised for accelerated global growth - cementing its position as a critical enabler in high-compliance, high-precision manufacturing ecosystems.Report Scope

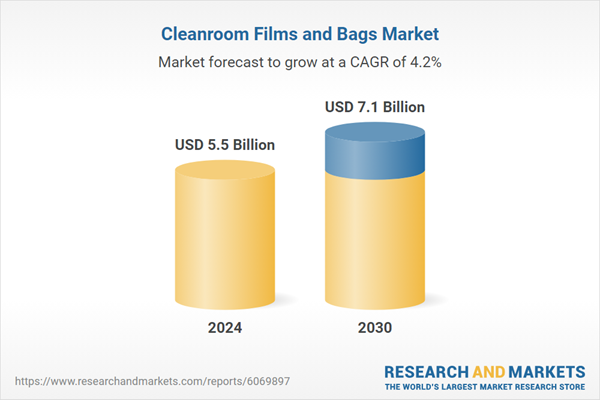

The report analyzes the Cleanroom Films and Bags market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Films and Wraps, Bags, Pouches, Tape, Boxes); Material (Plastic, Polyethylene (PE), Polypropylene (PP), Polyamide (PA), Others (PS, PVC, EVA), Paper and Paperboard); End-Use (Pharmaceuticals End-Use, Food and Beverages End-Use, Electrical and Electronics End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Films & Wraps segment, which is expected to reach US$2.6 Billion by 2030 with a CAGR of a 4%. The Bags segment is also set to grow at 4.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.5 Billion in 2024, and China, forecasted to grow at an impressive 7.6% CAGR to reach $1.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cleanroom Films and Bags Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cleanroom Films and Bags Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cleanroom Films and Bags Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AbTech, Inc, Airtech Japan Ltd., American Cleanroom Systems, Ardmac, Ltd., Brinda Pharma Technologies Private Limited and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Cleanroom Films and Bags market report include:

- AeroPackaging, Inc.

- Aicello Corporation

- Cleanroom Connection

- Cleanroom Film and Bags (CFB)

- Correct Products

- Degage Corp.

- Four Star Plastics

- Fruth Custom Packaging

- Healthmark Industries Company, Inc.

- Indoff

- Liberty Intercept

- Nelipak Healthcare Packaging

- Packform USA LLC

- Plitek

- PPC Flexible Packaging LLC

- Production Automation Corporation

- Protective Packaging Corporation

- Tekni-Plex, Inc.

- Texas Technologies, Inc.

- Thomas Scientific Holdings, LLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AeroPackaging, Inc.

- Aicello Corporation

- Cleanroom Connection

- Cleanroom Film and Bags (CFB)

- Correct Products

- Degage Corp.

- Four Star Plastics

- Fruth Custom Packaging

- Healthmark Industries Company, Inc.

- Indoff

- Liberty Intercept

- Nelipak Healthcare Packaging

- Packform USA LLC

- Plitek

- PPC Flexible Packaging LLC

- Production Automation Corporation

- Protective Packaging Corporation

- Tekni-Plex, Inc.

- Texas Technologies, Inc.

- Thomas Scientific Holdings, LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 394 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.5 Billion |

| Forecasted Market Value ( USD | $ 7.1 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |