Global Healthcare Testing, Inspection, and Certification (TIC) Outsourcing Market - Key Trends & Drivers Summarized

Why Is Testing, Inspection, and Certification Outsourcing Becoming Essential in Healthcare?

The healthcare industry is subject to stringent regulations, quality control requirements, and safety standards that necessitate rigorous testing, inspection, and certification (TIC) procedures. With the increasing complexity of medical devices, pharmaceuticals, biotechnology products, and digital health solutions, ensuring compliance with regulatory frameworks such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and the International Organization for Standardization (ISO) has become more challenging. Many healthcare companies lack the in-house expertise, infrastructure, and resources to manage TIC processes efficiently, leading to a growing reliance on outsourcing these services to specialized firms. Outsourcing TIC functions allows healthcare organizations to focus on research, manufacturing, and commercialization while ensuring that their products meet global safety and efficacy standards. Third-party TIC providers offer independent validation and compliance assurance, reducing the risk of product recalls, legal disputes, and reputational damage. The increasing globalization of healthcare supply chains has further driven the demand for outsourced TIC services, as companies must comply with multiple regional and international regulations. As healthcare innovations continue to advance, outsourcing TIC processes has become a strategic approach to maintaining high-quality standards while streamlining operations and reducing costs.How Are Digital Technologies and Automation Enhancing Healthcare TIC Processes?

The integration of digital technologies, artificial intelligence (AI), and automation is revolutionizing healthcare TIC outsourcing, making testing, inspection, and certification processes more efficient, accurate, and scalable. AI-powered analytics tools are being used to identify defects, analyze large datasets, and predict potential compliance issues before they arise. Automated testing systems, including robotic process automation (RPA), enable faster and more precise validation of pharmaceuticals, medical devices, and diagnostic equipment. The use of blockchain technology is enhancing transparency and traceability in certification processes by creating immutable records of compliance data, reducing the risk of fraud and errors. Cloud-based platforms are enabling real-time monitoring and remote inspection capabilities, allowing regulatory bodies and healthcare firms to access compliance reports from anywhere in the world. Additionally, digital twins - virtual replicas of physical healthcare products - are being used for simulation-based testing, reducing the need for physical trials and accelerating time-to-market. The rise of connected healthcare devices and IoT-enabled monitoring systems is also generating vast amounts of real-time performance data, which TIC providers are leveraging to conduct predictive inspections and ensure continuous compliance. As AI, automation, and>What Challenges Do Healthcare Companies Face in Outsourcing TIC Services?

Despite the growing advantages of outsourcing TIC services, healthcare companies face several challenges in managing regulatory compliance, quality assurance, and risk mitigation. One of the primary concerns is the complexity of global regulatory frameworks, as different regions impose varying standards for medical products and pharmaceuticals. Navigating these regulations requires working with TIC providers who have expertise in multiple jurisdictions and can ensure seamless compliance across markets. Another significant challenge is data security, as TIC processes involve handling sensitive patient data, clinical trial information, and proprietary healthcare innovations. Ensuring robust cybersecurity measures, encryption protocols, and regulatory compliance with data protection laws such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA) is critical to mitigating security risks. Additionally, the high cost of TIC services, particularly for small and mid-sized healthcare firms, can pose a financial barrier to outsourcing. Finding reliable TIC providers with industry-specific expertise is also a challenge, as not all third-party firms offer specialized knowledge in pharmaceuticals, biotechnology, or medical devices. Resistance to change and lack of internal awareness about the benefits of TIC outsourcing can further slow down adoption. Overcoming these challenges requires healthcare companies to adopt a strategic approach to selecting TIC partners, ensuring that service providers align with their regulatory needs, cybersecurity protocols, and long-term quality assurance goals.What Is Driving the Growth of the Healthcare TIC Outsourcing Market?

The growth in the healthcare TIC outsourcing market is driven by several factors, including increasing regulatory scrutiny, the expansion of global healthcare supply chains, and the rising complexity of medical technologies. As governments and regulatory bodies impose stricter quality and safety standards, healthcare companies are prioritizing third-party testing, inspection, and certification services to ensure compliance and avoid penalties. The rapid expansion of the biotechnology, pharmaceutical, and medical device sectors has further fueled demand for outsourced TIC services, as companies require specialized validation and approval processes before bringing products to market. Additionally, the globalization of healthcare supply chains has necessitated more rigorous inspection of raw materials, manufacturing practices, and final products to meet international safety requirements. The shift toward precision medicine, advanced diagnostics, and personalized healthcare has also increased the need for comprehensive testing and validation services. Moreover, advancements in AI-driven analytics, automation, and blockchain-based compliance tracking are making TIC outsourcing more efficient, driving greater adoption across healthcare organizations. The increasing emphasis on sustainability, ethical sourcing, and eco-friendly medical manufacturing is also contributing to market growth, as TIC providers offer sustainability certification services for healthcare products. As digital transformation continues to reshape regulatory processes, the demand for robust, technology-driven TIC outsourcing solutions is expected to surge, shaping the future of healthcare quality assurance and compliance management.Report Scope

The report analyzes the Healthcare Testing, Inspection and Certification Outsourcing market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Medical Devices Type, Pharmaceutical Type); Service (Testing Service, Inspection Service, Certification Service).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Medical Devices segment, which is expected to reach US$6.5 Billion by 2030 with a CAGR of a 9.2%. The Pharmaceuticals segment is also set to grow at 5.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.6 Billion in 2024, and China, forecasted to grow at an impressive 12.7% CAGR to reach $2.0 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Healthcare Testing, Inspection and Certification Outsourcing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Healthcare Testing, Inspection and Certification Outsourcing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Healthcare Testing, Inspection and Certification Outsourcing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Healthcare Testing, Inspection and Certification Outsourcing market report include:

- ALS Limited

- Applus+

- Bureau Veritas

- CSA Group Testing & Certification Inc.

- DEKRA Certification B.V.

- DeviceLab Inc.

- DNV GL

- EdgeOne Medical Inc.

- Element Materials Technology

- Eurofins Scientific

- F2 Labs

- Intertek Group plc

- Kiwa NV

- Nemko

- Neva Analytics

- North American Science Associates (NAMSA)

- SGS SA

- TÜV SÜD

- UL LLC

- UX Firm

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ALS Limited

- Applus+

- Bureau Veritas

- CSA Group Testing & Certification Inc.

- DEKRA Certification B.V.

- DeviceLab Inc.

- DNV GL

- EdgeOne Medical Inc.

- Element Materials Technology

- Eurofins Scientific

- F2 Labs

- Intertek Group plc

- Kiwa NV

- Nemko

- Neva Analytics

- North American Science Associates (NAMSA)

- SGS SA

- TÜV SÜD

- UL LLC

- UX Firm

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 278 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

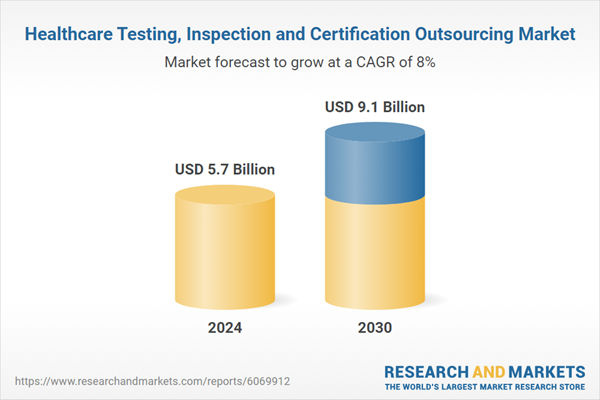

| Estimated Market Value ( USD | $ 5.7 Billion |

| Forecasted Market Value ( USD | $ 9.1 Billion |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Global |