Global Ophthalmic Loupes Market - Key Trends & Drivers Summarized

Why Are Ophthalmic Loupes Becoming an Indispensable Tool in Precision Eye Care?

In the world of microsurgery and detailed eye examinations, ophthalmic loupes have emerged as critical instruments enabling magnified visualization, enhanced precision, and practitioner comfort. Traditionally used by surgeons and dental professionals, loupes are now becoming increasingly common in ophthalmology due to their ability to provide detailed, hands-free magnification during delicate procedures. The demand for loupes in this field is growing in tandem with rising expectations for surgical accuracy and clinical efficiency. Ophthalmologists require consistent clarity, depth perception, and working distance to diagnose and treat minute structures within the eye, making high-quality loupes essential. As eye care expands into sub-specialties such as retina, glaucoma, and oculoplastics, the need for specialized visual aids grows as well. Today’ s ophthalmic loupes are designed with lightweight materials, adjustable magnification levels, and ergonomic support systems, allowing prolonged use without strain. Increasing focus on clinician well-being has driven innovations that address posture-related fatigue, while patients benefit from the reduced risk of errors. Moreover, the growing popularity of outpatient eye surgeries and in-office procedures is expanding the role of loupes beyond operating rooms into routine clinical settings. With the rise in global surgical volumes and training requirements, loupes are gaining ground as a standard accessory in ophthalmic practice, not just a preference.How Are Optical and Digital Enhancements Elevating Loupe Capabilities?

The evolution of ophthalmic loupes has been significantly shaped by rapid advancements in optics, digital integration, and materials engineering. Modern loupes now feature high-resolution optics with multi-coated lenses that offer superior clarity, brightness, and true color rendition - crucial in differentiating fine tissue structures during examination or microsurgery. Adjustable pupillary distance, custom declination angles, and flip-up functions are helping practitioners maintain optimal posture and reduce neck strain, especially during extended procedures. Digital loupes, which combine traditional magnification with built-in cameras or heads-up displays, are an emerging innovation in the field. These allow real-time video recording, tele-mentoring, and live streaming for educational or consultative purposes. Anti-glare coatings, scratch-resistant surfaces, and fog-proof lens systems enhance durability and user experience in varied clinical environments. The integration of lightweight composite materials and carbon fiber frames ensures that even high-magnification loupes remain comfortable for all-day wear. Additionally, prescription-compatible loupes allow ophthalmologists who wear corrective lenses to benefit from advanced magnification without compromising vision quality. Some models are even designed with modular configurations, enabling quick changes between lens types or magnification levels. These enhancements are not merely about visual support but are also elevating the safety, training quality, and procedural efficiency in ophthalmology across practice types.Which End-Users Are Driving Uptake and What Influences Their Choices?

The adoption of ophthalmic loupes is being shaped by a wide spectrum of users across clinical, academic, and research domains. Practicing ophthalmologists are the primary adopters, especially those engaged in high-precision subspecialties such as corneal surgery, vitreoretinal procedures, and oculoplastic interventions. Additionally, the rise of minimally invasive procedures and laser-assisted surgeries is prompting even general ophthalmologists to invest in loupes for improved visual control. Ophthalmology residents and fellows represent a fast-growing user segment, with training institutions increasingly mandating loupes as part of surgical education. The academic community values loupes for their ability to facilitate peer-to-peer learning and performance assessment. Moreover, optometrists and vision technicians are beginning to adopt loupes for detailed eye exams, lens fittings, and diagnostic tasks that benefit from enhanced magnification. Veterinary ophthalmologists are another niche but growing group, requiring similar levels of precision during eye surgeries on animals. Factors influencing purchase decisions include weight, battery life (in models with illumination), magnification range, adjustability, and cost-efficiency. The aesthetics and brand reputation of loupes are also important in competitive clinical environments, where equipment reflects professionalism and trust. Increasing awareness of ergonomic health, combined with evidence-based research supporting the use of magnification tools, is making ophthalmic loupes a foundational component of forward-looking eye care practices.What Market-Specific Trends Are Accelerating Growth Across the Ophthalmic Loupes Segment?

The growth in the ophthalmic loupes market is driven by several factors related to advanced optical technologies, evolving clinical protocols, practitioner behavior, and regional healthcare dynamics. A significant driver is the increasing global volume of ophthalmic surgeries and in-office procedures that require enhanced visualization, prompting sustained demand for high-performance loupes. The growing preference for ergonomically optimized tools among surgeons and clinicians - due to mounting awareness of occupational health issues like musculoskeletal strain - is pushing manufacturers to innovate loupes with better weight distribution, headgear customization, and declination angle adjustability. Another key factor is the integration of LED lighting systems into loupe frames, eliminating the need for separate light sources and improving visibility in low-light environments. In educational settings, the use of loupes is being standardized in residency training, especially in North America and parts of Europe, ensuring early adoption among the next generation of eye surgeons. Emerging markets in Asia-Pacific and Latin America are seeing rising demand due to expanding surgical infrastructure, growth of private eye care chains, and increased availability of high-quality, affordable loupe options. Online platforms and direct-to-clinic sales channels are also making premium loupes more accessible across regions. Lastly, the growing use of hybrid analog-digital systems and the rise of remote surgical mentoring are encouraging the development of smart loupes with video capture and wireless connectivity, ensuring that the ophthalmic loupes market continues to expand at the intersection of precision, technology, and practitioner wellness.Report Scope

The report analyzes the Ophthalmic Loupes market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Loupe (Galilean Loupes, Prismatic Loupes, Plate Loupes); Loupe Design (Through-the-Lens Design, Flip Up Design); End-Use (Hospitals End-Use, Ambulatory Surgery Centers End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Galilean Loupes segment, which is expected to reach US$470.5 Million by 2030 with a CAGR of a 6.2%. The Prismatic Loupes segment is also set to grow at 4.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $143.4 Million in 2024, and China, forecasted to grow at an impressive 9.2% CAGR to reach $150.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Ophthalmic Loupes Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Ophthalmic Loupes Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Ophthalmic Loupes Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

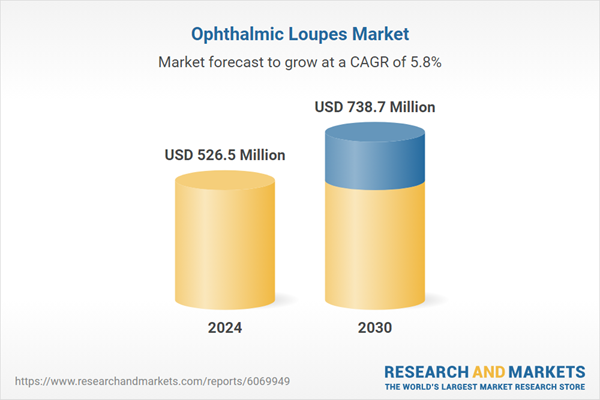

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Adelphi Healthcare Packaging, Alcon, Allergan (an AbbVie company), Aptar Pharma, Bausch + Lomb and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Ophthalmic Loupes market report include:

- Admetec

- Bryant Dental

- Carl Zeiss Meditec AG

- Designs for Vision, Inc.

- ExamVision

- HEINE Optotechnik GmbH & Co. KG

- Keeler Ltd.

- LumaDent Inc.

- North-Southern Electronics Limited (NSI)

- Orascoptic

- PeriOptix (a DenMat company)

- Q-Optics

- Rose Micro Solutions

- Seiler Instrument Inc.

- SheerVision

- SurgiTel

- Unify Medical, Inc.

- Univet S.r.l.

- Vision Engineering Ltd.

- Xenosys Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Admetec

- Bryant Dental

- Carl Zeiss Meditec AG

- Designs for Vision, Inc.

- ExamVision

- HEINE Optotechnik GmbH & Co. KG

- Keeler Ltd.

- LumaDent Inc.

- North-Southern Electronics Limited (NSI)

- Orascoptic

- PeriOptix (a DenMat company)

- Q-Optics

- Rose Micro Solutions

- Seiler Instrument Inc.

- SheerVision

- SurgiTel

- Unify Medical, Inc.

- Univet S.r.l.

- Vision Engineering Ltd.

- Xenosys Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 371 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 526.5 Million |

| Forecasted Market Value ( USD | $ 738.7 Million |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |