Global Expanded Metal Foils Market - Key Trends & Drivers Summarized

Why Is Expanded Metal Foil Gaining Momentum Across Industrial and High-Tech Sectors?

Expanded metal foils are increasingly being recognized as critical materials in a wide range of applications, from industrial filtration to advanced energy storage systems. These ultra-thin, yet strong, mesh-like structures are produced through a simultaneous slitting and stretching process, which gives them unique characteristics such as high surface area, electrical conductivity, low weight, and excellent mechanical durability. Traditionally used in EMI/RFI shielding and battery components, expanded metal foils have gained traction in emerging areas such as flexible electronics, fuel cells, and aerospace composites.As industries continue to seek materials that can deliver performance without adding significant weight or bulk, expanded metal foils offer a compelling alternative to woven wire meshes or perforated metals. Their zero-waste production process and superior open-area ratio contribute to environmental and cost advantages. Additionally, their ability to be fabricated from a variety of metals - including aluminum, copper, nickel, stainless steel, and titanium - enhances their adaptability for highly specialized environments, such as corrosive marine atmospheres, high-temperature industrial zones, and sensitive electronic enclosures.

How Are Technology and Material Innovations Driving Market Differentiation?

Innovation in expanded metal foil manufacturing has become a significant driver of product performance and customization. The development of micro-expanded and nano-patterned foil types is enabling their use in sophisticated electronic and electrochemical devices, including lithium-ion batteries, capacitors, and electrodes. These finely structured meshes provide superior mechanical support, improved current collection, and better electrolyte interaction in energy storage systems, thus boosting efficiency and life cycle performance. In clean energy applications, expanded foils are increasingly used as gas diffusion layers in proton exchange membrane (PEM) fuel cells and as current collectors in battery assemblies.Material science advancements have also led to the use of coated and laminated foils for enhanced thermal resistance, corrosion protection, or biocompatibility. Laser-controlled expansion techniques allow for highly uniform mesh patterns that are critical for optical and precision applications. Additionally, manufacturers are investing in roll-to-roll processing and scalable stamping systems, making it feasible to produce high-volume, precision-grade foils for industries such as electronics, filtration, aerospace, and defense. These technology improvements not only improve yield and quality but also open doors for new applications in wearable devices, medical sensors, and ultra-light shielding systems.

Where Are the High-Growth Applications for Expanded Metal Foils Emerging?

Expanded metal foils are increasingly being integrated into a wide array of industries beyond their traditional use cases. In electronics, they serve as shielding materials to prevent electromagnetic interference (EMI) in sensitive devices such as smartphones, medical imaging equipment, and radar systems. In the renewable energy sector, they are used in solar panels, battery packs, and hydrogen fuel cells, where conductivity, thermal dissipation, and weight reduction are essential. Meanwhile, in architectural and building materials, expanded foils are being used for decorative screens, lightweight cladding, and acoustic control panels due to their aesthetic flexibility and airflow properties.The aerospace and automotive sectors also represent strong demand channels for expanded metal foils, as these industries continuously seek lightweight yet high-strength materials to improve fuel efficiency and design flexibility. In the filtration industry, their structural integrity and open-area ratios make them ideal for supporting filtration membranes in water treatment, oil separation, and air purification units. Additionally, the medical sector is increasingly exploring their use in implantable devices and surgical tools, given their high biocompatibility when made with medical-grade metals. These expanding use cases are reinforcing the strategic importance of expanded metal foils in next-generation product design.

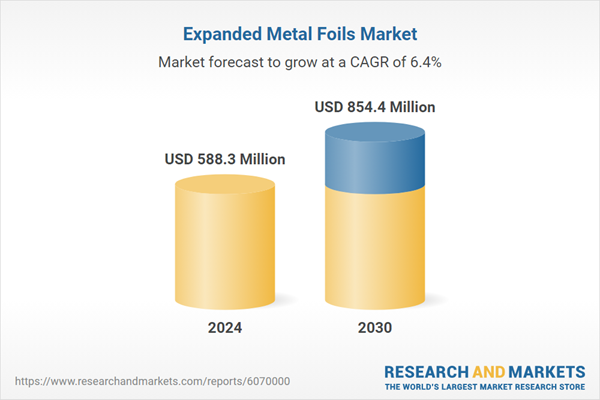

What Is Fueling the Sustained Growth of the Global Expanded Metal Foils Market?

The growth in the global expanded metal foils market is driven by several factors, including the rising demand for lightweight, high-strength conductive materials across energy storage, electronics, and aerospace applications; the ongoing miniaturization of devices requiring micro-scale mesh structures; and increased adoption in shielding, filtration, and architectural designs. Technological advancements in precision expansion, material coating, and pattern control are making expanded foils more versatile and application-specific. The shift toward renewable energy systems, especially batteries and fuel cells, is opening up new long-term use cases where foils serve as integral functional components.The expansion of electric vehicle (EV) production, coupled with the rise in investment for grid energy storage, is generating significant demand for copper and aluminum-based expanded foils in electrode and current collector applications. Growth in cleanroom environments and data centers is also supporting the use of anti-static and thermally conductive foil layers. Additionally, supply chain resilience and regional manufacturing incentives are encouraging domestic production of advanced metal meshes across North America, Europe, and Asia-Pacific. As manufacturers explore hybrid materials, multilayer constructions, and recyclable options, expanded metal foils are poised to play an even more prominent role in future-ready industrial design and material engineering.

Report Scope

The report analyzes the Expanded Metal Foils market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Wind Turbine (Horizontal Axis Wind Turbine, Vertical Axis Wind Turbine).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Horizontal Axis Wind Turbine segment, which is expected to reach US$487.9 Million by 2030 with a CAGR of a 5.2%. The Vertical Axis Wind Turbine segment is also set to grow at 8.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $160.3 Million in 2024, and China, forecasted to grow at an impressive 9.9% CAGR to reach $173.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Expanded Metal Foils Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Expanded Metal Foils Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Expanded Metal Foils Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 4KOR Fitness, Black Mountain Products, Inc., Bodylastics Inc., Coresteady, Elitefts.Com and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Expanded Metal Foils market report include:

- CThru Metals

- Heanjia Super Metals Co. Ltd - Quality Supplier leader for super alloys and metals

- Hebei Boni Tech Co., Ltd.

- Hebei Metal Mesh Corp.

- Niles International LLC

- Pacific Coast Composites

- PPG Industries, Inc.

- Thank-Metal Co.,Ltd.

- The Expanded Metal Company

- Wallner Expac, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- CThru Metals

- Heanjia Super Metals Co. Ltd - Quality Supplier leader for super alloys and metals

- Hebei Boni Tech Co., Ltd.

- Hebei Metal Mesh Corp.

- Niles International LLC

- Pacific Coast Composites

- PPG Industries, Inc.

- Thank-Metal Co.,Ltd.

- The Expanded Metal Company

- Wallner Expac, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 588.3 Million |

| Forecasted Market Value ( USD | $ 854.4 Million |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |