Global Military Transmit and Receive Module Market - Key Trends & Drivers Summarized

What Are Military Transmit and Receive Modules and Why Are They Essential?

Military transmit and receive (T/R) modules are critical components in radar, communication, and electronic warfare systems, enabling secure and high-performance signal transmission and reception in defense applications. These modules function as the building blocks of active electronically scanned arrays (AESA) used in modern military radar systems, providing advanced capabilities for target detection, tracking, and surveillance. They are also integral to satellite communications, secure tactical networks, and missile guidance systems, ensuring seamless and reliable data transmission in combat environments.The importance of T/R modules lies in their ability to enhance the performance of military communication and radar systems while improving efficiency, accuracy, and adaptability in dynamic battlefield conditions. Traditional radar and communication technologies relied on mechanically steered antennas, which were slower and more vulnerable to electronic countermeasures. In contrast, T/R modules enable AESA radars to achieve rapid beam steering, improved signal clarity, and enhanced jamming resistance, making them indispensable for air defense, naval operations, and airborne surveillance.

With the increasing complexity of modern warfare, the demand for high-frequency, lightweight, and power-efficient T/R modules is growing. These modules must withstand extreme environmental conditions, including high temperatures, electromagnetic interference, and operational stress, without compromising performance. As defense agencies prioritize network-centric operations and integrated battle management systems, the role of T/R modules in secure, real-time communication and surveillance becomes more critical than ever.

How Are Technological Advancements Shaping the Military T/R Module Market?

The military T/R module market is witnessing rapid advancements in semiconductor technologies, power efficiency, and miniaturization, significantly enhancing the performance of defense systems. One of the most notable innovations is the shift from gallium arsenide (GaAs) to gallium nitride (GaN)-based T/R modules. GaN technology offers superior power density, higher efficiency, and enhanced thermal performance compared to traditional GaAs modules. This translates to improved signal amplification, greater radar detection range, and reduced heat dissipation, making GaN-based modules ideal for high-power applications such as long-range radars and electronic warfare systems.Another major technological trend is the development of software-defined T/R modules, which allow defense agencies to dynamically reconfigure radar and communication systems in real time. Unlike traditional hardware-based solutions, software-defined T/R modules can adapt to different mission requirements, making them more versatile and cost-effective. These systems leverage artificial intelligence (AI) and machine learning algorithms to optimize signal processing, detect anomalies, and counter enemy jamming efforts more effectively.

The integration of multi-band and multi-functional T/R modules is also gaining traction. Modern military operations require the ability to operate across multiple frequency bands for surveillance, targeting, and communication. Multi-band T/R modules allow a single radar or communication system to switch between different frequency ranges, enhancing flexibility and reducing the need for multiple hardware configurations. This is particularly valuable for stealth aircraft, naval vessels, and ground-based air defense systems that rely on seamless multi-domain operations.

Additionally, the miniaturization of T/R modules is revolutionizing defense applications by enabling the deployment of compact, lightweight radar and communication systems. Smaller T/R modules are being integrated into next-generation UAVs, soldier-worn communication devices, and advanced missile guidance systems, improving mobility and operational effectiveness. Advancements in 3D packaging and chip-scale integration are driving this trend, allowing for reduced size without compromising performance.

What Are the Key Challenges Facing the Military T/R Module Market?

Despite the increasing adoption of military T/R modules, the market faces several challenges related to cost, supply chain constraints, and technological complexity. One of the primary concerns is the high cost of GaN-based T/R modules. While GaN technology offers superior performance, it is significantly more expensive to manufacture compared to traditional GaAs modules. The cost factor can limit the widespread adoption of GaN-based T/R modules, particularly for defense agencies with budget constraints or those seeking cost-effective radar and communication solutions.Another major challenge is the dependency on a specialized semiconductor supply chain. The production of high-performance T/R modules requires access to advanced semiconductor fabrication facilities, rare materials, and specialized manufacturing expertise. Global supply chain disruptions, trade restrictions, and geopolitical tensions can create shortages of critical components, delaying production and increasing costs for defense contractors. The push for domestic semiconductor manufacturing in key defense markets such as the U.S., Europe, and China is aimed at addressing these vulnerabilities, but it remains a long-term effort.

Thermal management and power efficiency

also pose challenges in T/R module design. High-power radar and communication systems generate significant heat, which can affect system performance and longevity. Effective cooling solutions, such as advanced heat sinks and liquid cooling mechanisms, must be integrated into T/R module designs to ensure reliable operation under extreme conditions. Additionally, optimizing power efficiency is crucial to reducing energy consumption in military platforms, particularly for airborne and naval applications where power availability is a critical factor.Electronic warfare threats and cybersecurity risks

present another challenge. Modern military systems face increasingly sophisticated jamming, spoofing, and cyberattacks that can disrupt communication and radar functionality. Ensuring that T/R modules are resistant to these threats requires advanced signal processing algorithms, encryption mechanisms, and AI-driven countermeasures. Continuous research and development (R&D) in anti-jamming and cyber-secure communication technologies are necessary to maintain battlefield superiority.What Are the Key Growth Drivers for the Military T/R Module Market?

The growth in the military T/R module market is driven by rising defense budgets, increasing demand for advanced radar and communication systems, and the shift toward electronic warfare capabilities. As military forces worldwide modernize their defense infrastructure, the need for high-performance T/R modules continues to rise, particularly in air defense, naval warfare, and space-based surveillance applications.One of the most significant drivers is the expansion of AESA radar systems. AESA radars are rapidly replacing conventional mechanically scanned radars due to their superior target detection, tracking speed, and resistance to jamming. T/R modules are the core components of AESA radars, making their demand surge as militaries invest in next-generation air superiority fighters, missile defense systems, and naval surveillance platforms. The ongoing procurement of F-35 fighter jets, advanced naval destroyers, and integrated air defense networks is fueling this trend.

The increasing emphasis on multi-domain operations (MDO) and network-centric warfare is another major growth factor. Modern military strategies require seamless integration of land, air, sea, space, and cyber capabilities, all of which rely on high-speed, secure communication networks. T/R modules enable real-time data sharing, long-range communication, and precision targeting, enhancing overall battlefield coordination. The rise of low-Earth orbit (LEO) military satellites and space-based radars is further driving demand for high-frequency, radiation-hardened T/R modules.

The growing adoption of unmanned systems and autonomous defense platforms is also boosting the T/R module market. UAVs, unmanned ground vehicles (UGVs), and autonomous naval vessels require compact, lightweight radar and communication systems to operate effectively. The integration of advanced T/R modules in drone-based surveillance, target acquisition, and electronic warfare applications is expected to accelerate as unmanned systems become a staple of modern defense forces.

Government initiatives and defense contracts for domestic semiconductor production are playing a crucial role in ensuring supply chain resilience and reducing dependency on foreign suppliers. Programs such as the U.S. CHIPS Act, European semiconductor initiatives, and China's push for self-sufficiency in military electronics are expected to enhance the availability of critical semiconductor components for defense applications. As domestic production capabilities expand, the cost of high-performance T/R modules is expected to decline, driving wider adoption.

In conclusion, the military T/R module market is experiencing significant growth due to advancements in radar, electronic warfare, and secure military communications. While challenges such as high costs, supply chain constraints, and cybersecurity threats persist, ongoing R&D efforts and government investments are driving innovation in the sector. As defense agencies worldwide prioritize next-generation military technologies, the demand for advanced T/R modules will continue to rise, ensuring strategic superiority and enhanced battlefield capabilities.

Report Scope

The report analyzes the Military Transmit and Receive Module market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Communication Medium (Radio Frequency Communication, Optical Communication, Hybrid Communication); Application (Radar Application, Communication Application, Electronic Warfare Application, Surveillance Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Radio Frequency Communication segment, which is expected to reach US$5.3 Billion by 2030 with a CAGR of a 5.2%. The Optical Communication segment is also set to grow at 2.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.6 Billion in 2024, and China, forecasted to grow at an impressive 8.2% CAGR to reach $1.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Military Transmit and Receive Module Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Military Transmit and Receive Module Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Military Transmit and Receive Module Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alaska Defense, Alaska Structures, Anchor Industries, Big Top Fabric Structures, Camel Manufacturing and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Military Transmit and Receive Module market report include:

- API Technologies

- CAES System LLC

- Curtiss-Wright Corporation

- Elbit Systems Ltd.

- Fairview Microwave Inc.

- Israel Aerospace Industries

- Kratos Microwave USA

- Kyocera Corporation

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Merrimac Communications

- Northrop Grumman Corporation

- Pasternack Enterprises

- Rheinmetall AG

- Rohde & Schwarz

- RTX Corporation

- Saab AB

- Thales Group

- X-COM Systems

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- API Technologies

- CAES System LLC

- Curtiss-Wright Corporation

- Elbit Systems Ltd.

- Fairview Microwave Inc.

- Israel Aerospace Industries

- Kratos Microwave USA

- Kyocera Corporation

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Merrimac Communications

- Northrop Grumman Corporation

- Pasternack Enterprises

- Rheinmetall AG

- Rohde & Schwarz

- RTX Corporation

- Saab AB

- Thales Group

- X-COM Systems

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 277 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

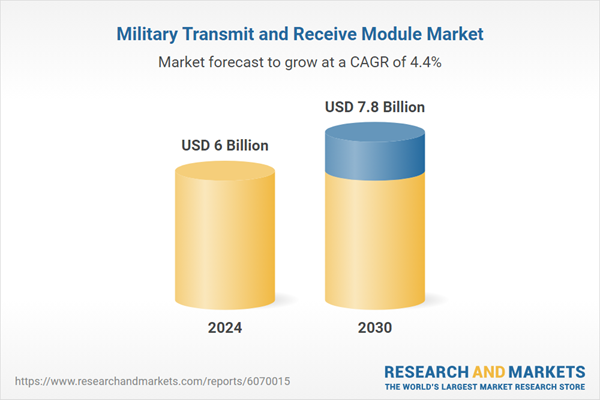

| Estimated Market Value ( USD | $ 6 Billion |

| Forecasted Market Value ( USD | $ 7.8 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |