Global Secondary Paper & Paperboard Luxury Packaging Market - Key Trends & Drivers Summarized

Why Is The Luxury Packaging Industry Embracing Paper-Based Solutions?

The demand for secondary paper and paperboard luxury packaging is rising as high-end brands seek sustainable, eco-friendly alternatives to traditional plastic and metal packaging. Luxury brands in cosmetics, fashion, jewelry, and premium spirits are shifting toward paper-based packaging to align with environmental regulations and consumer preferences for sustainable products. High-end packaging serves as a crucial branding tool, enhancing the unboxing experience while maintaining a premium look and feel. With sustainability becoming a key differentiator in the luxury market, the use of FSC-certified (Forest Stewardship Council) and recycled paperboard is gaining traction. As global luxury markets expand, the demand for high-quality, customizable paper packaging solutions is on the rise.What Innovations Are Enhancing Paper-Based Luxury Packaging?

Technological advancements in material engineering and printing techniques are making paper and paperboard packaging more sophisticated and durable. Embossing, foil stamping, and high-definition digital printing are enabling brands to maintain a premium aesthetic while using sustainable materials. Smart packaging solutions, including RFID-enabled paperboard and NFC-integrated packaging, are enhancing product authentication and consumer engagement. Additionally, the development of bio-based coatings is improving the moisture resistance and longevity of paperboard packaging, making it a viable alternative to traditional plastic coatings. These innovations are driving the adoption of luxury paper packaging across multiple industries.Which Industries Are Driving Demand For Secondary Paper & Paperboard Luxury Packaging?

The luxury fashion, cosmetics, jewelry, and premium beverage industries are leading the adoption of secondary paper and paperboard packaging. High-end perfume and skincare brands are embracing eco-friendly packaging to appeal to environmentally conscious consumers. The spirits and wine industry is also shifting toward paper-based gift boxes and display packaging. Additionally, luxury confectionery and gourmet food brands are investing in high-quality, biodegradable packaging to enhance product appeal. As brands prioritize sustainability, the paperboard luxury packaging market is experiencing rapid expansion.What Factors Are Fueling The Growth Of The Paper-Based Luxury Packaging Market?

The growth in the secondary paper & paperboard luxury packaging market is driven by increasing sustainability regulations, rising consumer demand for eco-friendly packaging, and innovations in biodegradable materials. The push for plastic-free packaging is encouraging luxury brands to explore premium, recyclable alternatives. The expansion of e-commerce and direct-to-consumer sales channels is also boosting demand for secondary packaging that enhances the unboxing experience. Additionally, the rise of personalization and limited-edition luxury packaging is fueling demand for high-quality paperboard solutions. As sustainability continues to shape packaging trends, the market for luxury paper packaging is set for substantial growth.Report Scope

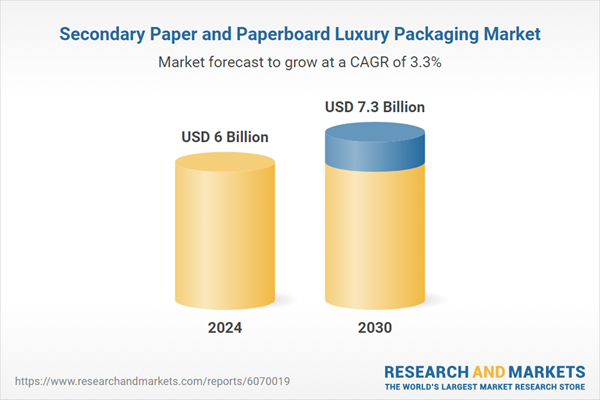

The report analyzes the Secondary Paper and Paperboard Luxury Packaging market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Grade (Solid Bleached Sulfate, White Lined Chipboard, Kraft Paper, Glassine & Greaseproof Paper, Others); End-Use (Cosmetics & Fragrances, Confectionery, Watches & Jewelry, Premium Beverages, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Solid Bleached Sulfate Grade segment, which is expected to reach US$2.6 Billion by 2030 with a CAGR of a 4.8%. The White Lined Chipboard Grade segment is also set to grow at 1.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.6 Billion in 2024, and China, forecasted to grow at an impressive 6.5% CAGR to reach $1.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Secondary Paper and Paperboard Luxury Packaging Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Secondary Paper and Paperboard Luxury Packaging Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Secondary Paper and Paperboard Luxury Packaging Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AgustaWestland (Leonardo), Air Rescue Systems, Airbus Defence and Space, Airbus Helicopters, Babcock International Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Secondary Paper and Paperboard Luxury Packaging market report include:

- Amcor Limited

- Arjowiggins Group

- Arkay Packaging

- Bellwyck Packaging Solutions

- CLP Packaging Solutions Inc.

- Cosfibel Group

- DS Smith Plc

- Fedrigoni S.p.A.

- GPA Global

- HH Deluxe Packaging

- Holmen Iggesund

- Hunter Luxury

- International Paper Company

- IPL Packaging

- KOLBUS GmbH & Co. KG

- Luxpac

- Mayr-Melnhof Karton AG

- Metsä Board

- MM Group

- Mondi Group

- Prestige Packaging Industries

- Progress Packaging

- Pusterla 1880

- Robinson plc

- Sappi Limited

- Smurfit Kappa

- Stora Enso

- Tinshine

- WestRock Company

- Winter & Company AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amcor Limited

- Arjowiggins Group

- Arkay Packaging

- Bellwyck Packaging Solutions

- CLP Packaging Solutions Inc.

- Cosfibel Group

- DS Smith Plc

- Fedrigoni S.p.A.

- GPA Global

- HH Deluxe Packaging

- Holmen Iggesund

- Hunter Luxury

- International Paper Company

- IPL Packaging

- KOLBUS GmbH & Co. KG

- Luxpac

- Mayr-Melnhof Karton AG

- Metsä Board

- MM Group

- Mondi Group

- Prestige Packaging Industries

- Progress Packaging

- Pusterla 1880

- Robinson plc

- Sappi Limited

- Smurfit Kappa

- Stora Enso

- Tinshine

- WestRock Company

- Winter & Company AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 297 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6 Billion |

| Forecasted Market Value ( USD | $ 7.3 Billion |

| Compound Annual Growth Rate | 3.3% |

| Regions Covered | Global |