Global Sugar-Based Surfactants Market - Key Trends & Drivers Summarized

Why Are Sugar-Based Surfactants Emerging as the Sustainable Choice in Formulation Science?

Sugar-based surfactants, also known as glycolipids or alkyl polyglucosides (APGs), are gaining widespread acceptance as the global demand for eco-friendly and biodegradable ingredients continues to accelerate. Derived from renewable resources such as glucose (from corn, wheat, or sugarcane) and fatty alcohols (often sourced from coconut or palm), these surfactants offer a sustainable alternative to petroleum-derived or synthetic variants. With growing concerns about the environmental and health impacts of conventional surfactants - especially sulfates and ethoxylates - consumers and formulators alike are shifting toward greener solutions that minimize aquatic toxicity and are safer for skin contact. Sugar-based surfactants exhibit low toxicity, excellent dermatological compatibility, and robust biodegradability, making them particularly popular in personal care, baby care, and household cleaning products. Regulatory bodies and sustainability frameworks such as REACH, COSMOS, and the USDA BioPreferred Program are further propelling their adoption by certifying and promoting their use. As global consumer awareness around ingredient transparency and environmental responsibility grows, sugar-based surfactants are carving out a prominent niche in natural product formulations, influencing both legacy manufacturers and emerging clean-label brands to reformulate using naturally derived, high-performing alternatives.How Are Consumer Trends and Industry Innovation Converging in This Market?

The sugar-based surfactants market is being shaped by the convergence of conscious consumerism and industry-driven innovation. Today's consumers are more informed, demanding products that are not only effective but also ethically sourced, cruelty-free, and biodegradable. This shift has prompted companies across industries - cosmetics, detergents, pharmaceuticals, and agriculture - to rethink their ingredient portfolios and adopt sugar-derived surfactants as both a performance enhancer and a marketing differentiator. In response, manufacturers are investing in research to optimize these ingredients for multifunctionality: enhancing foaming, emulsification, and mild cleansing properties while maintaining skin and environmental safety. Major players are also expanding into specialized formats such as concentrated formulations, solid-state products (like bar shampoos and facial cleansers), and waterless technologies where sugar-based surfactants shine due to their stability and efficacy. Technological improvements in biocatalysis and fermentation are also making it more cost-effective to produce complex sugar surfactant molecules with improved performance across pH ranges and hard water tolerance. This alignment of consumer values with scalable industrial production is not just transforming how surfactants are manufactured, but also how entire categories of goods are marketed - from “natural” and “non-toxic” to “climate-conscious” and “zero-waste.”Are Regulations and Global Standards Catalyzing Market Transformation?

Yes, evolving global regulations and industry standards are playing a pivotal role in accelerating the adoption of sugar-based surfactants. Governments and international regulatory bodies are increasingly implementing policies that promote the use of renewable raw materials, restrict hazardous substances, and reward eco-certifications. In the European Union, for instance, the REACH regulation has encouraged the replacement of synthetic surfactants with safer alternatives, driving innovation in sugar-derived products. Similarly, North America's rising emphasis on clean-label products and ingredient transparency - particularly in California under Proposition 65 - has made sugar-based surfactants a preferred option for manufacturers aiming to meet evolving compliance norms. The cosmetics industry is seeing the influence of the COSMOS and ECOCERT certifications, which prioritize natural origin and environmental impact, further bolstering demand. Additionally, the food-grade quality and GRAS (Generally Recognized As Safe) status of certain sugar surfactants make them suitable for pharmaceutical and food-related applications. These evolving regulations are not merely limitations - they are acting as catalysts for innovation, pushing companies to invest in greener technologies, partner with biotech firms, and seek supply chain transparency that aligns with ESG (Environmental, Social, and Governance) goals. In this regulatory-driven climate, sugar-based surfactants are no longer a niche option - they're fast becoming a new industry benchmark.What's Fueling the Rapid Growth of This Market on a Global Scale?

The growth in the sugar-based surfactants market is driven by several factors tied to raw material accessibility, changing formulation needs, shifting consumer behavior, and industrial expansion. First and foremost, the abundance and renewability of feedstocks such as glucose and fatty alcohols make sugar surfactants an economically viable and sustainable option in the long term. Second, consumer demand for non-toxic, biodegradable, and plant-derived products is reshaping entire industries, from beauty and home care to industrial cleaning and agrochemicals. Sugar-based surfactants, due to their gentle cleansing properties and environmental compatibility, are ideal for sensitive-skin applications, child care, and sustainable formulations - segments that are growing rapidly across global markets. Third, the increasing adoption of green chemistry principles by both multinational corporations and indie startups is fostering innovation in production processes, leading to better cost-efficiency and wider application scopes. Furthermore, as supply chains globalize, developing regions like Asia-Pacific and Latin America are not only emerging as production hubs but also as high-growth consumer markets, aided by rising disposable incomes and environmental awareness. Collaborations between chemical companies and biotechnology firms are further enhancing product development, while investment in clean-label technologies continues to attract funding from both public and private sectors. Collectively, these dynamics are positioning sugar-based surfactants as a high-growth, high-impact segment within the broader surfactants and specialty chemicals market.Report Scope

The report analyzes the Sugar-based Surfactants market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Alkyl Polyglycoside, Decyl Glucoside, Sucrose Cocoate, Others); Raw Material (Monomeric, Polymeric, Dimeric); Application (Biotechnology, Homecare & Personal Care, Pharmaceuticals, Agriculture, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Alkyl Polyglycoside segment, which is expected to reach US$3.6 Billion by 2030 with a CAGR of a 5.6%. The Decyl Glucoside segment is also set to grow at 3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.7 Billion in 2024, and China, forecasted to grow at an impressive 8.3% CAGR to reach $1.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Sugar-based Surfactants Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Sugar-based Surfactants Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Sugar-based Surfactants Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

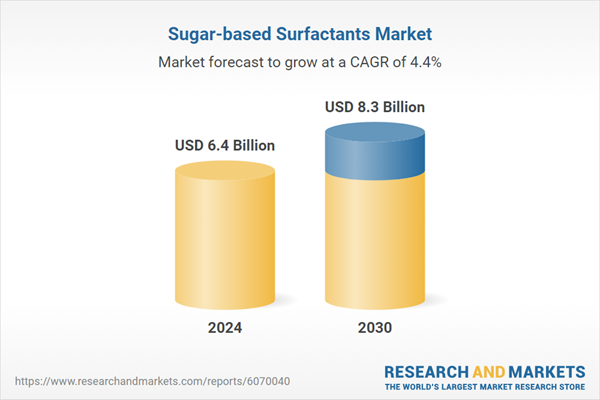

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AirLife (a subsidiary of Vyaire Medical), Amsino International, Inc., B. Braun Melsungen AG, Becton, Dickinson and Company (BD), Cardinal Health and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Sugar-based Surfactants market report include:

- AGAE Technologies

- AkzoNobel N.V.

- Arkema

- BASF SE

- Cardolite Corporation

- Cargill, Incorporated

- Clariant AG

- Croda International Plc

- Dispersa

- Dow Inc.

- Evonik Industries AG

- Galaxy Surfactants Ltd.

- GlycoSurf

- Hansa Group AG

- Henkel AG & Co. KGaA

- Henkel AG & Co. KGaA

- Huntsman Corporation

- Kao Corporation

- LG Household & Health Care Ltd.

- Lonza Group AG

- NOVEL CHEM

- Pilot Chemical Company

- Seatex Corporation

- SEPPIC S.A.

- Shanghai Fine Chemicals Co., Ltd.

- Solvay S.A.

- Stepan Company

- Tate & Lyle PLC

- Vijaya Enterprises

- VSM AGRO

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AGAE Technologies

- AkzoNobel N.V.

- Arkema

- BASF SE

- Cardolite Corporation

- Cargill, Incorporated

- Clariant AG

- Croda International Plc

- Dispersa

- Dow Inc.

- Evonik Industries AG

- Galaxy Surfactants Ltd.

- GlycoSurf

- Hansa Group AG

- Henkel AG & Co. KGaA

- Henkel AG & Co. KGaA

- Huntsman Corporation

- Kao Corporation

- LG Household & Health Care Ltd.

- Lonza Group AG

- NOVEL CHEM

- Pilot Chemical Company

- Seatex Corporation

- SEPPIC S.A.

- Shanghai Fine Chemicals Co., Ltd.

- Solvay S.A.

- Stepan Company

- Tate & Lyle PLC

- Vijaya Enterprises

- VSM AGRO

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 378 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.4 Billion |

| Forecasted Market Value ( USD | $ 8.3 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |