Global Arabinoxylan Fibers Market - Key Trends & Drivers Summarized

Why Are Arabinoxylan Fibers Gaining Popularity in the Functional Food and Nutraceutical Sectors?

Arabinoxylan fibers, a class of complex polysaccharides found predominantly in cereal grains such as wheat, rye, barley, and corn, are gaining considerable attention in the functional food and nutraceutical industries. The increasing consumer preference for dietary fibers and plant-based nutrition has fueled the demand for arabinoxylan as a functional ingredient in health-focused food formulations. The growing interest in gut health and the role of prebiotics in digestive wellness have positioned arabinoxylan as an essential component in fiber-enriched foods, dietary supplements, and functional beverages. Additionally, with the rising prevalence of lifestyle-related health issues such as obesity, diabetes, and cardiovascular diseases, food manufacturers are incorporating arabinoxylan into fortified products aimed at promoting metabolic health and glycemic control. The trend toward clean-label and minimally processed ingredients has also contributed to its increasing adoption, as consumers demand fiber-rich alternatives without artificial additives. Meanwhile, the global shift toward plant-based diets has led to greater exploration of arabinoxylan’ s potential as a natural thickening and stabilizing agent in dairy alternatives, bakery products, and gluten-free formulations.How Are Advancements in Extraction and Processing Enhancing Arabinoxylan Utilization?

Significant advancements in extraction and processing technologies have improved the commercial viability of arabinoxylan fibers, making them more accessible for large-scale food production, pharmaceuticals, and industrial applications. Traditional extraction methods using alkaline or enzymatic treatments have evolved into more efficient and sustainable techniques, including ultrasound-assisted extraction (UAE) and microwave-assisted extraction (MAE), which enhance yield while preserving the bioactive properties of arabinoxylan. The integration of biorefinery approaches is also optimizing the valorization of agricultural byproducts, allowing for the extraction of arabinoxylan from wheat bran and corn husks with minimal waste generation. Additionally, advancements in microencapsulation and spray-drying technologies are improving the stability and solubility of arabinoxylan fibers in liquid-based formulations, expanding their applications in nutraceuticals and functional beverages. The development of high-purity arabinoxylan fractions with improved water-binding capacity and controlled viscosity has further increased its use in food texturization, where it serves as a natural alternative to synthetic hydrocolloids. As these technologies continue to evolve, they are not only enhancing product consistency and formulation flexibility but also driving down production costs, making arabinoxylan fibers more competitive in the global dietary fiber market.What Market Trends Are Driving the Adoption of Arabinoxylan in Diverse Industries?

Several key market trends are shaping the demand for arabinoxylan fibers, particularly in the food, pharmaceutical, and biotechnology sectors. The increasing consumer focus on fiber-rich diets and digestive wellness has led to a surge in the development of prebiotic-enhanced foods and beverages, with arabinoxylan being widely incorporated into fiber-fortified cereals, snack bars, and probiotic formulations. The growing demand for plant-derived, non-GMO ingredients is further driving the expansion of arabinoxylan-based products, as brands seek to align with consumer preferences for clean-label and allergen-free options. In the pharmaceutical industry, arabinoxylan is being explored for its role in drug delivery systems, particularly in controlled-release formulations where its gel-forming and emulsifying properties enhance bioavailability. Additionally, the rapid expansion of the bio-based materials industry has opened new avenues for arabinoxylan in biodegradable films, sustainable packaging, and green adhesives, further broadening its market potential. Meanwhile, the increasing adoption of arabinoxylan in sports nutrition and weight management products reflects the broader trend of consumers prioritizing functional ingredients that support overall health and well-being. With growing scientific research validating the benefits of arabinoxylan in human health, its integration into novel formulations across multiple industries is expected to continue accelerating.What Are the Key Growth Drivers Fueling the Arabinoxylan Fibers Market?

The growth in the arabinoxylan fibers market is driven by several factors, including advancements in extraction technology, the increasing demand for functional and fiber-rich foods, and expanding applications in pharmaceuticals and bio-based materials. The rising adoption of innovative processing techniques, such as enzymatic hydrolysis and high-pressure processing, is improving the commercial availability of high-purity arabinoxylan, making it more attractive to manufacturers. Additionally, the shift toward personalized nutrition and gut microbiome-targeted dietary solutions is driving increased investment in prebiotic and fiber-based formulations, further boosting demand. The expanding research on arabinoxylan’ s role in modulating immune function and glycemic response is also contributing to its increased incorporation into medical foods and therapeutic dietary interventions. Meanwhile, the sustainability-driven trend of utilizing agricultural residues for high-value product development is enhancing the cost-effectiveness and environmental appeal of arabinoxylan extraction. Regulatory approvals supporting the use of natural dietary fibers in health-promoting foods and nutraceuticals are further strengthening the market, encouraging manufacturers to invest in product innovation and formulation expansion. As global consumers continue to prioritize wellness, clean-label ingredients, and functional nutrition, the arabinoxylan fibers market is set for sustained growth, fueled by technological advancements, evolving dietary trends, and an increasing emphasis on plant-based and sustainable product development.Report Scope

The report analyzes the Arabinoxylan Fibers market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Source (Wheat Source, Rice Source, Barley Source, Oats Source, Maize Source, Rye Source, Millet Source, Other Sources); Application (Food Application, Beverages Application, Pharmaceutical Application, Animal Nutrition Application, Personal Care & Cosmetics Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Wheat Source segment, which is expected to reach US$14.8 Million by 2030 with a CAGR of a 9%. The Rice Source segment is also set to grow at 8.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $9.2 Million in 2024, and China, forecasted to grow at an impressive 7.2% CAGR to reach $8.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Arabinoxylan Fibers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Arabinoxylan Fibers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Arabinoxylan Fibers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

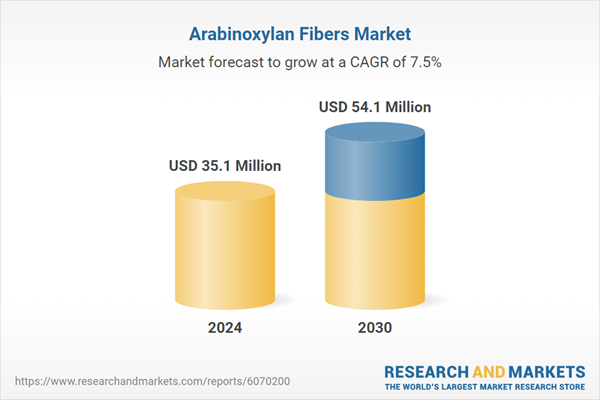

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Apple, Inc., AppliedVR, Inc., Autodesk, Inc., Blippar.Com Ltd., EON Reality, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Arabinoxylan Fibers market report include:

- Archer-Daniels-Midland Company

- ClonBio Group Ltd.

- Comet Biorefining, Inc.

- Cosucra Groupe Warcoing SA

- Daiwa Pharmaceutical Co. Ltd.

- H.L. Agro Products Pvt. Ltd.

- Ingredion, Inc.

- J Rettenmaier & Shone GmbH + Co Kg

- Megazyme Ltd.

- Roquette FrAres

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Archer-Daniels-Midland Company

- ClonBio Group Ltd.

- Comet Biorefining, Inc.

- Cosucra Groupe Warcoing SA

- Daiwa Pharmaceutical Co. Ltd.

- H.L. Agro Products Pvt. Ltd.

- Ingredion, Inc.

- J Rettenmaier & Shone GmbH + Co Kg

- Megazyme Ltd.

- Roquette FrAres

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 206 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 35.1 Million |

| Forecasted Market Value ( USD | $ 54.1 Million |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | Global |