Global Ultrasound Needle Guides Market - Key Trends & Drivers Summarized

Can Precision and Safety in Procedures Redefine the Role of Ultrasound Needle Guides?

The increasing emphasis on accuracy and safety in medical procedures is pushing ultrasound needle guides into the spotlight as essential tools in interventional and diagnostic imaging. These guides play a pivotal role in helping clinicians achieve optimal needle placement during ultrasound-guided interventions such as biopsies, nerve blocks, vascular access, and fluid drainage. Their use significantly reduces procedural errors, minimizes patient discomfort, and improves first-pass success rates, particularly in high-risk or anatomically complex cases. In an era where healthcare systems are focusing on outcome-based care and reducing procedural variability, the role of ultrasound needle guides is gaining prominence. The technology is especially relevant in environments with high patient throughput, such as emergency departments, ICUs, and interventional radiology suites. Furthermore, needle guides are increasingly becoming standard in educational settings, supporting the training of new clinicians in ultrasound-guided procedures with enhanced confidence and consistency. This shift toward technique standardization and clinical efficiency is gradually transforming the ultrasound needle guide from a niche accessory into a routine necessity in procedural care. As both diagnostic and therapeutic procedures migrate toward minimally invasive modalities, the adoption of supportive technologies like needle guides continues to accelerate.Why Is the Shift to Point-of-Care Ultrasound (POCUS) Accelerating the Need for Needle Guides?

One of the most transformative trends in healthcare today is the growing use of point-of-care ultrasound (POCUS), which is reshaping how and where ultrasound procedures are performed. With POCUS becoming increasingly accessible across a variety of specialties - emergency medicine, anesthesiology, critical care, and even general practice - the need for intuitive, user-friendly guidance tools like needle guides is surging. These devices are particularly valuable for non-radiologists or less experienced users who require additional support to achieve procedural accuracy in real-time. The democratization of ultrasound, facilitated by the proliferation of portable and handheld devices, has allowed more clinicians to perform bedside interventions with minimal delay. In such settings, needle guides improve workflow efficiency by aligning the needle trajectory with the imaging plane, eliminating trial-and-error approaches that may otherwise compromise safety. Furthermore, the integration of disposable and sterile needle guide systems is making them highly suitable for rapid deployment in time-sensitive environments. This aligns perfectly with the demands of outpatient settings, ambulance services, and field hospitals, where rapid diagnostics and interventions can be life-saving. As POCUS becomes embedded into the daily workflow of modern healthcare providers, needle guides are emerging as indispensable tools that elevate the safety and efficiency of ultrasound-guided care delivery.Could Innovation in Imaging and Device Design Reshape the Next Generation of Needle Guides?

Technological innovation in imaging, materials, and ergonomic design is expanding the functionality and appeal of ultrasound needle guides, allowing them to meet a broader range of clinical needs. Advancements in 3D imaging and real-time needle tracking are enabling more precise alignment, while smart needle guide systems - integrated with sensors and software - are being developed to provide visual or haptic feedback during needle insertion. These next-generation systems aim to reduce reliance on hand-eye coordination, making procedures more intuitive for both seasoned professionals and trainees. On the hardware front, manufacturers are focusing on compatibility with an increasing array of ultrasound probes, introducing universal mounts and adjustable guide designs that cater to diverse clinical settings. Additionally, the use of high-quality biocompatible polymers has allowed the development of disposable, sterile guides that address infection control concerns while offering cost-effective scalability. Customization is also gaining traction, with specialty guides being developed for specific procedures such as central line placement, regional anesthesia, or fine needle aspiration. Innovations in packaging and sterilization techniques are ensuring ease of use and compliance with infection control protocols. This rapid pace of innovation is making needle guides smarter, safer, and more integrated with broader procedural ecosystems, thereby deepening their clinical relevance across multiple use cases.What Is Driving the Sustained Growth of the Ultrasound Needle Guides Market Worldwide?

The growth in the ultrasound needle guides market is driven by several factors closely linked to healthcare delivery trends, user adoption patterns, and evolving clinical protocols. A primary growth driver is the rising global demand for minimally invasive and image-guided procedures across emergency care, anesthesia, oncology, and vascular interventions. The increased use of ultrasound in point-of-care settings is expanding the user base beyond radiologists to include generalists, intensivists, and paramedics, who often rely on needle guides for enhanced accuracy. Surgeons and interventionalists are increasingly adopting needle guides to improve procedural standardization and reduce complication rates, especially in high-stakes procedures such as biopsies or central venous catheterizations. The growing volume of outpatient and ambulatory procedures is also driving demand for cost-effective, sterile, single-use needle guides that align with infection prevention protocols. Furthermore, the development of universal and probe-specific guide designs is boosting cross-platform compatibility, making them more adaptable to varying clinical infrastructures. Investment in healthcare infrastructure in emerging markets is further widening adoption, especially as portable ultrasound systems become more prevalent. Training institutions and simulation centers are incorporating needle guides into skill-building modules, cementing their role in the next generation of clinical education. Combined with regulatory support for safety-enhancing medical devices and increased awareness of clinical best practices, these factors are creating a strong, sustained growth trajectory for the ultrasound needle guides market.Report Scope

The report analyzes the Ultrasound Needle Guides market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Reusable, Disposable); Application (Tissue Biopsy, Fluid Aspiration, Nerve Block, Regional Anesthesia, Vascular Access, Others); End-Use (Hospitals & Clinics, Ambulatory Surgery Centers, Diagnostic Imaging Centers, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Reusable Needle Guides segment, which is expected to reach US$322.5 Million by 2030 with a CAGR of a 3.7%. The Disposable Needle Guides segment is also set to grow at 1.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $103.6 Million in 2024, and China, forecasted to grow at an impressive 5.9% CAGR to reach $90.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Ultrasound Needle Guides Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Ultrasound Needle Guides Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Ultrasound Needle Guides Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

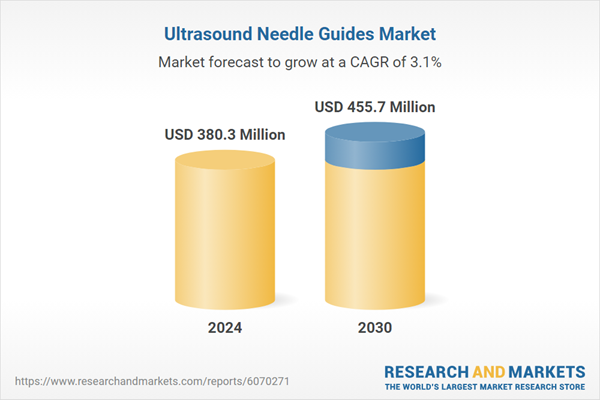

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aquasonic Gel (Parker Laboratories), Bovie Medical Corporation, Cardinal Health, Compass Health Brands, Eco-Med Diagnostic Imaging and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Ultrasound Needle Guides market report include:

- Aspen Surgical

- BK Medical

- Terason

- CIVCO Medical Solutions

- EDM Medical Solutions

- Esaote S.p.A.

- FUJIFILM Sonosite, Inc.

- GE HealthCare

- Hitachi Healthcare Americas

- Koelis

- Leapmed Healthcare Corporation

- McKesson Medical-Surgical

- Medline Industries, LP

- Mermaid Medical Group

- Mindray Medical International Limited

- Nanjing Keweisi Medical Technology

- Philips Healthcare

- Samsung Medison Co., Ltd.

- Siemens Healthineers

- SonoScape Medical Corp.

- SuperSonic Imagine

- Telemed Medical Systems

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aspen Surgical

- BK Medical

- Terason

- CIVCO Medical Solutions

- EDM Medical Solutions

- Esaote S.p.A.

- FUJIFILM Sonosite, Inc.

- GE HealthCare

- Hitachi Healthcare Americas

- Koelis

- Leapmed Healthcare Corporation

- McKesson Medical-Surgical

- Medline Industries, LP

- Mermaid Medical Group

- Mindray Medical International Limited

- Nanjing Keweisi Medical Technology

- Philips Healthcare

- Samsung Medison Co., Ltd.

- Siemens Healthineers

- SonoScape Medical Corp.

- SuperSonic Imagine

- Telemed Medical Systems

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 376 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 380.3 Million |

| Forecasted Market Value ( USD | $ 455.7 Million |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | Global |