Global Aluminum Foams Market - Key Trends & Drivers Summarized

Why Are Aluminum Foams Gaining Traction Across Diverse Industries?

Aluminum foams are rapidly gaining popularity across various industries due to their unique combination of lightweight structure, high strength-to-weight ratio, and exceptional energy absorption capabilities. These advanced materials are widely used in industries such as automotive, aerospace, construction, and defense, where their ability to provide impact resistance, thermal insulation, and sound dampening makes them highly desirable. The automotive sector, in particular, has been increasingly adopting aluminum foams for crash management systems, lightweight structural components, and noise-reducing panels, driven by the demand for fuel-efficient and environmentally friendly vehicles. Similarly, the aerospace industry is utilizing aluminum foams to achieve significant weight reductions while maintaining structural integrity, thereby enhancing fuel efficiency and performance.In the construction sector, aluminum foams are being incorporated into modern building designs for their fire-resistant properties, energy-efficient insulation, and noise reduction capabilities, making them suitable for both residential and commercial applications. Moreover, the growing focus on sustainable construction materials has further propelled the demand for aluminum foams, as they are fully recyclable and contribute to green building initiatives. Defense and military applications are another critical area where aluminum foams are being deployed in ballistic protection systems, explosion mitigation structures, and lightweight armor solutions, offering enhanced safety without adding excessive weight. As industries continue to explore advanced materials that balance performance and sustainability, aluminum foams are expected to witness increased adoption across diverse applications.

How Are Technological Advancements Driving Innovation in Aluminum Foam Manufacturing?

Technological advancements in aluminum foam manufacturing have played a crucial role in enhancing their properties, production efficiency, and application potential. Innovations in production techniques, such as powder metallurgy, foaming agents, and direct foaming methods, have allowed manufacturers to produce aluminum foams with improved porosity control, structural integrity, and tailored mechanical properties. Advanced processing techniques, including additive manufacturing and 3D printing, have further expanded the design possibilities of aluminum foams, enabling the creation of complex geometries with optimized performance characteristics. These advancements have made it possible to customize aluminum foams for specific end-use applications, such as heat exchangers, energy absorption systems, and acoustic insulation panels.In addition to process improvements, material scientists are exploring new alloy compositions and surface treatments to enhance the mechanical and thermal properties of aluminum foams. The integration of nanotechnology in foam production is also being investigated to achieve superior strength and conductivity while maintaining the lightweight nature of the material. Furthermore, advancements in computer-aided design (CAD) and simulation technologies have enabled manufacturers to predict the behavior of aluminum foams under various conditions, leading to optimized product development and reduced prototyping costs. With continuous research and development efforts aimed at improving the cost-effectiveness and scalability of production processes, aluminum foams are becoming increasingly viable for large-scale industrial applications.

What Are the Emerging Applications and Market Trends in the Aluminum Foam Industry?

The aluminum foam industry is witnessing several emerging applications and market trends that are shaping its growth and expansion. One of the key trends driving demand is the increasing use of aluminum foams in the energy sector, particularly in battery enclosures and heat dissipation systems for electric vehicles (EVs). As the global push for electrification intensifies, manufacturers are seeking lightweight materials that can provide efficient thermal management and structural support, making aluminum foams an ideal choice. Another growing application is in the marine industry, where aluminum foams are used for hull structures, bulkheads, and buoyancy applications due to their corrosion resistance and impact absorption properties.The architectural and interior design sectors are also exploring innovative uses of aluminum foams in decorative panels, partitions, and furniture, leveraging their aesthetic appeal and functional benefits. Additionally, the healthcare sector is adopting aluminum foams for orthopedic implants, prosthetics, and lightweight medical equipment, benefiting from their biocompatibility and mechanical strength. The growing focus on sustainability and the circular economy has also prompted increased interest in aluminum foams for eco-friendly packaging solutions, providing lightweight and protective materials for high-value products. With rapid urbanization and technological advancements, new applications are expected to emerge, further solidifying the role of aluminum foams in a wide range of industries.

What Are the Key Factors Driving the Growth of the Aluminum Foams Market?

The growth in the aluminum foams market is driven by several factors, including technological advancements in manufacturing processes, increasing adoption in end-use industries, and evolving consumer preferences for lightweight and sustainable materials. The automotive and aerospace industries are key contributors to market expansion, as manufacturers seek to enhance vehicle and aircraft performance through weight reduction and improved energy efficiency. The growing emphasis on safety and impact absorption in sectors such as defense, construction, and transportation is further propelling the demand for aluminum foams. Consumer preferences for eco-friendly and recyclable materials are also playing a critical role, prompting industries to incorporate aluminum foams into sustainable product solutions. Additionally, the expansion of electric mobility and renewable energy infrastructure is creating new opportunities for aluminum foams in energy storage and thermal management applications. As regulatory bodies impose stricter environmental and safety standards, manufacturers are investing in research and development to produce advanced aluminum foam solutions that meet industry-specific requirements. The increasing availability of high-performance aluminum foams and the expansion of global supply chains are expected to support market growth in the coming years.Report Scope

The report analyzes the Aluminum Foams market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Open-Cell Aluminum Foam, Closed-Cell Aluminum Foam); Application (Anti-Intrusion Bars Application, Heat Exchangers Application, Sound Insulation Application, Filters Application, Other Applications); End-Use (Automotive End-Use, Construction and Infrastructure End-Use, Industrial End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Open-Cell Aluminum Foam segment, which is expected to reach US$30.7 Million by 2030 with a CAGR of a 4.2%. The Closed-Cell Aluminum Foam segment is also set to grow at 2.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $12.5 Million in 2024, and China, forecasted to grow at an impressive 6.4% CAGR to reach $11.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Aluminum Foams Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Aluminum Foams Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Aluminum Foams Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as American Douglas Metals, Inc., Arconic, Inc., Constellium NV, Elvalhalcor Hellenic Copper and Aluminum Industry S.A, FONNOV Aluminium Extrusion & Fabrication and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Aluminum Foams market report include:

- Alantum Corporation

- American Elements

- Beihai Composite Materials Co., Ltd.

- CYMAT Technologies Ltd.

- ERG Aerospace Corporation

- FoamTech Global

- Havel metal foam GmbH

- Liaoning Rongda New Materials Technology Co., Ltd.

- NanochemZone

- Nanoshel LLC

- Pohltec Metalfoam GmbH

- Xiamen Tmax Battery Equipments Limited.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alantum Corporation

- American Elements

- Beihai Composite Materials Co., Ltd.

- CYMAT Technologies Ltd.

- ERG Aerospace Corporation

- FoamTech Global

- Havel metal foam GmbH

- Liaoning Rongda New Materials Technology Co., Ltd.

- NanochemZone

- Nanoshel LLC

- Pohltec Metalfoam GmbH

- Xiamen Tmax Battery Equipments Limited.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 371 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

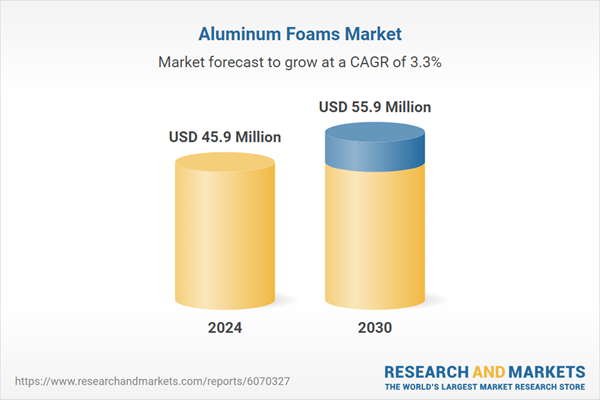

| Estimated Market Value ( USD | $ 45.9 Million |

| Forecasted Market Value ( USD | $ 55.9 Million |

| Compound Annual Growth Rate | 3.3% |

| Regions Covered | Global |