Global Sports Nutrition and Dietary Supplements Testing & Certification Market - Key Trends & Drivers Summarized

Why Is Testing & Certification Becoming Central to the Sports Nutrition Industry?

As the global sports nutrition and dietary supplements industry continues to expand, testing and certification have emerged as vital safeguards for ensuring product safety, quality, efficacy, and regulatory compliance. Driven by rising consumer awareness, athlete safety protocols, and increasingly stringent global regulations, the role of third-party testing and independent certification has never been more critical. The market is flooded with performance-enhancing products - ranging from protein powders and pre-workout formulas to recovery drinks and micronutrient supplements - many of which are self-regulated or manufactured in loosely controlled environments. For competitive athletes, the risk of contamination with banned substances can result in career-ending sanctions, prompting governing bodies, sports organizations, and training academies to mandate certified products. Even recreational users are growing more cautious, increasingly demanding products that are non-GMO, allergen-free, and tested for heavy metals, stimulants, or adulterants. In this context, testing and certification not only build consumer trust but also serve as critical tools for brand differentiation, supply chain transparency, and international market entry. This ecosystem of trust and compliance is transforming testing and certification from a back-end compliance measure into a front-line brand asset.How Are Technology and Evolving Standards Reshaping Testing Protocols and Certification Models?

Advancements in laboratory technology, analytical chemistry, and molecular diagnostics are dramatically improving the accuracy, sensitivity, and scope of sports nutrition testing protocols. High-performance liquid chromatography (HPLC), gas chromatography-mass spectrometry (GC-MS), and isotope-ratio mass spectrometry (IRMS) are now routinely used to detect trace levels of prohibited substances, contaminants, and impurities in supplement formulations. DNA barcoding is increasingly being adopted to verify botanical ingredients and detect adulteration in herbal-based products. Simultaneously, rapid testing methods and portable spectrometers are being piloted for on-site quality control, especially in decentralized manufacturing hubs. Certification frameworks are also evolving - programs such as NSF Certified for Sport, Informed-Sport, BSCG Certified Drug Free, and USP Verified are setting new standards for transparency and rigor, often requiring facility audits, batch-wise testing, and label claim verification. The rise of blockchain-backed certification and digital traceability is further enhancing consumer confidence by offering transparent, tamper-proof records of a product's manufacturing and testing history. These technological and regulatory developments are not only raising the bar for compliance but also enabling brands to proactively mitigate risks, respond to recalls, and expand into new markets with confidence.Where Is Demand Growing Fastest, and Who Are the Key Stakeholders Fueling Market Expansion?

Demand for testing and certification services is surging across North America, Europe, and increasingly Asia-Pacific, where the rise of sports culture, fitness trends, and functional foods is driving supplement consumption among both elite athletes and health-conscious consumers. In the United States, the presence of high-profile sports leagues (NFL, MLB, NCAA) and strict anti-doping regulations has made third-party certified supplements the industry norm. In Europe, increased regulatory oversight under EFSA and consumer pressure for clean-label products are pushing manufacturers to invest in independent verification. Meanwhile, Asia-Pacific is witnessing rapid adoption due to growing fitness adoption in countries like China, India, and Japan, where supplement brands seek to differentiate themselves in crowded and competitive markets. Key stakeholders include sports federations, anti-doping agencies, regulatory bodies, contract manufacturers, testing labs, and supplement brands themselves - all playing interconnected roles in building a safe and trustworthy product ecosystem. Online retailers and specialty health stores are also increasingly requiring proof of certification to feature products on their platforms, effectively making testing a gateway to retail visibility. Furthermore, consumer advocacy groups and athlete unions are lobbying for stricter enforcement and transparent testing disclosures, adding momentum to the demand for standardized certification protocols worldwide.What's Driving the Long-term Growth of the Sports Nutrition and Dietary Supplements Testing & Certification Market?

The growth in the sports nutrition and dietary supplements testing & certification market is driven by a blend of consumer expectations, regulatory tightening, market globalization, and brand protection imperatives. A key driver is the increased consumption of supplements across mainstream and niche consumer groups - not only competitive athletes but also fitness enthusiasts, older adults, and wellness-focused consumers - many of whom prioritize product safety, purity, and performance. The heightened scrutiny around doping, especially in international competitions and collegiate sports, is compelling brands to voluntarily adopt third-party certification to demonstrate credibility. Meanwhile, regulatory bodies across the globe are rolling out stricter guidelines on ingredient labeling, health claims, and manufacturing practices, creating a compliance-driven push toward verified products. Supply chain complexity - often involving global ingredient sourcing and third-party manufacturing - adds further impetus for testing, to ensure quality control at every touchpoint. In addition, reputational risk and legal liabilities related to product contamination or mislabeling are prompting brands to treat testing not as a cost center, but as a strategic investment in long-term consumer trust. As digital commerce continues to grow, certification logos and lab-verified claims are becoming key decision-making factors for online shoppers. Together, these factors signal a long-term shift toward a more transparent, compliant, and quality-assured sports nutrition marketplace, where testing and certification are foundational to sustainable growth.Report Scope

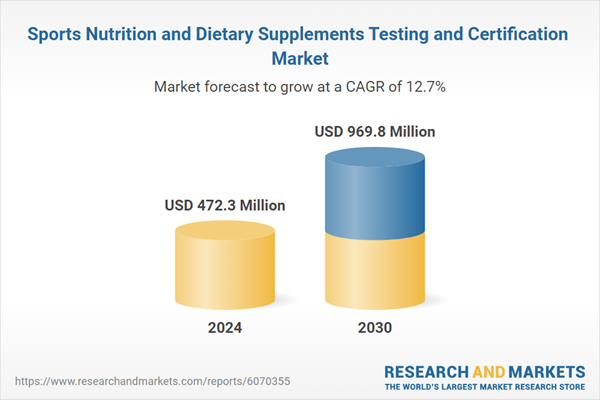

The report analyzes the Sports Nutrition and Dietary Supplements Testing and Certification market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Stability Testing, Analytical Testing, Microbiological Testing, Regulatory Testing & Compliance, Others); Ingredient (Herbal, Vitamins, Minerals, Amino Acids, Enzymes, Probiotics, Others); End-Use (Manufacturers, Contract Manufacturers, Distributors, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Stability Testing segment, which is expected to reach US$391.9 Million by 2030 with a CAGR of a 15.2%. The Analytical Testing segment is also set to grow at 9.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $128.7 Million in 2024, and China, forecasted to grow at an impressive 17.5% CAGR to reach $208.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Sports Nutrition and Dietary Supplements Testing and Certification Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Sports Nutrition and Dietary Supplements Testing and Certification Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Sports Nutrition and Dietary Supplements Testing and Certification Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Appear TV, Ateme, Avid Technology, Inc., AWS Elemental, Bitmovin and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Sports Nutrition and Dietary Supplements Testing and Certification market report include:

- ALS Limited

- AOAC International

- Banned Substances Control Group (BSCG)

- Biofortis (a Mérieux NutriSciences company)

- BioReference Laboratories

- Bureau Veritas

- Certified Laboratories

- ConsumerLab.com

- Covance (now part of Labcorp)

- Covance Food Solutions

- Eurofins Food Integrity and Innovation

- Eurofins Scientific

- Informed Choice (LGC Group)

- Informed Sport (LGC Group)

- Intertek Alchemy

- Intertek Caleb Brett

- Intertek Group plc

- Labdoor, Inc.

- LGC Group

- Microbac Laboratories

- NFS International Certified for Sport® Division

- NSF Certified for Sport® Program

- NSF International

- NSF International Strategic Registrations

- QPS Holdings, LLC

- SGS S.A.

- TÜV Rheinland

- TÜV SÜD

- U.S. Pharmacopeia (USP)

- UL Solutions

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ALS Limited

- AOAC International

- Banned Substances Control Group (BSCG)

- Biofortis (a Mérieux NutriSciences company)

- BioReference Laboratories

- Bureau Veritas

- Certified Laboratories

- ConsumerLab.com

- Covance (now part of Labcorp)

- Covance Food Solutions

- Eurofins Food Integrity and Innovation

- Eurofins Scientific

- Informed Choice (LGC Group)

- Informed Sport (LGC Group)

- Intertek Alchemy

- Intertek Caleb Brett

- Intertek Group plc

- Labdoor, Inc.

- LGC Group

- Microbac Laboratories

- NFS International Certified for Sport® Division

- NSF Certified for Sport® Program

- NSF International

- NSF International Strategic Registrations

- QPS Holdings, LLC

- SGS S.A.

- TÜV Rheinland

- TÜV SÜD

- U.S. Pharmacopeia (USP)

- UL Solutions

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 396 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 472.3 Million |

| Forecasted Market Value ( USD | $ 969.8 Million |

| Compound Annual Growth Rate | 12.7% |

| Regions Covered | Global |