Global Sacroiliac Joint Fusion Injections and RF Ablation Market - Key Trends & Drivers Summarized

What Are Sacroiliac Joint Fusion Injections and RF Ablation, and Why Are They Key to Non-Surgical SI Joint Pain Management?

Sacroiliac (SI) joint injections and radiofrequency (RF) ablation are two leading non-surgical interventions used for the diagnosis and management of SI joint-related pain, a significant contributor to chronic low back pain. SI joint injections involve the targeted delivery of corticosteroids and/or anesthetics directly into the joint to reduce inflammation and provide temporary pain relief. They are also used diagnostically to confirm SI joint pathology when pain relief is observed following the injection. In contrast, RF ablation uses high-frequency electrical currents to heat and disable the sensory nerves transmitting pain signals from the SI joint, offering longer-lasting relief than injections.Both techniques serve as critical therapeutic steps before considering surgical sacroiliac joint fusion. They are commonly performed in outpatient settings under image guidance (fluoroscopy or CT) for precision and safety. These interventions are particularly valuable for patients who are not immediate surgical candidates, wish to delay surgery, or have comorbidities that complicate operative procedures. As SI joint pain becomes more clinically recognized and diagnostic accuracy improves, these non-surgical procedures are gaining traction as frontline solutions in multidisciplinary pain management strategies.

How Are Innovations Enhancing the Effectiveness and Safety of SI Joint Injections and RF Ablation?

Technological advancements are refining both SI joint injections and RF ablation techniques, improving their precision, efficacy, and duration of pain relief. Injections now leverage ultrasound-guided and image-fusion techniques, allowing for more accurate needle placement and reduced risk of nerve or vascular injury. The use of long-acting corticosteroids and biologic injectables - such as platelet-rich plasma (PRP) and stem cell formulations - is being explored to prolong anti-inflammatory effects and promote joint healing beyond temporary symptom suppression.In RF ablation, significant innovation is occurring in electrode design, ablation algorithms, and procedural techniques. Cooled RF ablation is emerging as a superior method, offering larger lesion sizes and improved treatment of variable nerve anatomy, which is especially beneficial for the sacral lateral branches responsible for SI joint innervation. Pulsed RF and multi-lesion RF probes are also being investigated to minimize tissue damage while extending the duration of pain relief. Additionally, real-time nerve mapping and neuromodulation technologies are enhancing the specificity of nerve targeting during ablation procedures.

Patient comfort and safety are being further improved with the development of disposable, sterile RF kits, automated ablation consoles, and integrated pain management software platforms that streamline treatment planning and post-procedural follow-up. These innovations are making SI joint interventions more consistent, reproducible, and appealing to both pain specialists and interventional spine physicians.

Which Patient Populations and Clinical Use Cases Are Driving Market Demand?

The demand for SI joint injections and RF ablation is increasing among diverse patient demographics, particularly among adults aged 40 and above who are more prone to sacroiliac degeneration, postural stress, or trauma-induced dysfunction. Patients with a history of lumbar spine surgery - especially lumbar fusion - are at elevated risk of developing adjacent SI joint pain and often turn to non-surgical interventions before considering revision surgery. Similarly, women experiencing postpartum pelvic pain due to ligamentous laxity or biomechanical strain are increasingly being referred for these procedures.These interventions are also gaining popularity among athletes and active individuals who seek quicker recovery and want to avoid surgical downtime. In elderly patients or those with multiple comorbidities, where surgery poses higher risks, injections and RF ablation serve as valuable long-term management tools. Moreover, the increasing prevalence of obesity, osteoarthritis, and sedentary lifestyle-induced joint dysfunction is broadening the patient base for SI joint pain treatment.

Healthcare systems are increasingly integrating SI joint injections and ablation into chronic pain management programs, supported by evidence-based care pathways and insurance coverage in most developed markets. Multidisciplinary spine clinics and ambulatory surgery centers are becoming hubs for these procedures, given their minimally invasive nature, low complication rates, and strong cost-effectiveness profile.

What Is Driving the Growth of the Global Sacroiliac Joint Fusion Injections and RF Ablation Market?

The growth in the global sacroiliac joint fusion injections and RF ablation market is driven by several factors, including rising prevalence of SI joint dysfunction, increased clinical awareness and diagnostic accuracy, and growing demand for non-surgical pain management alternatives. The expansion of minimally invasive interventional pain practices, coupled with patient preference for outpatient, low-risk procedures, is accelerating market adoption.Technological advancements in image-guided intervention, nerve ablation systems, and regenerative injectables are enhancing treatment outcomes and broadening use cases. Additionally, supportive reimbursement frameworks in North America, Europe, and increasingly in Asia-Pacific are encouraging wider use in both public and private healthcare systems. The integration of SI joint procedures into multidisciplinary care models for low back pain, along with a shift toward value-based healthcare and opioid-sparing strategies, is further boosting the demand for injections and RF ablation.

As spine and pain specialists increasingly recognize the sacroiliac joint as a significant source of chronic pain, the role of targeted, image-guided interventions continues to grow. With ongoing innovation, rising patient demand for minimally invasive solutions, and expanding clinical application, the SI joint injections and RF ablation market is poised for sustained global expansion in the years ahead.

Report Scope

The report analyzes the Sacroiliac Joint Fusion Injections and RF Ablation market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Indication (Degenerative Sacroilitis, Sacral Disruption, Trauma); Type (Diagnosis, Treatment); End-Use (Hospitals, Ambulatory Surgery Centers, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Some of the 34 companies featured in this Sacroiliac Joint Fusion Injections and RF Ablation market report include -

- Abbott Laboratories

- Aesculap Implant Systems, LLC

- Amedica Corporation

- Aurora Spine Corporation

- Boston Scientific Corporation

- CornerLoc

- Globus Medical, Inc.

- Life Spine, Inc.

- Medtronic plc

- NuVasive, Inc.

- Orthofix Medical Inc.

- PainTEQ

- RTI Surgical Holdings, Inc.

- SI-BONE, Inc.

- Stratus Medical

- Surgalign Holdings, Inc.

- Tenon Medical, Inc.

- Xtant Medical Holdings, Inc.

- Zimmer Biomet Holdings, Inc.

- Zyga Technology, Inc.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Degenerative Sacroilitis Indication segment, which is expected to reach US$989.3 Million by 2030 with a CAGR of a 22%. The Sacral Disruption Indication segment is also set to grow at 16.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $135.8 Million in 2024, and China, forecasted to grow at an impressive 26.6% CAGR to reach $345.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Sacroiliac Joint Fusion Injections and RF Ablation Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Sacroiliac Joint Fusion Injections and RF Ablation Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Sacroiliac Joint Fusion Injections and RF Ablation Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

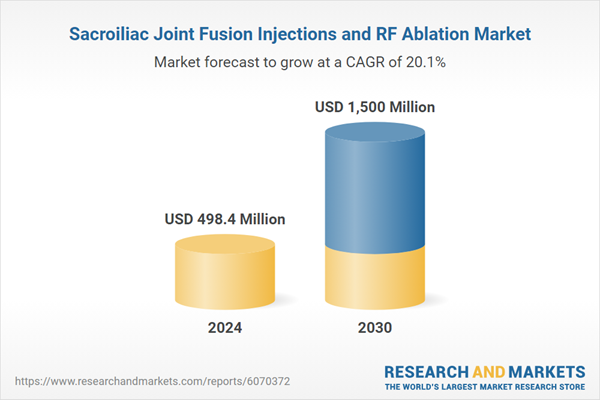

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Select Competitors (Total 34 Featured):

- Abbott Laboratories

- Aesculap Implant Systems, LLC

- Amedica Corporation

- Aurora Spine Corporation

- Boston Scientific Corporation

- CornerLoc

- Globus Medical, Inc.

- Life Spine, Inc.

- Medtronic plc

- NuVasive, Inc.

- Orthofix Medical Inc.

- PainTEQ

- RTI Surgical Holdings, Inc.

- SI-BONE, Inc.

- Stratus Medical

- Surgalign Holdings, Inc.

- Tenon Medical, Inc.

- Xtant Medical Holdings, Inc.

- Zimmer Biomet Holdings, Inc.

- Zyga Technology, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- Aesculap Implant Systems, LLC

- Amedica Corporation

- Aurora Spine Corporation

- Boston Scientific Corporation

- CornerLoc

- Globus Medical, Inc.

- Life Spine, Inc.

- Medtronic plc

- NuVasive, Inc.

- Orthofix Medical Inc.

- PainTEQ

- RTI Surgical Holdings, Inc.

- SI-BONE, Inc.

- Stratus Medical

- Surgalign Holdings, Inc.

- Tenon Medical, Inc.

- Xtant Medical Holdings, Inc.

- Zimmer Biomet Holdings, Inc.

- Zyga Technology, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 364 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 498.4 Million |

| Forecasted Market Value ( USD | $ 1500 Million |

| Compound Annual Growth Rate | 20.1% |

| Regions Covered | Global |