Global Marine Diesel Engine Market - Key Trends & Drivers Summarized

How Is the Maritime Industry Navigating the Shift Toward Fuel-Efficient Marine Diesel Engines?

The marine diesel engine market is undergoing a transformation as shipping companies seek fuel-efficient solutions to comply with tightening emission regulations. Modern diesel engines are being optimized for lower fuel consumption, improved thermal efficiency, and reduced greenhouse gas emissions. Hybrid propulsion systems, which combine diesel engines with battery storage or LNG-powered components, are emerging as a key trend, helping vessels transition toward cleaner energy. The increasing focus on fuel economy is also driving investments in digital engine monitoring systems that optimize performance in real time. As the global shipping industry looks for ways to cut operating costs and meet environmental mandates, next-generation marine diesel engines are gaining traction.Why Are Environmental Regulations Reshaping Marine Diesel Engine Design?

Stringent environmental regulations imposed by the International Maritime Organization (IMO), including the IMO 2020 sulfur cap and future decarbonization targets, are accelerating the development of cleaner marine diesel engines. Low-sulfur fuel requirements have prompted engine manufacturers to design dual-fuel and LNG-compatible engines that meet compliance standards while maintaining performance. The increasing adoption of exhaust gas recirculation (EGR) and selective catalytic reduction (SCR) systems is helping vessels reduce NOx emissions and achieve regulatory compliance. Additionally, the push for carbon-neutral shipping has led to research in biofuels and synthetic diesel alternatives, ensuring that marine engines remain adaptable to future fuel transitions.How Is Digitalization Enhancing Marine Diesel Engine Performance?

Digitalization is playing a crucial role in improving the efficiency and reliability of marine diesel engines. Real-time engine monitoring, powered by IoT and AI-driven analytics, is allowing ship operators to track fuel consumption, detect anomalies, and prevent breakdowns through predictive maintenance. The integration of digital twins is also revolutionizing marine engine performance, enabling shipowners to simulate operational conditions and optimize fuel efficiency before voyages. Advanced automation in engine control systems is further reducing human intervention, ensuring consistent and optimized performance in varying sea conditions. As digital solutions become more integrated into marine propulsion systems, ship operators are achieving greater efficiency and lower maintenance costs.The Growth in the Marine Diesel Engine Market Is Driven by Several Factors

The increasing demand for fuel-efficient, low-emission propulsion systems is a major driver of the marine diesel engine market. The implementation of strict environmental regulations, such as IMO 2020 and future decarbonization goals, is pushing engine manufacturers to develop cleaner, hybrid, and dual-fuel solutions. The expansion of global trade and maritime transportation is further fueling demand for advanced marine diesel engines. Additionally, the adoption of digital monitoring and predictive maintenance technologies is optimizing engine performance, reducing fuel consumption, and extending equipment lifespan. The growing investment in alternative fuels, including LNG and biofuels, is also shaping the future of marine diesel engine development.Report Scope

The report analyzes the Marine Diesel Engine market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (Low Speed Technology, Medium Speed Technology, High Speed Technology); Application (Merchant Application, Offshore Application, Cruise & Ferry Application, Navy Application, Other Applications); Power (1000 HP, 1000 HP - 5000 HP, 5000 HP - 10000 HP, 10000 HP - 20000 HP, Above 20000 HP).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Low Speed Technology segment, which is expected to reach US$3.7 Billion by 2030 with a CAGR of a 3.4%. The Medium Speed Technology segment is also set to grow at 2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.4 Billion in 2024, and China, forecasted to grow at an impressive 5.7% CAGR to reach $1.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Marine Diesel Engine Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Marine Diesel Engine Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Marine Diesel Engine Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aker BioMarine, AlgaPrime DHA, AlgaVia, Arctic Nutrition AS, Aroma NZ Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Marine Diesel Engine market report include:

- Anglo Belgian Corporation

- British Polar Engines

- Caterpillar Inc.

- China Yuchai International

- Costruzioni Motori Diesel S.p.A.

- Cox Marine

- Cox Powertrain

- Cummins Inc.

- Deere & Company

- DNV

- Fairbanks Morse Defense

- Greaves Cotton Limited

- Honda Motor Co., Ltd.

- Hyundai Heavy Industries Co., Ltd.

- Kirloskar Oil Engines Ltd.

- MAN Energy Solutions

- Marinediesel AB

- Perkins Engines

- STX Engine

- Wärtsilä

- Yanmar Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Anglo Belgian Corporation

- British Polar Engines

- Caterpillar Inc.

- China Yuchai International

- Costruzioni Motori Diesel S.p.A.

- Cox Marine

- Cox Powertrain

- Cummins Inc.

- Deere & Company

- DNV

- Fairbanks Morse Defense

- Greaves Cotton Limited

- Honda Motor Co., Ltd.

- Hyundai Heavy Industries Co., Ltd.

- Kirloskar Oil Engines Ltd.

- MAN Energy Solutions

- Marinediesel AB

- Perkins Engines

- STX Engine

- Wärtsilä

- Yanmar Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 389 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

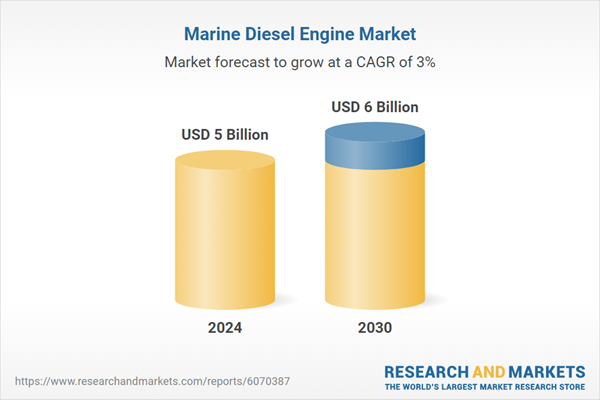

| Estimated Market Value ( USD | $ 5 Billion |

| Forecasted Market Value ( USD | $ 6 Billion |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Global |