Revolutionizing Earth Observation: The Power of MEO Remote Sensing, Imagery & Data Services

How Is Medium Earth Orbit (MEO) Transforming Remote Sensing Capabilities?

Medium Earth Orbit (MEO), positioned between 2,000 km and 35,786 km above Earth’ s surface, is rapidly emerging as a crucial zone for remote sensing, imagery, and data services. Traditionally, Low Earth Orbit (LEO) and Geostationary Orbit (GEO) have dominated Earth observation applications, with LEO offering high-resolution imaging at low altitudes and GEO providing continuous global coverage from high altitudes. However, MEO presents a unique balance between coverage and resolution, making it an optimal choice for a range of remote sensing applications. Satellites in MEO can capture frequent revisit imagery with broader swath coverage than LEO, while providing superior resolution and lower latency compared to GEO.The strategic positioning of MEO satellites is particularly advantageous for climate monitoring, meteorology, and environmental observation. With improved imaging consistency and reduced signal degradation, MEO satellites offer more accurate long-term weather pattern tracking and disaster response capabilities. Moreover, the advancement of multi-spectral and hyperspectral imaging technologies has enabled MEO-based remote sensing systems to detect finer details in environmental changes, aiding in global efforts to monitor deforestation, oceanic currents, and atmospheric pollution. These advancements make MEO an essential player in the growing need for real-time, high-precision Earth observation data.

What Are the Latest Innovations in MEO-Based Imagery and Data Services?

The increasing deployment of high-performance sensors and AI-powered analytics is revolutionizing MEO-based imagery and data services. Unlike older satellite imaging systems that relied on passive sensing methods, modern MEO satellites now integrate active radar imaging, LiDAR technology, and thermal infrared sensors to capture data in extreme conditions, such as cloud cover, darkness, and high-altitude atmospheric monitoring. This has significantly enhanced early-warning systems for natural disasters, providing governments and emergency response teams with crucial data to predict and mitigate the impact of hurricanes, wildfires, and earthquakes.Additionally, edge computing and AI-driven data processing have allowed MEO satellites to analyze and compress massive datasets in-orbit before transmitting critical insights to ground stations. This reduces transmission delays and enhances decision-making speed for applications like border security, maritime surveillance, and urban planning. The ability of MEO satellites to process and distribute actionable intelligence in near real-time has been particularly beneficial for the defense and intelligence sector, where persistent surveillance and reconnaissance are critical for national security. As computing power and on-orbit data storage capacities improve, MEO satellites are expected to play a larger role in facilitating autonomous decision-making and AI-based predictive analytics across multiple industries.

Why Are Industry Trends and Government Policies Pushing for MEO Expansion?

The commercialization of space and growing government investments in Earth observation are accelerating the expansion of MEO-based remote sensing and data services. In the past, remote sensing capabilities were primarily driven by national space agencies such as NASA, ESA, and Roscosmos, but the entry of private space enterprises like SpaceX, Amazon’ s Project Kuiper, and OneWeb has fueled competition and technological advancements in the sector. Companies are now actively developing constellations of MEO satellites to enhance global communication, precision agriculture, and geospatial intelligence.Government policies are also shaping the adoption of MEO satellite systems. Regulatory bodies such as the International Telecommunication Union (ITU) and the U.S. Federal Communications Commission (FCC) have introduced new frequency allocations and spectrum regulations, encouraging satellite operators to expand MEO-based data services. Additionally, international collaborations on space sustainability and orbital debris management have prompted investment in longer-lasting, fuel-efficient propulsion systems for MEO satellites, ensuring their operational longevity while minimizing space congestion. Furthermore, strategic alliances between satellite providers and cloud computing giants are enabling faster and more cost-effective data distribution, strengthening the role of MEO satellites in the digital economy.

What Is Driving the Growth of the MEO Remote Sensing, Imagery & Data Services Market?

The growth in the MEO remote sensing, imagery & data services market is driven by several factors, including rising demand for high-resolution, near-real-time Earth observation data, increasing government and defense sector investments, and advancements in AI-powered geospatial analytics. The agriculture, oil & gas, and infrastructure sectors are also accelerating the adoption of MEO-based imagery services to enhance crop monitoring, pipeline surveillance, and smart city planning. The ability of MEO satellites to provide continuous, mid-latency data transmission is particularly valuable for global navigation satellite systems (GNSS) like GPS, Galileo, and BeiDou, which rely on MEO orbits for accurate geolocation services.The surging need for climate resilience strategies is further propelling the market, as MEO remote sensing systems are being increasingly utilized to track rising sea levels, glacier melt rates, and extreme weather patterns. Additionally, the expanding role of MEO satellites in 5G and next-generation telecommunications infrastructure is creating new market opportunities, particularly in rural connectivity and maritime internet services. As satellite miniaturization and low-cost launch capabilities become more prevalent, the adoption of MEO satellite-as-a-service (SaaS) models is expected to further drive the market, enabling businesses and governments to leverage cutting-edge space-based data services without the need for massive capital expenditures. With continuous advancements in sensor fusion, autonomous satellite operations, and AI-enhanced image processing, the MEO remote sensing industry is set to revolutionize global Earth observation for years to come.

Report Scope

The report analyzes the Medium Earth Orbit (MEO) Remote Sensing, Imagery & Data Services market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Deployment (Public cloud, Private cloud, Hybrid cloud); Vertical (Agriculture, forestry & fishing, Mining, Engineering & infrastructure, Energy & power, Environment & weather monitoring, Maritime, Transport & logistics, Aerospace & Defense, Others); End-Use (Government, Commercial, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Public Cloud Deployment segment, which is expected to reach US$69.4 Million by 2030 with a CAGR of a 15.3%. The Private Cloud Deployment segment is also set to grow at 12.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $13.7 Million in 2024, and China, forecasted to grow at an impressive 13.6% CAGR to reach $18.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Medium Earth Orbit (MEO) Remote Sensing, Imagery & Data Services Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Medium Earth Orbit (MEO) Remote Sensing, Imagery & Data Services Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Medium Earth Orbit (MEO) Remote Sensing, Imagery & Data Services Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Medium Earth Orbit (MEO) Remote Sensing, Imagery & Data Services market report include:

- Airbus Defence and Space

- BAE Systems

- Boeing Defense, Space & Security

- China Aerospace Science and Technology Corporation (CASC)

- Deimos Imaging

- DigitalGlobe (now part of Maxar Technologies)

- Esri

- GeoEye (now part of Maxar Technologies)

- ICEYE

- IQPS

- Lockheed Martin Corporation

- Maxar Technologies

- Northrop Grumman Corporation

- OHB SE

- Orbital Insight

- Pixxel

- Planet Labs

- Thales Group

- WARPSPACE

- Zhuhai Orbita Aerospace Science & Technology Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Airbus Defence and Space

- BAE Systems

- Boeing Defense, Space & Security

- China Aerospace Science and Technology Corporation (CASC)

- Deimos Imaging

- DigitalGlobe (now part of Maxar Technologies)

- Esri

- GeoEye (now part of Maxar Technologies)

- ICEYE

- IQPS

- Lockheed Martin Corporation

- Maxar Technologies

- Northrop Grumman Corporation

- OHB SE

- Orbital Insight

- Pixxel

- Planet Labs

- Thales Group

- WARPSPACE

- Zhuhai Orbita Aerospace Science & Technology Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 146 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

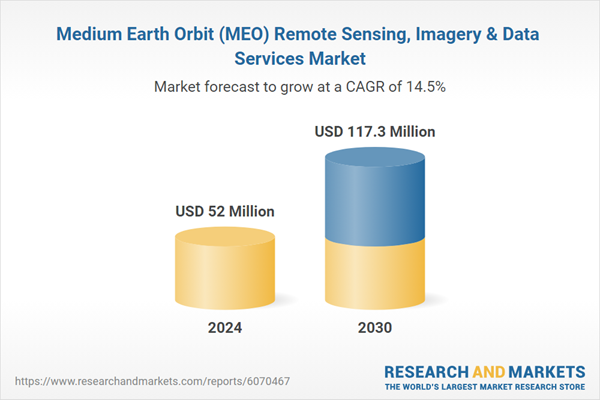

| Estimated Market Value ( USD | $ 52 Million |

| Forecasted Market Value ( USD | $ 117.3 Million |

| Compound Annual Growth Rate | 14.5% |

| Regions Covered | Global |